Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1221

Pages:96

Published On:August 2025

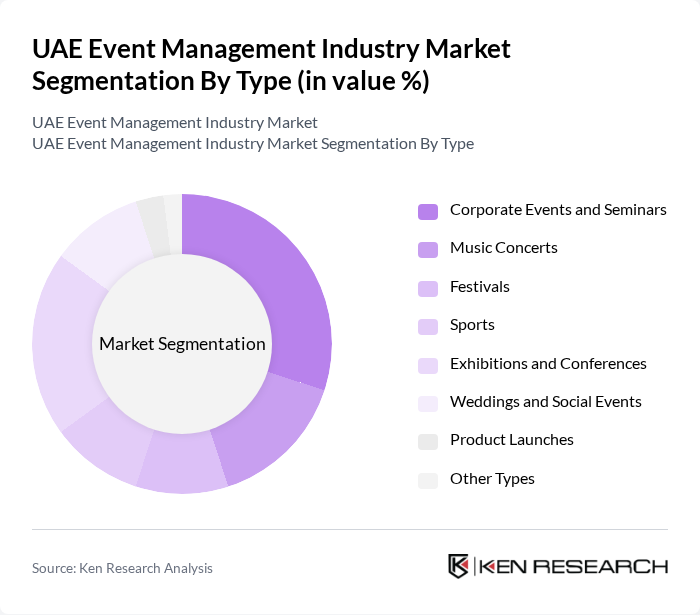

By Type:The event management market is segmented into corporate events and seminars, music concerts, festivals, sports, exhibitions and conferences, weddings and social events, product launches, and other types. Each segment addresses distinct audiences and objectives, reflecting the diversity of the UAE's event landscape. Corporate and public sector events are particularly prominent, driven by business tourism and government initiatives.

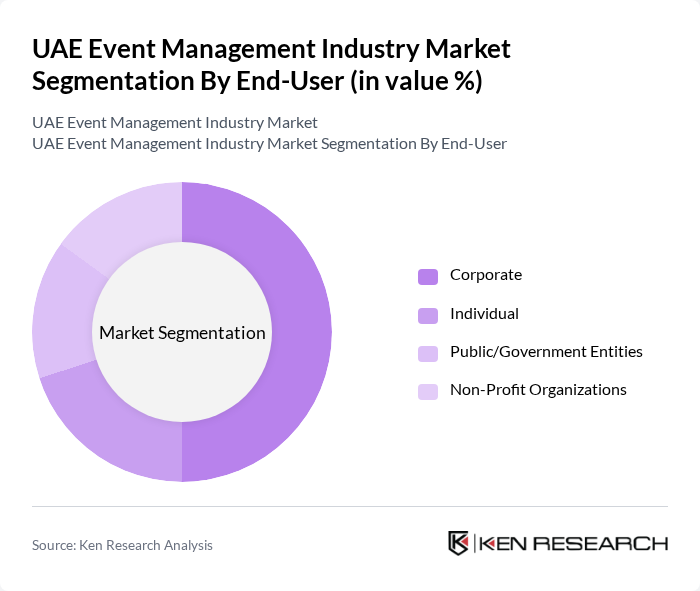

By End-User:End-user segmentation includes corporate clients, individuals, public/government entities, and non-profit organizations. Corporate and government clients are the largest contributors, reflecting the UAE's focus on business tourism, international summits, and large-scale public events.

The UAE Event Management Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Done Events, Prisme International, DXB Live, Invent Creative Event Solutions, Oasis Events, Max Events Dubai, Purple Honey Group, La Table Events, Q Communications, Event Lab, The Event Company, MICE Middle East, Mamemo Productions, Linkviva, and Dubai World Trade Centre (Events Division) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE event management industry is poised for robust growth, driven by increasing corporate activities and a surge in destination weddings. The integration of advanced technologies, such as virtual reality and AI, is expected to enhance event experiences, making them more engaging and personalized. Additionally, sustainability practices are becoming essential, with a growing emphasis on eco-friendly events. As the market adapts to these trends, it will likely see a diversification of services and innovative solutions to meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Events and Seminars Music Concerts Festivals Sports Exhibitions and Conferences Weddings and Social Events Product Launches Other Types |

| By End-User | Corporate Individual Public/Government Entities Non-Profit Organizations |

| By Venue Type | Indoor Venues Outdoor Venues Virtual Platforms |

| By Service Type | Event Planning and Management Venue Sourcing Catering Entertainment Audio-Visual Production Marketing and Promotion Destination Management |

| By Duration | One-Day Events Multi-Day Events |

| By Audience Size | Small Events (1-100 attendees) Medium Events (101-500 attendees) Large Events (501+ attendees) |

| By Revenue Source | Tickets Sponsorships Advertising Broadcasting Other Sources of Revenue |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Management | 60 | Event Managers, Corporate Executives |

| Wedding Planning Services | 50 | Wedding Planners, Venue Coordinators |

| Exhibition and Trade Shows | 40 | Exhibition Organizers, Marketing Directors |

| Concert and Entertainment Events | 40 | Event Producers, Talent Managers |

| Sporting Events Management | 40 | Sports Event Coordinators, Sponsorship Managers |

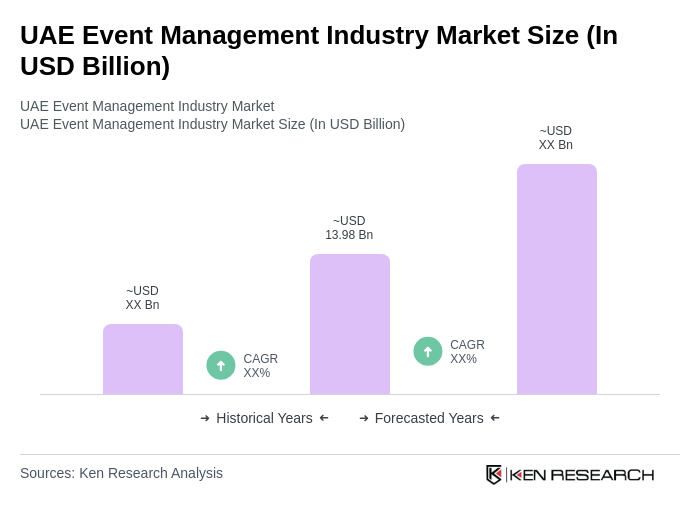

The UAE Event Management Industry Market is valued at approximately USD 13.98 billion, reflecting significant growth driven by corporate events, exhibitions, and an increase in tourism and business travel.