Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5940

Pages:82

Published On:December 2025

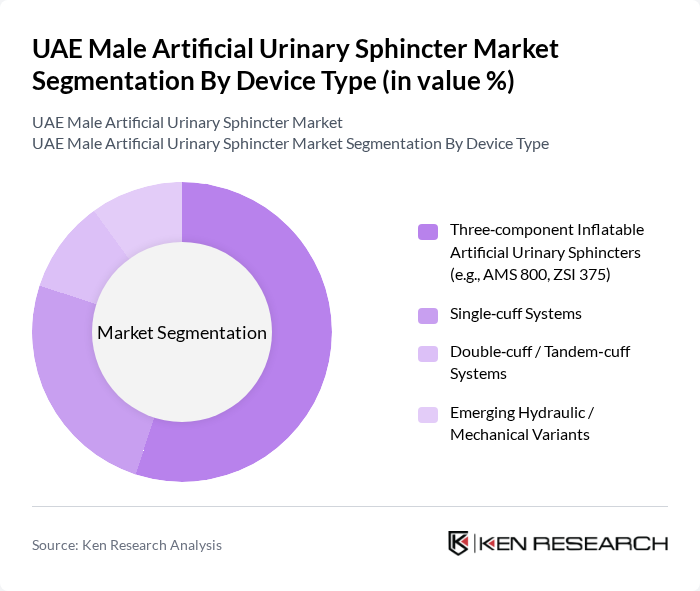

By Device Type:The device type segmentation includes various artificial urinary sphincters that cater to different patient needs and surgical preferences. The three-component inflatable artificial urinary sphincters, such as the AMS 800 (now marketed by Boston Scientific) and the ZSI 375, are widely used and considered the reference standard for managing severe male stress urinary incontinence after prostate surgery, owing to their proven long?term efficacy and durability. Single-cuff systems and double-cuff/tandem-cuff configurations are also employed in selected patients, including those with recurrent incontinence or specific urethral conditions, to optimize continence outcomes. Emerging hydraulic and mechanical variants are attracting interest as they aim to simplify activation, reduce mechanical failure risk, and offer alternative options for patients who are unsuitable for standard three?component inflatable systems.

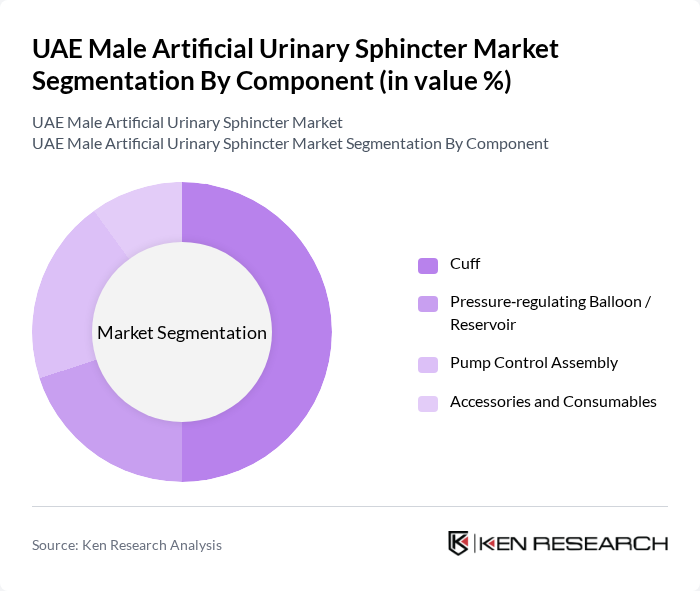

By Component:The component segmentation of the market includes various parts that make up the artificial urinary sphincters. The cuff is the most critical component, as it encircles the urethra and directly controls urinary flow by providing circumferential compression. The pressure-regulating balloon/reservoir and pump control assembly are also essential, maintaining system pressure and allowing the patient to manually cycle the device between continence and voiding phases. Accessories and consumables, including tubing, connectors, and surgical tools specific to implantation and revision, play a supporting role, ensuring effective operation, customization to patient anatomy, and long?term maintenance of the sphincters. The demand for these components is driven by primary implantations as well as the need for replacements and upgrades due to device wear, mechanical failure, or infection over time.

