Region:Middle East

Author(s):Shubham

Product Code:KRAB3180

Pages:82

Published On:October 2025

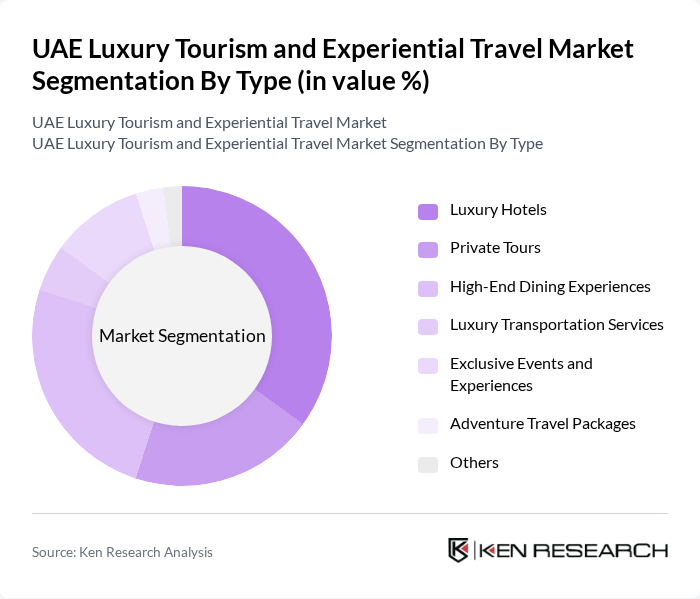

By Type:The market is segmented into various types, including Luxury Hotels, Private Tours, High-End Dining Experiences, Luxury Transportation Services, Exclusive Events and Experiences, Adventure Travel Packages, and Others. Among these, Luxury Hotels and High-End Dining Experiences are particularly prominent, driven by consumer preferences for premium accommodations and gourmet culinary offerings.

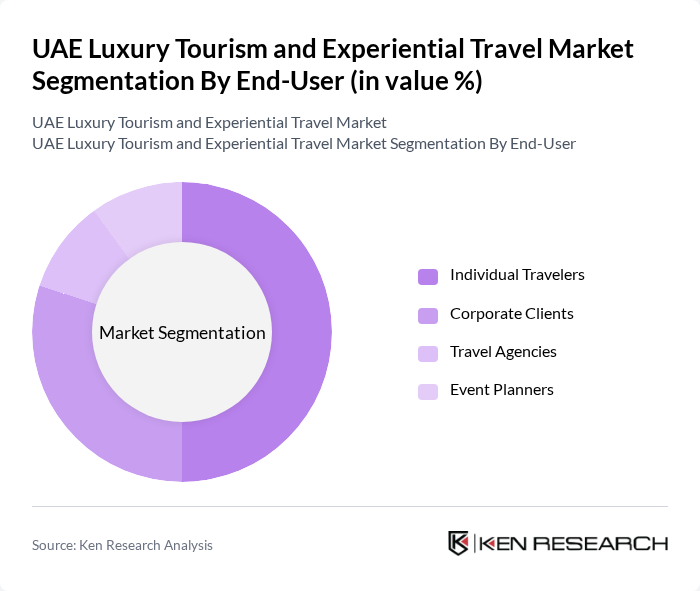

By End-User:The end-user segmentation includes Individual Travelers, Corporate Clients, Travel Agencies, and Event Planners. Individual Travelers dominate the market, driven by a growing trend of personalized travel experiences and the increasing number of affluent tourists seeking unique luxury offerings.

The UAE Luxury Tourism and Experiential Travel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumeirah Group, Emirates Palace, Atlantis, The Palm, Four Seasons Hotels and Resorts, The Ritz-Carlton, Mandarin Oriental Hotel Group, Anantara Hotels, Resorts & Spas, Waldorf Astoria Hotels & Resorts, Address Hotels + Resorts, Rove Hotels, Banyan Tree Hotels & Resorts, Shangri-La Hotels and Resorts, Al Habtoor Group, Accor Hotels, Hilton Worldwide contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE luxury tourism market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek immersive experiences, the demand for unique, culturally rich offerings is expected to rise. Additionally, the integration of digital platforms for travel planning will enhance customer engagement. With government support for tourism initiatives and a focus on sustainability, the market is poised for growth, attracting both local and international tourists seeking luxury experiences in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Private Tours High-End Dining Experiences Luxury Transportation Services Exclusive Events and Experiences Adventure Travel Packages Others |

| By End-User | Individual Travelers Corporate Clients Travel Agencies Event Planners |

| By Customer Demographics | Millennials Gen X Baby Boomers Families |

| By Travel Purpose | Leisure Travel Business Travel Medical Tourism Cultural Tourism |

| By Booking Channel | Online Travel Agencies Direct Bookings Travel Agents Mobile Apps |

| By Price Range | Budget Luxury Mid-Range Luxury High-End Luxury |

| By Duration of Stay | Short-Term Stays Long-Term Stays Weekend Getaways Extended Vacations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Guests | 150 | Affluent Travelers, Business Executives |

| Experiential Travel Providers | 100 | Tour Operators, Experience Curators |

| Luxury Travel Agents | 80 | Travel Advisors, Agency Owners |

| Wellness Retreat Participants | 70 | Health-Conscious Travelers, Wellness Enthusiasts |

| Cultural Experience Tourists | 90 | Culture Seekers, Art Enthusiasts |

The UAE Luxury Tourism and Experiential Travel Market is valued at approximately USD 20 billion, driven by an influx of high-net-worth individuals and increased disposable incomes, alongside significant investments in tourism infrastructure.