Region:Middle East

Author(s):Rebecca

Product Code:KRAA9451

Pages:84

Published On:November 2025

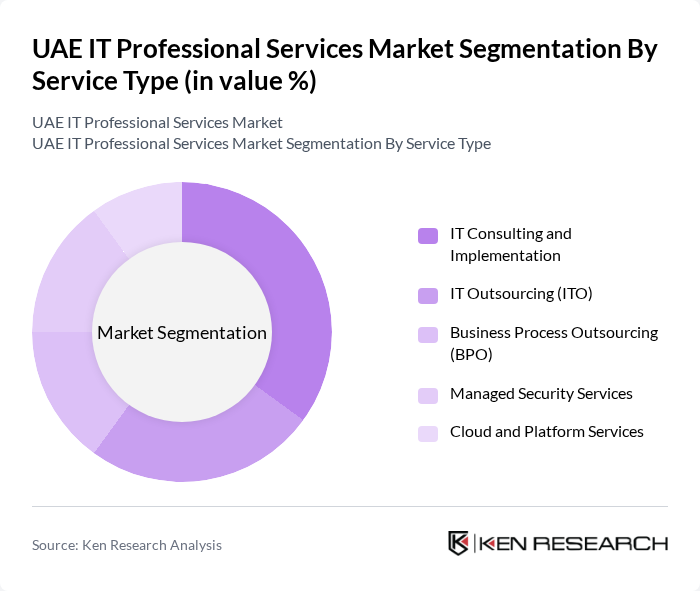

By Service Type:The service type segmentation includes various categories such as IT Consulting and Implementation, IT Outsourcing (ITO), Business Process Outsourcing (BPO), Managed Security Services, and Cloud and Platform Services. Among these, IT Consulting and Implementation is the leading sub-segment, driven by the increasing complexity of IT environments and the need for strategic guidance in digital transformation initiatives. Organizations are increasingly seeking expert advice to optimize their IT investments and align technology with business goals. The rise in demand for project-oriented services, particularly in cybersecurity and systems integration, is a notable trend in the UAE market .

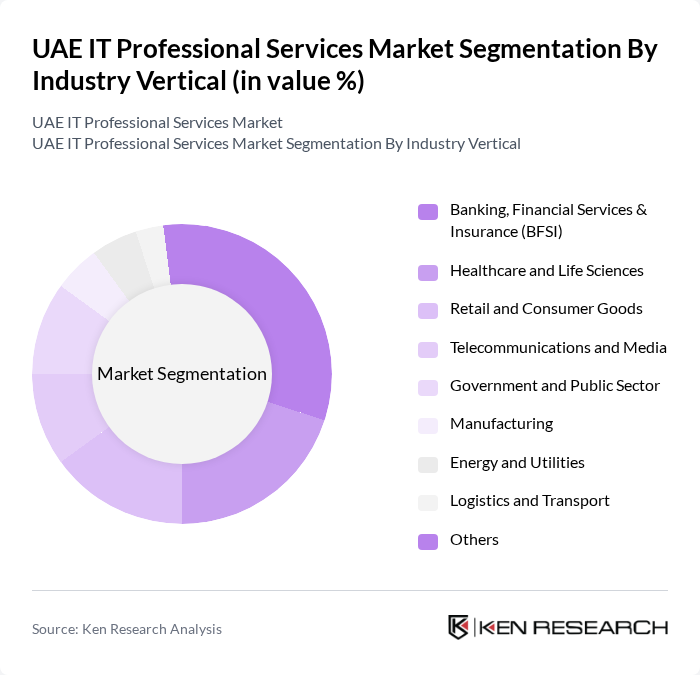

By Industry Vertical:The industry vertical segmentation encompasses sectors such as Banking, Financial Services & Insurance (BFSI), Healthcare and Life Sciences, Retail and Consumer Goods, Telecommunications and Media, Government and Public Sector, Manufacturing, Energy and Utilities, Logistics and Transport, and Others. The BFSI sector is the most significant contributor to the market, as financial institutions increasingly rely on IT services to enhance customer experience, ensure regulatory compliance, and improve operational efficiency. The growing adoption of fintech solutions and digital banking further drives demand in this vertical. Healthcare and life sciences are also experiencing strong growth due to digital health initiatives and investments in electronic medical records .

The UAE IT Professional Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM, Deloitte, Capgemini, Infosys, Wipro, Tata Consultancy Services (TCS), Oracle, SAP, HCL Technologies, Tech Mahindra, Atos, Fujitsu, NTT Data, DXC Technology, G42, Injazat, e& (formerly Etisalat Group), du (Emirates Integrated Telecommunications Company), Cloud4C, Mindware, Alpha Data, Emitac Enterprise Solutions, BIOS Middle East, Moro Hub (Digital DEWA) contribute to innovation, geographic expansion, and service delivery in this space .

The UAE IT professional services market is poised for significant evolution, driven by advancements in artificial intelligence and machine learning. As businesses increasingly adopt these technologies, the demand for specialized IT services will rise. Additionally, the ongoing investment in IT infrastructure, particularly in cloud and cybersecurity, will create new avenues for growth. Companies that adapt to these trends will likely thrive, positioning themselves as leaders in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | IT Consulting and Implementation IT Outsourcing (ITO) Business Process Outsourcing (BPO) Managed Security Services Cloud and Platform Services |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Healthcare and Life Sciences Retail and Consumer Goods Telecommunications and Media Government and Public Sector Manufacturing Energy and Utilities Logistics and Transport Others |

| By Client Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Delivery Model | On-Premises Cloud-Based Hybrid |

| By Geographic Presence | Abu Dhabi Dubai Sharjah Ajman Others |

| By Technology Focus | Cloud Computing Cybersecurity Data Analytics Artificial Intelligence Internet of Things (IoT) Others |

| By Customer Segment | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise IT Services | 100 | IT Managers, CIOs, CTOs |

| Cloud Computing Solutions | 60 | Cloud Architects, IT Consultants |

| Cybersecurity Services | 50 | Security Analysts, Compliance Officers |

| Software Development Services | 70 | Project Managers, Software Engineers |

| IT Infrastructure Management | 40 | Network Administrators, System Engineers |

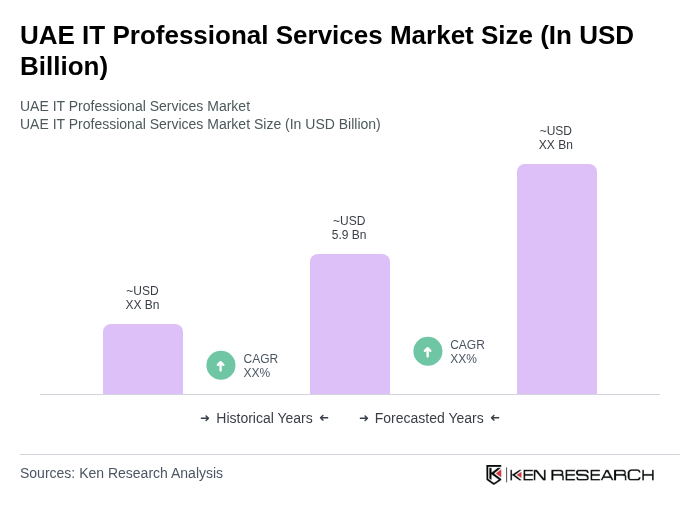

The UAE IT Professional Services Market is valued at approximately USD 5.9 billion, driven by digital transformation, cloud services demand, and cybersecurity needs. Significant investments in technology infrastructure, including smart city projects, have further fueled this market's growth.