UAE Halal Fashion Market Overview

- The UAE Halal Fashion Market is valued at USD 5.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for modest clothing among Muslim consumers, the rise of e-commerce platforms, and a growing awareness of ethical and sustainable fashion practices. The market has seen a surge in both local and international brands, reflecting a broader trend towards inclusivity and innovation in fashion, with social media and Muslim fashion influencers playing a significant role in shaping consumer preferences .

- Key players in this market include Dubai and Abu Dhabi, which dominate due to their large expatriate populations and vibrant retail environments. These cities serve as cultural hubs where traditional and modern fashion coalesce, attracting both local and international consumers. The presence of major shopping festivals, such as Dubai Shopping Festival, and events like Modest Fashion Week further enhance their appeal as leading markets for Halal fashion .

- In 2023, the UAE government implemented the “UAE Halal Products Standard: UAE.S GSO 2055-1:2023” issued by the Emirates Authority for Standardization and Metrology (ESMA). This regulation mandates that all fashion products marketed as "Halal" must comply with specific Islamic guidelines, including requirements for materials, production processes, and certification. The regulation aims to ensure authenticity and consumer trust in Halal products, thereby fostering a more transparent market environment. This initiative is part of a broader strategy to promote the UAE as a global hub for Halal industries, with operational compliance required for all brands labeling products as Halal .

UAE Halal Fashion Market Segmentation

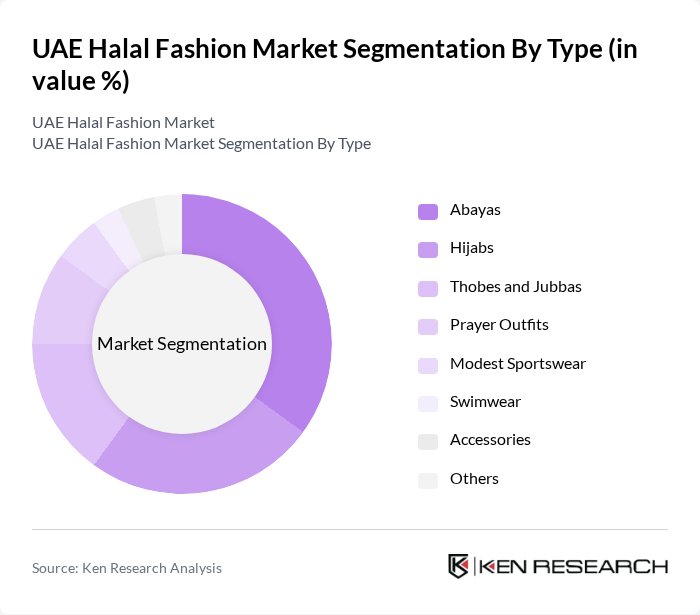

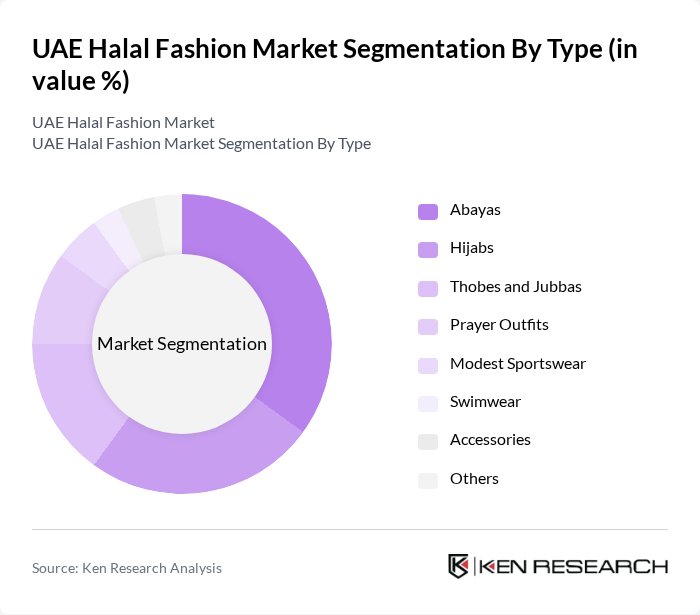

By Type:The market is segmented into various types, including Abayas, Hijabs, Thobes and Jubbas, Prayer Outfits, Modest Sportswear, Swimwear, Accessories, and Others. Each of these sub-segments caters to specific consumer needs and preferences, reflecting the diversity within the Halal fashion landscape. The Abayas segment is particularly dominant due to its cultural significance and widespread acceptance among Muslim women, with hijabs also showing strong demand driven by both religious and fashion considerations .