The UAE Male Artificial Urinary Sphincter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation (including legacy AMS 800 system), Zephyr Surgical Implants Sàrl, Coloplast A/S, GT Urological LLC, Laborie Medical Technologies Corp., Cook Medical LLC, Teleflex Incorporated, B. Braun Melsungen AG, Andromeda Medizinische Systeme GmbH, Promedon S.A., Neomedic International S.L., SRS Medical Systems, Inc., Albyn Medical Ltd., RBM-Med S.p.A., Silimed Indústria de Implantes Ltda. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE male artificial urinary sphincter market appears promising, driven by ongoing advancements in medical technology and increasing healthcare investments. The integration of digital health solutions is expected to enhance patient monitoring and post-operative care, improving overall treatment outcomes. Additionally, the growing emphasis on patient-centric care will likely lead to more tailored treatment options, fostering a more supportive environment for patients seeking surgical interventions for urinary incontinence.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Three?component Inflatable Artificial Urinary Sphincters (e.g., AMS 800, ZSI 375) Single?cuff Systems Double?cuff / Tandem?cuff Systems Emerging Hydraulic / Mechanical Variants |

| By Component | Cuff Pressure?regulating Balloon / Reservoir Pump Control Assembly Accessories and Consumables |

| By Indication | Post?prostatectomy Stress Urinary Incontinence Neurogenic Bladder?related Incontinence Iatrogenic / Traumatic Sphincter Damage Others |

| By Implantation Approach | Perineal Approach Penoscrotal Approach Revision / Explant and Re?implant Procedures Others |

| By End?User | Tertiary Care Hospitals & Academic Medical Centers Specialized Urology & Andrology Centers Day?surgery Centers Others |

| By Distribution Channel | Direct Tenders to Hospitals Local Medical Device Distributors Regional Importers / Group Purchasing Organizations Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urology Clinics | 100 | Urologists, Clinic Managers |

| Hospitals (Public Sector) | 90 | Procurement Managers, Surgical Unit Heads |

| Hospitals (Private Sector) | 90 | Medical Directors, Purchasing Managers |

| Patient Advocacy Groups | 60 | Patient Representatives, Healthcare Advocates |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

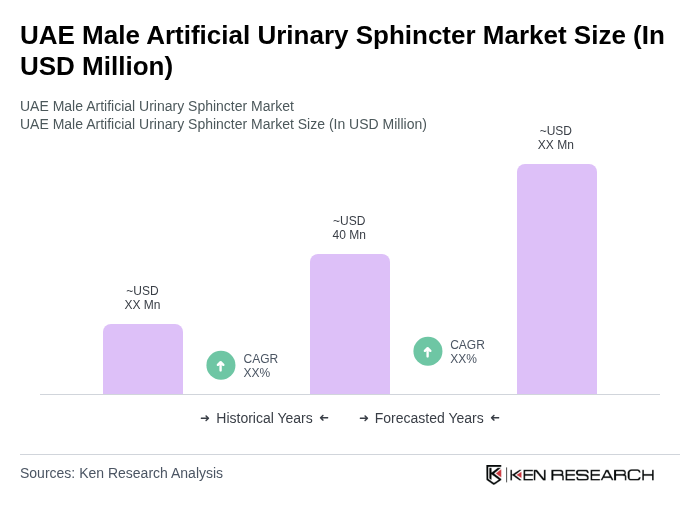

The UAE Male Artificial Urinary Sphincter market is valued at approximately USD 40 million, reflecting a significant demand driven by increasing urinary incontinence cases and advancements in surgical techniques.