Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0001

Pages:91

Published On:November 2025

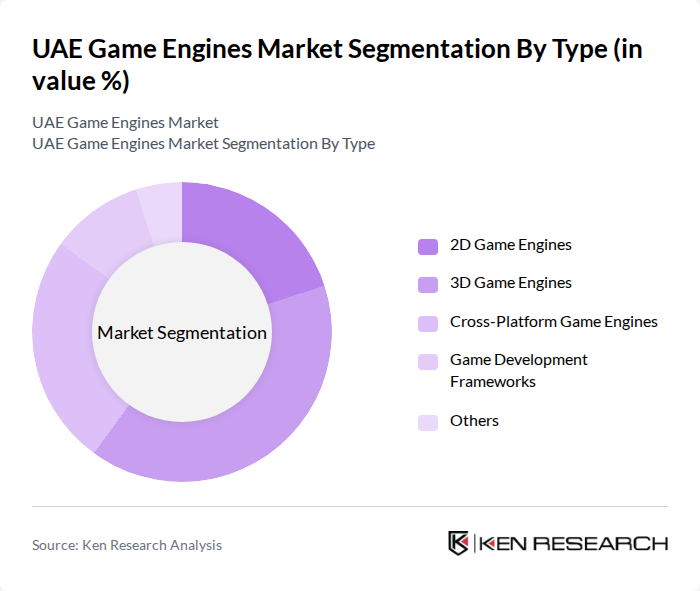

By Type:The market is segmented into various types of game engines, including 2D Game Engines, 3D Game Engines, Cross-Platform Game Engines, Game Development Frameworks, and Others. Among these, 3D Game Engines are currently leading the market due to their ability to create immersive gaming experiences that attract a larger audience. The demand for high-quality graphics and realistic gameplay has driven developers to prefer 3D engines, making them the most popular choice in the UAE.

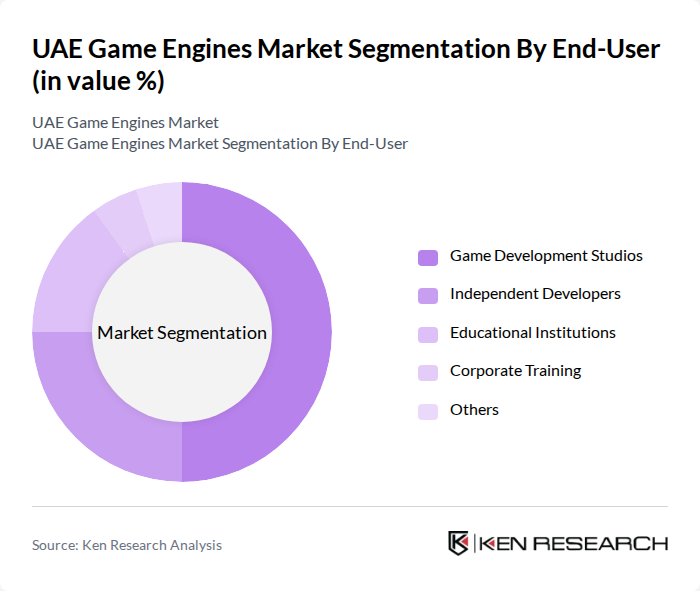

By End-User:The end-user segmentation includes Game Development Studios, Independent Developers, Educational Institutions, Corporate Training, and Others. Game Development Studios dominate this segment as they are the primary users of game engines, leveraging advanced tools to create high-quality games. The increasing number of studios in the UAE, driven by a growing interest in gaming, has led to a surge in demand for sophisticated game engines.

The UAE Game Engines Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unity Technologies, Epic Games, Crytek, GameSalad, Cocos2d-x, Amazon Lumberyard, Godot Engine, Construct, Buildbox, AppGameKit, Defold, RPG Maker, Phaser, GameMaker Studio, Stencyl contribute to innovation, geographic expansion, and service delivery in this space.

The UAE game engines market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in game development is expected to enhance user experiences, while the shift towards cloud gaming will provide greater accessibility. Additionally, the growing popularity of subscription-based gaming services will likely reshape revenue models, encouraging developers to innovate and diversify their offerings to meet changing demands in the gaming landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | D Game Engines D Game Engines Cross-Platform Game Engines Game Development Frameworks Others |

| By End-User | Game Development Studios Independent Developers Educational Institutions Corporate Training Others |

| By Genre | Action and Adventure Role-Playing Games (RPG) Simulation Games Sports Games Others |

| By Distribution Channel | Digital Distribution Platforms Retail Stores Direct Sales Subscription Services Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Platform | PC Console Mobile Web Others |

| By Monetization Model | Free-to-Play Pay-to-Play Subscription-Based In-App Purchases Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Game Developers | 100 | Founders, Lead Developers |

| Console Game Studios | 80 | Creative Directors, Producers |

| PC Game Publishers | 70 | Marketing Managers, Sales Directors |

| Gaming Hardware Retailers | 60 | Store Managers, Product Buyers |

| Esports Organizations | 50 | Team Managers, Event Coordinators |

The UAE Game Engines Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by mobile gaming popularity, technological advancements, and an increasing number of game development studios in the region.