Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7292

Pages:99

Published On:December 2025

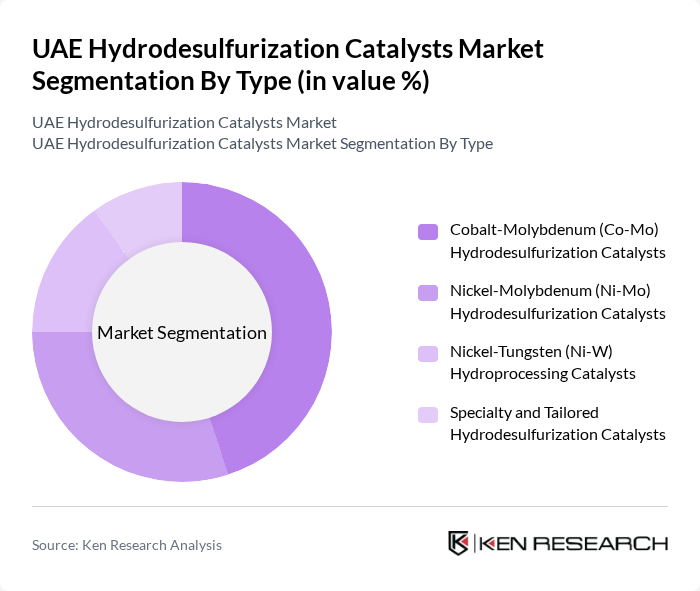

By Type:The market is segmented into various types of hydrodesulfurization catalysts, including Cobalt-Molybdenum (Co-Mo), Nickel-Molybdenum (Ni-Mo), Nickel-Tungsten (Ni-W), and Specialty and Tailored Hydrodesulfurization Catalysts. Co-Mo catalysts are widely used in diesel and gas oil hydrotreating because of their strong hydrodesulfurization activity, robustness on standard middle distillate feeds, and cost-effectiveness. The demand for Ni-Mo catalysts is also significant, particularly in integrated refineries processing heavier or more sour feeds, as they offer higher hydrogenation and hydrodenitrogenation activity and better performance on cracked feedstocks. Ni-W hydroprocessing catalysts and specialty/tailored formulations are increasingly applied in high-pressure and residue hydroprocessing units, where deep desulfurization and aromatics saturation are required for ultra-low sulfur fuels and petrochemical feedstock preparation.

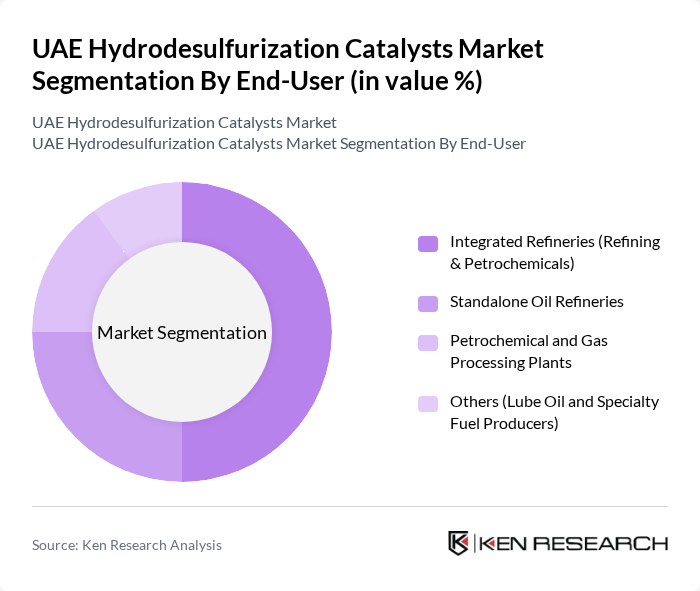

By End-User:The end-user segment includes Integrated Refineries, Standalone Oil Refineries, Petrochemical and Gas Processing Plants, and Others such as Lube Oil and Specialty Fuel Producers. Integrated Refineries dominate the market due to their comprehensive processing configurations, larger hydroprocessing capacity, and the need for advanced catalyst systems to meet stringent international fuel and petrochemical feedstock specifications. Standalone Oil Refineries also contribute significantly, as they require efficient hydrotreating catalysts to optimize operations, extend run lengths, and consistently achieve low-sulfur diesel, gasoline, and jet fuel grades. Petrochemical and gas processing plants, along with lube oil and specialty fuel producers, utilize hydrodesulfurization catalysts to remove sulfur and other impurities from feedstocks, protecting downstream catalysts and ensuring product quality for aromatics, olefins, and high-grade lubricants.

