Region:Middle East

Author(s):Dev

Product Code:KRAB7052

Pages:97

Published On:October 2025

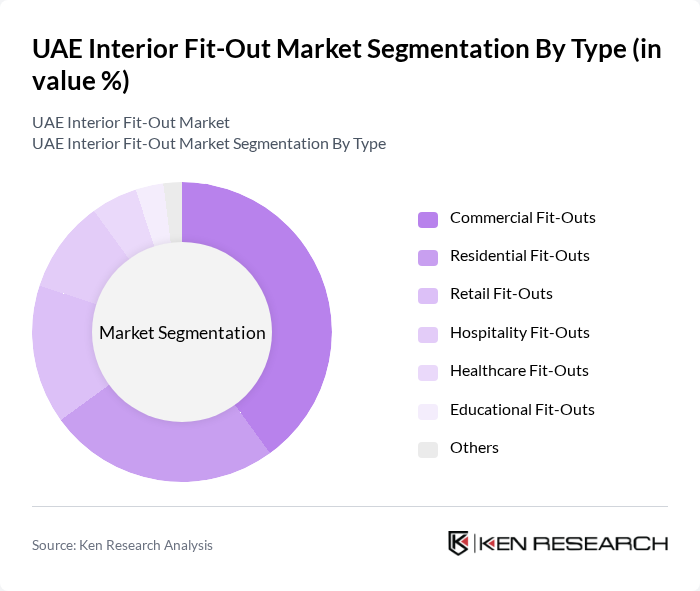

By Type:The market is segmented into various types, including Commercial Fit-Outs, Residential Fit-Outs, Retail Fit-Outs, Hospitality Fit-Outs, Healthcare Fit-Outs, Educational Fit-Outs, and Others. Among these, Commercial Fit-Outs dominate the market due to the increasing number of businesses and office spaces being established in the UAE. The demand for modern and functional office environments has led to significant investments in commercial fit-outs, making it a key driver of market growth.

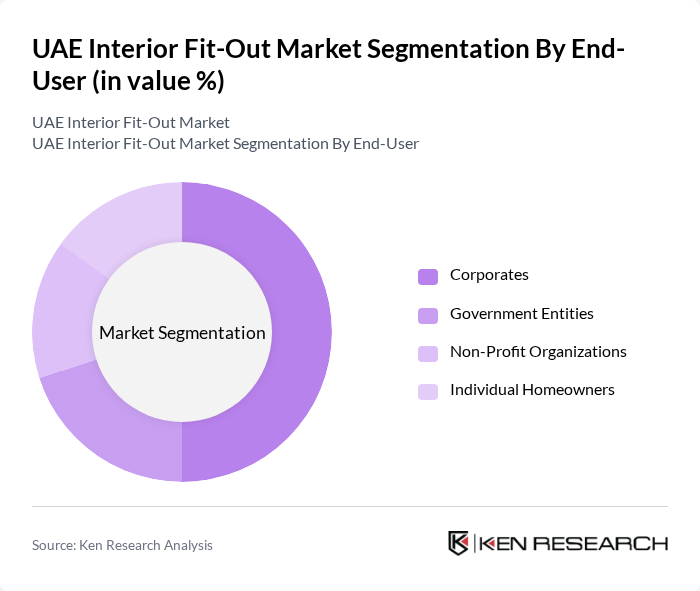

By End-User:The end-user segmentation includes Corporates, Government Entities, Non-Profit Organizations, and Individual Homeowners. Corporates are the leading end-users in the market, driven by the need for modern office spaces that enhance productivity and employee satisfaction. The trend towards flexible workspaces and collaborative environments has further fueled the demand for fit-out services among corporate clients.

The UAE Interior Fit-Out Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Habtoor Group, Al Futtaim Group, Arabtec Construction LLC, Khatib & Alami, Al Tayer Group, Al Jaber Group, Emaar Properties, Al Shafar General Contracting, Al Mufeed Group, Interiors International, Fit-Outs UAE, Design & Build, Al Maktoum Group, Al Mufeed Interiors, Al Mufeed Contracting contribute to innovation, geographic expansion, and service delivery in this space.

The UAE interior fit-out market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the demand for smart buildings increases, integrating technology into design will become essential. Additionally, the emphasis on sustainability will push companies to adopt eco-friendly practices and materials. With the hospitality and retail sectors expanding, the market will likely see a surge in innovative fit-out solutions that cater to these industries, ensuring continued growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Fit-Outs Residential Fit-Outs Retail Fit-Outs Hospitality Fit-Outs Healthcare Fit-Outs Educational Fit-Outs Others |

| By End-User | Corporates Government Entities Non-Profit Organizations Individual Homeowners |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Design Style | Modern Design Traditional Design Minimalist Design Industrial Design |

| By Material Used | Wood Metal Glass Fabric |

| By Service Type | Design Services Project Management Construction Services Post-Completion Services |

| By Investment Source | Private Investment Government Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Fit-Outs | 100 | Project Managers, Facility Managers |

| Hospitality Sector Renovations | 80 | Hotel Operations Managers, Interior Designers |

| Retail Space Transformations | 70 | Store Managers, Visual Merchandisers |

| Residential Interior Projects | 60 | Homeowners, Interior Decorators |

| Healthcare Facility Upgrades | 50 | Healthcare Administrators, Architects |

The UAE Interior Fit-Out Market is valued at approximately USD 10 billion, driven by growth in the construction sector, urbanization, and demand for high-quality interior spaces across commercial, residential, and hospitality sectors.