Region:Middle East

Author(s):Rebecca

Product Code:KRAB7535

Pages:89

Published On:October 2025

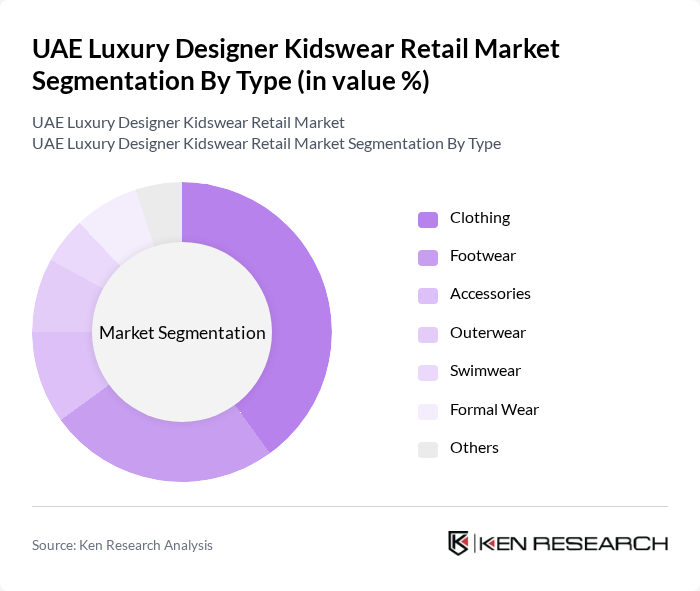

By Type:The market is segmented into various types, including Clothing, Footwear, Accessories, Outerwear, Swimwear, Formal Wear, and Others. Among these, Clothing is the leading sub-segment, driven by the high demand for stylish and comfortable apparel for children. The trend towards personalized and branded clothing has further fueled this segment's growth, as parents seek unique and high-quality options for their kids.

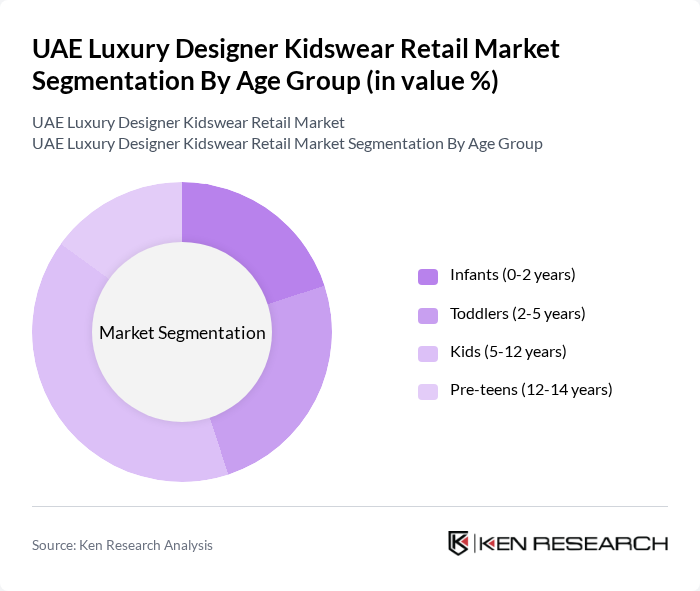

By Age Group:The market is segmented by age groups, including Infants (0-2 years), Toddlers (2-5 years), Kids (5-12 years), and Pre-teens (12-14 years). The Kids (5-12 years) segment dominates the market, as this age group is often the focus of fashion trends and parents are keen to dress their children in stylish, high-quality clothing. The increasing influence of social media and celebrity endorsements also drives demand in this segment.

The UAE Luxury Designer Kidswear Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci, Dolce & Gabbana, Burberry, Fendi, Versace, Ralph Lauren, Moncler, Stella McCartney, Kenzo, Balmain, Givenchy, Armani, Hugo Boss, Paul Smith, Chloé contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE luxury designer kidswear market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly prioritize quality and sustainability, brands that adapt to these trends are likely to thrive. Additionally, the expansion of e-commerce and digital marketing strategies will enhance brand visibility and accessibility. Collaborations with local designers and a focus on personalized shopping experiences will further differentiate offerings, catering to the unique tastes of affluent consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Accessories Outerwear Swimwear Formal Wear Others |

| By Age Group | Infants (0-2 years) Toddlers (2-5 years) Kids (5-12 years) Pre-teens (12-14 years) |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores Specialty Stores |

| By Brand Positioning | High-End Luxury Premium Brands Affordable Luxury |

| By Material | Cotton Polyester Wool Blends |

| By Occasion | Casual Wear Formal Events Sports Activities Seasonal Wear |

| By Distribution Mode | Direct Sales Wholesale Franchise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Kidswear Retailers | 100 | Store Managers, Brand Owners |

| Parents of Luxury Kidswear Consumers | 150 | Parents aged 25-45 with children aged 0-12 |

| Fashion Influencers and Bloggers | 50 | Child Fashion Influencers, Lifestyle Bloggers |

| Market Analysts and Consultants | 30 | Industry Analysts, Retail Consultants |

| Luxury Brand Representatives | 40 | Marketing Managers, Product Development Heads |

The UAE Luxury Designer Kidswear Retail Market is valued at approximately USD 1.2 billion, reflecting a robust growth driven by increasing disposable incomes and a rising population of affluent families seeking high-quality children's clothing.