Region:Middle East

Author(s):Dev

Product Code:KRAD1708

Pages:93

Published On:November 2025

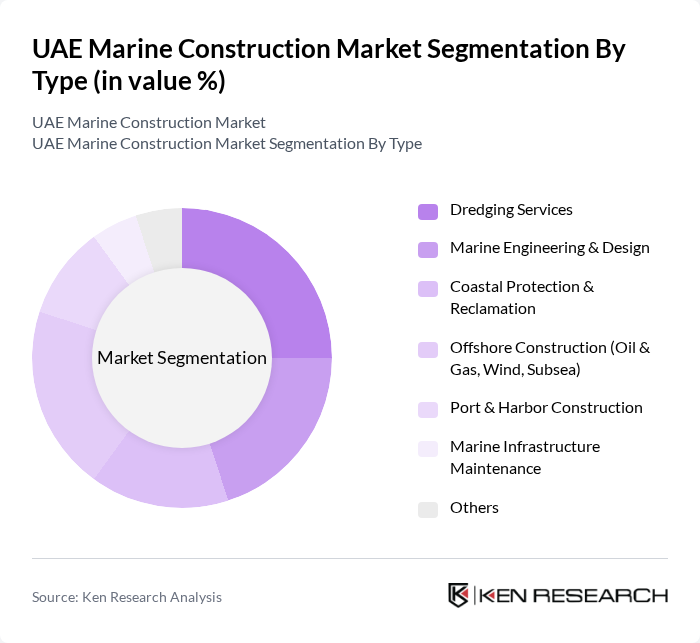

By Type:The marine construction market is segmented into dredging services, marine engineering and design, coastal protection and reclamation, offshore construction (oil & gas, wind, subsea), port and harbor construction, marine infrastructure maintenance, and others. Each segment addresses specific infrastructure needs, with dredging and offshore construction supporting port expansion and energy projects, while coastal protection and reclamation focus on shoreline resilience and land development .

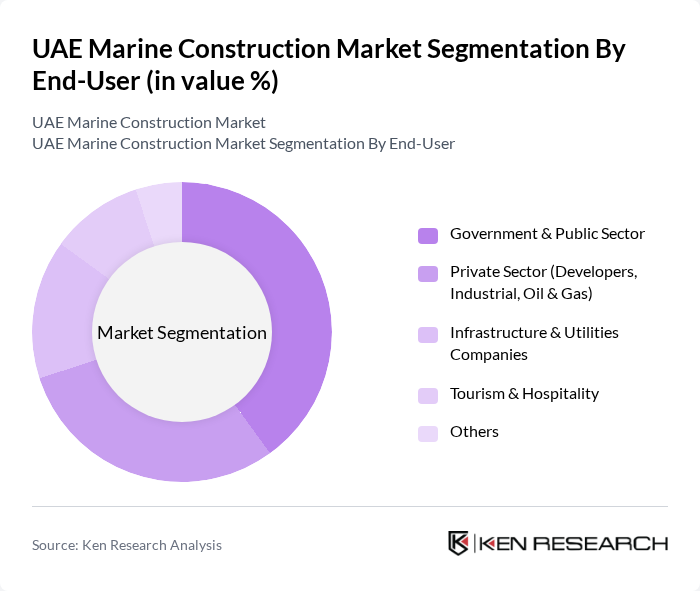

By End-User:The end-user segmentation of the marine construction market includes government and public sector, private sector (developers, industrial, oil & gas), infrastructure and utilities companies, tourism and hospitality, and others. Government and public sector entities drive demand through national infrastructure and port development programs, while the private sector and utilities invest in industrial terminals, energy infrastructure, and tourism-related marine assets .

The UAE Marine Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Marine Dredging Company (NMDC), Jan De Nul Group, Boskalis Westminster Middle East Ltd., Van Oord, Gulf Cobla, Archirodon Group NV, China Harbour Engineering Company Ltd. (CHEC), Al Jaber Group, Abu Dhabi Marine Operating Company (ADNOC Offshore), McDermott International, TechnipFMC, Saipem S.p.A., Besix Group (Six Construct), Dutco Balfour Beatty LLC, Lamprell plc contribute to innovation, geographic expansion, and service delivery in this space.

The UAE marine construction market is poised for significant growth, driven by ongoing infrastructure investments and a focus on sustainable practices. As the government continues to prioritize coastal protection and tourism development, innovative construction techniques and smart technologies will likely gain traction. Additionally, public-private partnerships are expected to play a crucial role in financing and executing large-scale projects, enhancing collaboration between the public sector and private investors in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dredging Services Marine Engineering & Design Coastal Protection & Reclamation Offshore Construction (Oil & Gas, Wind, Subsea) Port & Harbor Construction Marine Infrastructure Maintenance Others |

| By End-User | Government & Public Sector Private Sector (Developers, Industrial, Oil & Gas) Infrastructure & Utilities Companies Tourism & Hospitality Others |

| By Region | Abu Dhabi Dubai Sharjah Ras Al Khaimah Fujairah Ajman & Umm Al Quwain Others |

| By Application | Port Development & Expansion Marine Structures (Jetties, Quay Walls, Breakwaters) Waterfront & Land Reclamation Offshore Oil & Gas Facilities Renewable Energy (Offshore Wind, Solar Islands) Others |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| By Technology | Traditional Construction Methods Advanced Marine Technologies (Automation, Drones, BIM) Eco-friendly & Sustainable Construction Techniques Modular & Prefabricated Marine Structures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coastal Infrastructure Projects | 100 | Project Managers, Civil Engineers |

| Marine Construction Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Environmental Impact Assessments | 50 | Environmental Consultants, Regulatory Officers |

| Port Development Initiatives | 80 | Port Authorities, Infrastructure Planners |

| Marina Construction Projects | 50 | Architects, Urban Planners |

The UAE Marine Construction Market is valued at approximately USD 4.5 billion, driven by infrastructure development, port expansion, and investments in tourism and trade-related marine assets.