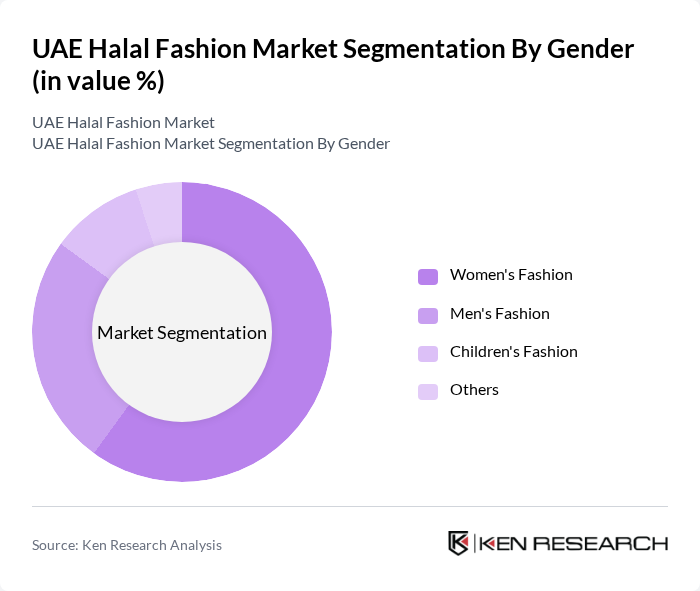

By Gender:The market is also segmented by gender, including Women's Fashion, Men's Fashion, Children's Fashion, and Others. Women's Fashion is the leading segment, driven by a growing demand for stylish and modest clothing options among women. This trend is further supported by the increasing number of brands focusing on women's Halal fashion, which has led to a wider variety of choices for consumers. Men's and children's segments are also expanding, with more brands offering tailored modest options for these groups .

UAE Halal Fashion Market Competitive Landscape

The UAE Halal Fashion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Fashion, Modanisa, Aab Collection, Haute Hijab, Sukaina, An-Nahar, Inayah, SHUKR Islamic Clothing, Haf & Haf, The WRDS Clothing, Dolce & Gabbana (Halal Collection), Zainab Al Shamsi, Areej Al Shamsi, Azzah Al Shamsi, Alia Khan, Aisha Al Shamsi, Noor Al Shamsi, Layla Al Shamsi, Rania Al Shamsi, Huda Al Shamsi, Fatima Al Shamsi contribute to innovation, geographic expansion, and service delivery in this space .

UAE Halal Fashion Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Halal Standards:The UAE's population, which is approximately10 million, has shown a significant increase in awareness regarding halal standards, with70%of consumers actively seeking halal-certified products. This growing consciousness is driven by educational campaigns and the influence of social media, which have highlighted the importance of halal compliance in fashion. As a result, brands that align with these standards are witnessing a surge in demand, contributing to market growth.

- Rising Demand for Modest Fashion:The modest fashion segment in the UAE has expanded rapidly, with the market size estimated atAED 20 billionin future. This growth is fueled by a diverse demographic, including expatriates and local consumers, who prefer stylish yet modest clothing. The increasing participation of women in the workforce, which reached50%, has further driven the demand for fashionable yet modest attire, creating a robust market for halal fashion brands.

- Growth of E-commerce Platforms:E-commerce in the UAE is projected to reachAED 27 billionin future, with a significant portion attributed to the halal fashion sector. The convenience of online shopping, coupled with the rise of mobile commerce, has made it easier for consumers to access halal fashion brands. Additionally, the UAE's internet penetration rate of99%supports this trend, allowing brands to reach a wider audience and enhance their sales through digital channels.

Market Challenges

- Limited Awareness Among Non-Muslim Consumers:Despite the growing halal fashion market, non-Muslim consumers in the UAE remain largely unaware of halal fashion principles. Approximately60%of non-Muslim consumers have limited knowledge about halal certifications, which restricts market expansion. This lack of awareness poses a challenge for brands aiming to diversify their customer base and necessitates targeted marketing strategies to educate potential consumers about the benefits of halal fashion.

- Competition from Non-Halal Fashion Brands:The UAE fashion market is highly competitive, with non-halal brands dominating a significant share.75%of non-halal fashion brands accounted for75%of the total market. This competition presents a challenge for halal fashion brands, which must differentiate themselves through unique offerings and marketing strategies. The presence of established non-halal brands can hinder the growth of halal alternatives, making it essential for halal brands to innovate and capture market interest.

UAE Halal Fashion Market Future Outlook

The UAE halal fashion market is poised for significant growth, driven by increasing consumer awareness and the rising demand for modest fashion. As e-commerce continues to expand, brands will leverage digital platforms to reach a broader audience. Additionally, collaborations with influencers and a focus on sustainable practices will enhance brand visibility and appeal. The integration of technology in retail will further streamline operations, making it easier for consumers to access halal fashion products, thus fostering a vibrant market landscape.

Market Opportunities

- Expansion into International Markets:UAE halal fashion brands have a unique opportunity to expand into international markets, particularly in regions with significant Muslim populations, such as Southeast Asia and Europe. The global halal market is valued at overUSD 2 trillion, presenting a lucrative avenue for growth. By tapping into these markets, brands can increase their customer base and enhance revenue streams.

- Collaborations with Influencers:Collaborating with social media influencers can significantly boost brand visibility and credibility in the halal fashion sector.80%of consumers in the UAE are influenced by social media recommendations, partnerships with popular influencers can drive engagement and sales. This strategy not only enhances brand awareness but also fosters a community around halal fashion, encouraging consumer loyalty and repeat purchases.