Region:Middle East

Author(s):Shubham

Product Code:KRAA8505

Pages:80

Published On:November 2025

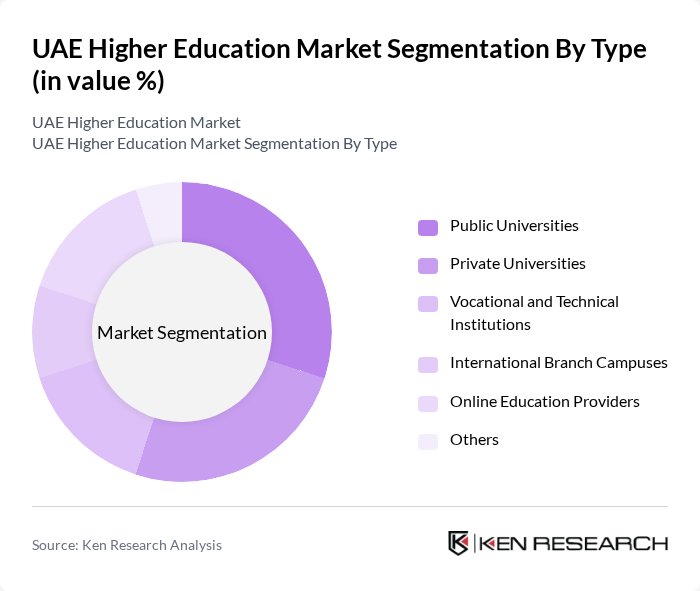

By Type:The UAE Higher Education Market is segmented into Public Universities, Private Universities, Vocational and Technical Institutions, International Branch Campuses, Online Education Providers, and Others. Public universities are primarily government-funded and offer a wide spectrum of academic programs, while private universities address specialized educational needs and often provide internationally accredited degrees. Vocational and technical institutions focus on skill development and workforce readiness, responding to the UAE’s emphasis on innovation and economic diversification. International branch campuses deliver globally recognized degrees, and online education providers have seen rapid growth due to increased demand for flexible, technology-enabled learning options .

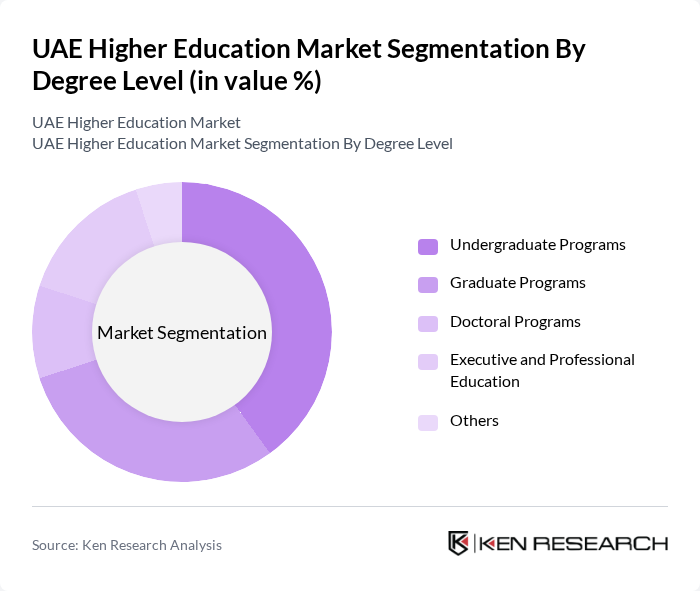

By Degree Level:The market is also segmented by degree level, including Undergraduate Programs, Graduate Programs, Doctoral Programs, Executive and Professional Education, and Others. Undergraduate programs represent the largest share, serving recent high school graduates and forming the foundation of higher education in the UAE. Graduate programs are increasingly popular among professionals seeking advanced qualifications, while doctoral programs are essential for academic and research careers. Executive and professional education is tailored for working professionals aiming to enhance leadership and specialized skills .

The UAE Higher Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Khalifa University, University of Sharjah, American University of Sharjah, Abu Dhabi University, Zayed University, University of Dubai, Al Ain University, United Arab Emirates University, Heriot-Watt University Dubai, The British University in Dubai, Canadian University Dubai, Middlesex University Dubai, University of Wollongong in Dubai, University of Birmingham Dubai, Manipal Academy of Higher Education, Dubai Campus contribute to innovation, geographic expansion, and service delivery in this space.

The UAE higher education market is poised for significant transformation, driven by technological advancements and evolving educational needs. Institutions are increasingly adopting hybrid learning models, integrating online and in-person education to enhance accessibility. Additionally, the focus on STEM education is expected to intensify, aligning with national goals for economic diversification. As the demand for micro-credentials rises, institutions will likely expand their offerings to include short courses, catering to the needs of a dynamic workforce and fostering innovation in education.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Universities Private Universities Vocational and Technical Institutions International Branch Campuses Online Education Providers Others |

| By Degree Level | Undergraduate Programs Graduate Programs Doctoral Programs Executive and Professional Education Others |

| By Field of Study | Engineering & Technology Business & Management Health Sciences & Medicine Arts, Humanities & Social Sciences Science & Mathematics Law Others |

| By Delivery Mode | On-Campus Learning Online Learning Blended/Hybrid Learning Distance Learning Others |

| By Demographics | Emirati Students International Students Adult Learners/Working Professionals Recent High School Graduates Others |

| By Institutional Type | Research Universities Teaching-Focused Universities Community Colleges Specialized Institutions (e.g., Arts, Technology, Medicine) Others |

| By Funding Source | Government/Public Funding Private Funding International Grants & Endowments Student Tuition & Fees Corporate Sponsorships Others |

| By Region | Dubai Abu Dhabi Sharjah Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Administrators | 60 | Deans, Registrars, Academic Affairs Directors |

| Current Students | 150 | Undergraduate and Postgraduate Students |

| Prospective Students | 100 | High School Graduates, Career Counselors |

| Industry Experts | 50 | HR Managers, Corporate Training Directors |

| Alumni | 40 | Recent Graduates, Established Professionals |

The UAE Higher Education Market is valued at approximately USD 10.5 billion, reflecting significant growth driven by increasing demand for quality education, government investment, and a rise in both local and international student enrollments.