The UAE Hydrodesulfurization Catalysts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, Haldor Topsoe A/S, Axens, Honeywell UOP, BASF SE, Johnson Matthey, W. R. Grace & Co., Shell Catalysts & Technologies, Advanced Refining Technologies LLC (ART Hydroprocessing), China Petroleum & Chemical Corporation (Sinopec Catalyst), Clariant AG, JGC C&C, Linde plc, Technip Energies, KBR, Inc. contribute to innovation, geographic expansion, and service delivery in this space, with many of these companies recognized globally as key suppliers of hydroprocessing and hydrotreating catalysts.

The UAE hydrodesulfurization catalysts market is poised for significant transformation as the region prioritizes sustainable refining practices and compliance with stringent environmental regulations. In future, the integration of digital technologies in catalyst management is expected to enhance operational efficiencies, while ongoing investments in research and development will lead to innovative catalyst formulations. As the market evolves, strategic partnerships among key players will be crucial in addressing challenges and capitalizing on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cobalt-Molybdenum (Co-Mo) Hydrodesulfurization Catalysts Nickel-Molybdenum (Ni-Mo) Hydrodesulfurization Catalysts Nickel-Tungsten (Ni-W) Hydroprocessing Catalysts Specialty and Tailored Hydrodesulfurization Catalysts |

| By End-User | Integrated Refineries (Refining & Petrochemicals) Standalone Oil Refineries Petrochemical and Gas Processing Plants Others (Lube Oil and Specialty Fuel Producers) |

| By Application | Diesel and Gasoil Hydrotreating Naphtha and Gasoline Hydrotreating Kerosene and Jet Fuel Hydrotreating Residue and Vacuum Gas Oil (VGO) Hydrodesulfurization |

| By Catalyst Composition | Cobalt-Molybdenum on Alumina Nickel-Molybdenum on Alumina Nickel-Tungsten on Alumina or Silica-Alumina Others (Promoted and Multi-Metal Systems) |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Fujairah, Ras Al Khaimah, Umm Al Quwain) |

| By Technology | Fixed-Bed Hydrotreating Units Trickle-Bed Reactors Ebullated-Bed and Slurry-Phase Systems Others (Hybrid and Proprietary Reactor Configurations) |

| By Market Structure | Presence of Global Catalyst Suppliers Presence of Technology Licensors and Service Providers Role of Local Distributors and Agents |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refinery Operations | 110 | Refinery Managers, Process Engineers |

| Catalyst Suppliers | 90 | Sales Directors, Product Managers |

| Environmental Compliance | 60 | Regulatory Affairs Specialists, Environmental Engineers |

| Research & Development | 70 | R&D Managers, Chemical Researchers |

| Market Analysts | 50 | Market Analysts, Industry Consultants |

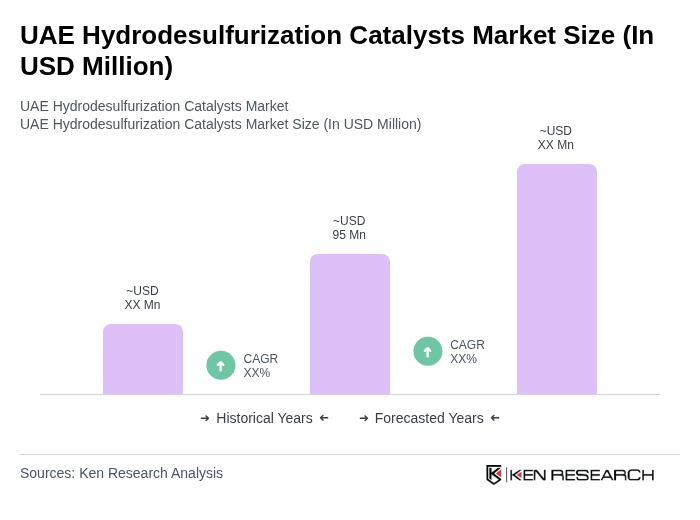

The UAE Hydrodesulfurization Catalysts Market is valued at approximately USD 95 million, reflecting its significance within the broader Middle East refinery and hydroprocessing catalyst market, driven by environmental regulations and the demand for cleaner fuels.