Region:Middle East

Author(s):Shubham

Product Code:KRAC4346

Pages:98

Published On:October 2025

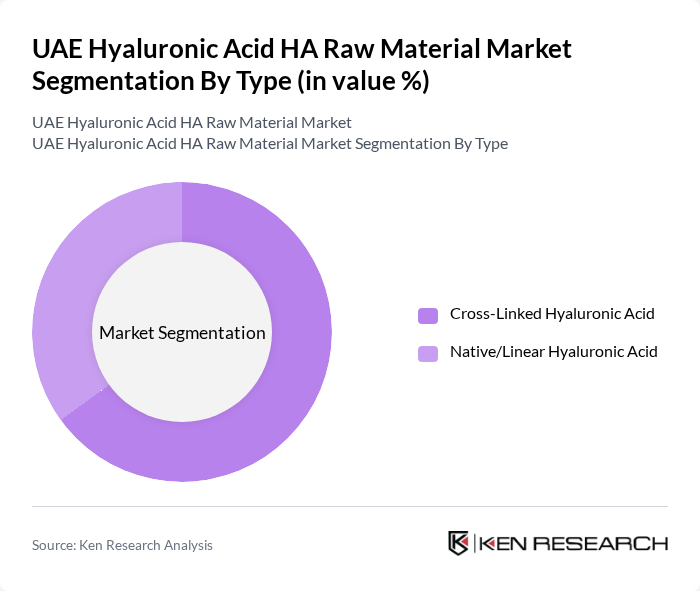

By Type:The market is segmented into Cross-Linked Hyaluronic Acid and Native/Linear Hyaluronic Acid. Cross-Linked Hyaluronic Acid is gaining traction due to its longer-lasting effects in aesthetic applications, while Native/Linear Hyaluronic Acid is preferred for its natural properties in skincare formulations. The demand for both types is influenced by consumer preferences for effective and safe products.

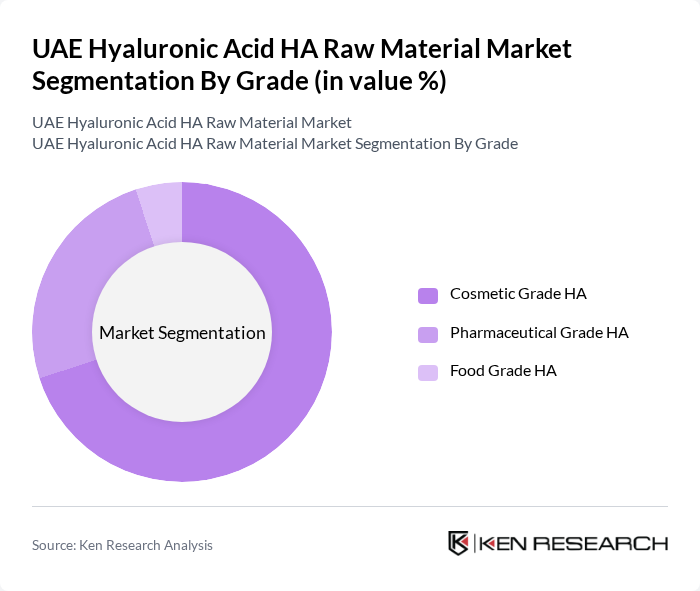

By Grade:The market is categorized into Cosmetic Grade HA, Pharmaceutical Grade HA, and Food Grade HA. Cosmetic Grade HA is the leading segment, driven by the booming beauty industry and the increasing use of hyaluronic acid in skincare products. Pharmaceutical Grade HA is also significant due to its applications in medical treatments, while Food Grade HA is emerging as a niche market.

The UAE Hyaluronic Acid HA Raw Material Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bloomage Freda Biopharm Co., Ltd., LG Chem, Ltd., Allergan, Inc., Merz Pharmaceuticals GmbH, Galderma S.A., Fidia Farmaceutici S.p.A., Medytox, Inc., Shiseido Company, Limited, Revance Therapeutics, Inc., Suneva Medical, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE hyaluronic acid market appears promising, driven by increasing consumer demand for innovative skincare solutions and the expansion of the pharmaceutical sector. As the market evolves, companies are likely to focus on developing advanced formulations that cater to specific consumer needs. Additionally, the rise of e-commerce platforms will facilitate broader distribution, allowing manufacturers to reach a wider audience and enhance their market presence in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Cross-Linked Hyaluronic Acid Native/Linear Hyaluronic Acid |

| By Grade | Cosmetic Grade HA Pharmaceutical Grade HA Food Grade HA |

| By Dosage Form | Solution Form Gel Form Powder Form |

| By Application | Aesthetics & Cosmetics Osteoarthritis Treatment Ophthalmic Solutions Pharmaceutical API Dietary Supplements |

| By End-User | Dermatology Clinics Cosmetic Surgery Centers Medical Spas and Beauty Centers Pharmaceutical Manufacturers |

| By Distribution Channel | Retail Sales (Pharmacies, Online Platforms, Beauty Retailers) Direct Tender (Hospitals, Specialty Clinics, Government Healthcare Systems) |

| By Region | Dubai Abu Dhabi Sharjah Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Industry Suppliers | 60 | Product Managers, R&D Directors |

| Pharmaceutical Manufacturers | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Food and Beverage Sector | 40 | Product Development Managers, Nutritionists |

| Research Institutions | 40 | Academic Researchers, Lab Managers |

| Distributors and Wholesalers | 50 | Sales Managers, Supply Chain Coordinators |

The UAE Hyaluronic Acid HA Raw Material Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing demand in cosmetic and medical applications, as well as heightened consumer awareness regarding the benefits of hyaluronic acid.