Region:Middle East

Author(s):Dev

Product Code:KRAB7072

Pages:93

Published On:October 2025

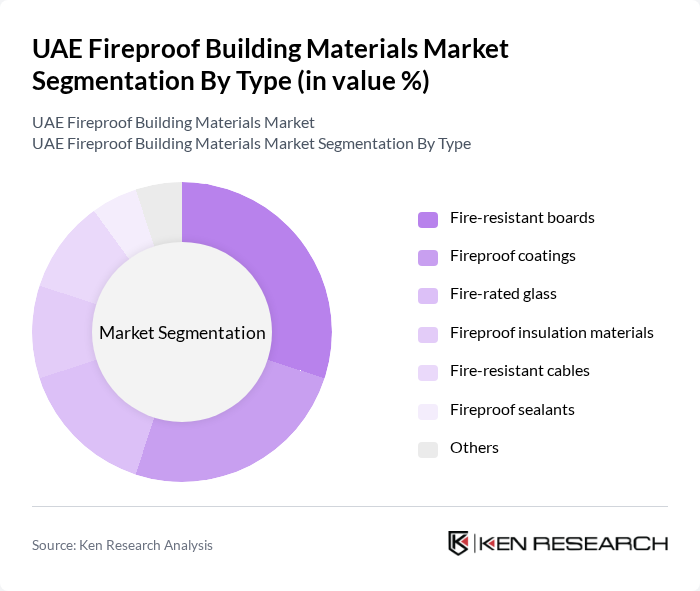

By Type:The market is segmented into various types of fireproof building materials, including fire-resistant boards, fireproof coatings, fire-rated glass, fireproof insulation materials, fire-resistant cables, fireproof sealants, and others. Among these, fire-resistant boards and fireproof coatings are the most prominent due to their widespread application in both residential and commercial buildings. The increasing focus on safety and compliance with building codes has led to a surge in demand for these materials, making them the leading subsegments in the market.

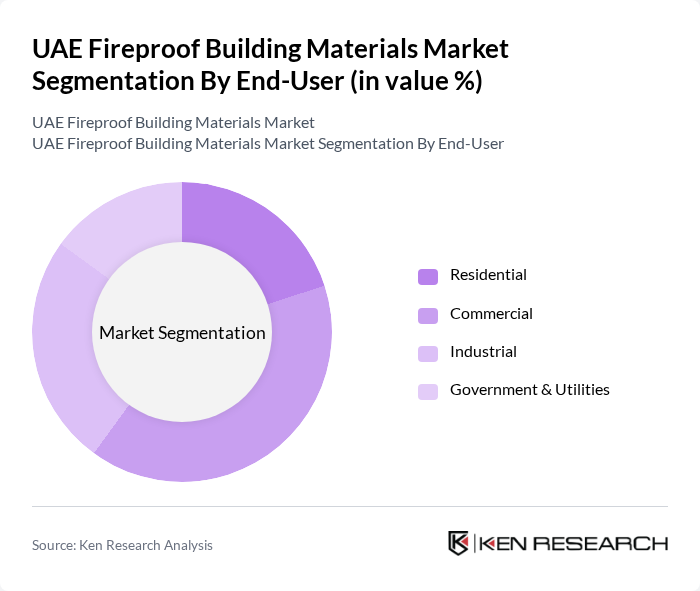

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The commercial sector is the largest consumer of fireproof building materials, driven by the rapid growth of office spaces, retail outlets, and hospitality projects in urban areas. The increasing emphasis on safety regulations in commercial buildings has led to a higher adoption of fireproof materials, making this segment the most significant contributor to market growth.

The UAE Fireproof Building Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain, Rockwool International A/S, Kingspan Group, BASF SE, 3M Company, Etex Group, Firestone Building Products, Owens Corning, Knauf Insulation, Sika AG, Hilti Corporation, USG Corporation, ArcelorMittal, CEMEX S.A.B. de C.V., Boral Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE fireproof building materials market appears promising, driven by ongoing construction projects and a commitment to safety. As the government continues to enforce stringent regulations, the demand for compliant materials will rise. Additionally, the integration of smart technologies in building safety systems is expected to enhance the functionality of fireproof materials. With a focus on sustainability, the market is likely to see innovations that align with green building initiatives, further propelling growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire-resistant boards Fireproof coatings Fire-rated glass Fireproof insulation materials Fire-resistant cables Fireproof sealants Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New construction Renovation Retrofitting Maintenance |

| By Distribution Channel | Direct sales Distributors Online sales Retail outlets |

| By Price Range | Low-end Mid-range High-end |

| By Material Source | Domestic manufacturers International suppliers Recycled materials |

| By Certification Type | UL certified BS certified ISO certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Building Projects | 100 | Architects, Project Managers |

| Commercial Construction | 80 | Construction Managers, Safety Officers |

| Industrial Facility Developments | 70 | Facility Managers, Procurement Specialists |

| Fire Safety Compliance Audits | 60 | Regulatory Inspectors, Fire Safety Consultants |

| Supplier and Manufacturer Insights | 90 | Sales Managers, Product Development Leads |

The UAE Fireproof Building Materials Market is valued at approximately USD 1.2 billion, driven by increasing fire safety regulations, urbanization, and the expansion of the construction sector, particularly in major cities like Dubai and Abu Dhabi.