Region:Middle East

Author(s):Dev

Product Code:KRAD5105

Pages:96

Published On:December 2025

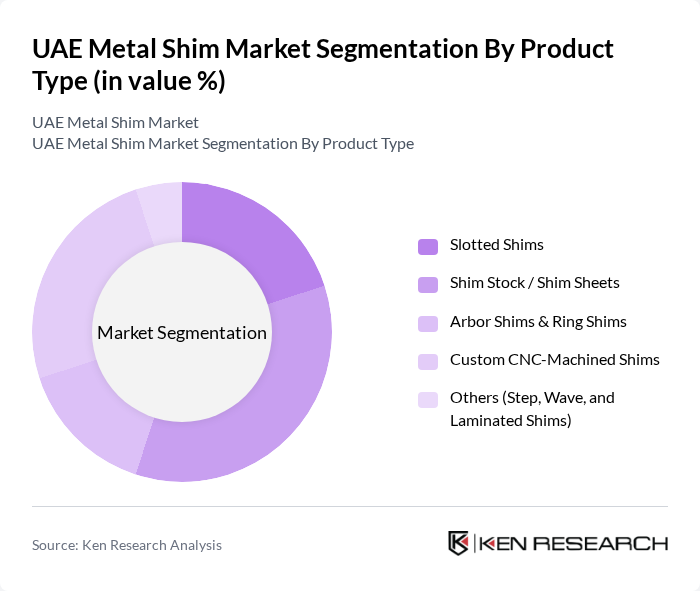

By Product Type:The product type segmentation includes various categories such as Slotted Shims, Shim Stock / Shim Sheets, Arbor Shims & Ring Shims, Custom CNC-Machined Shims, and Others (Step, Wave, and Laminated Shims). This structure is consistent with global metal shim product classifications, where flat shim stock, pre-cut slotted shims, and arbor/ring shims are standard categories supplied to OEMs and maintenance operations. Among these, Shim Stock / Shim Sheets are particularly popular due to their versatility, availability in coils and sheets across multiple thicknesses and alloys (carbon steel, stainless steel, brass), and ease of on-site cutting or stamping, making them a preferred choice for manufacturers and maintenance teams that require flexible adjustment solutions. The demand for Custom CNC-Machined Shims is also on the rise, driven by the need for precision-engineered, complex-geometry shims for aerospace, automotive, power generation, and high-spec industrial equipment, where tight tolerances, repeatability, and material traceability are essential.

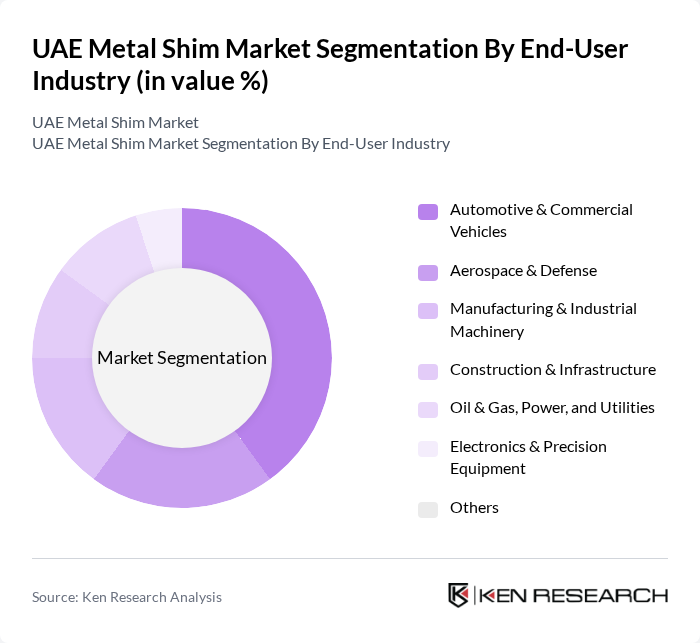

By End-User Industry:The end-user industry segmentation encompasses Automotive & Commercial Vehicles, Aerospace & Defense, Manufacturing & Industrial Machinery, Construction & Infrastructure, Oil & Gas, Power, and Utilities, Electronics & Precision Equipment, and Others. This segmentation aligns with the principal global demand centers for metal shims, which include transportation (automotive and aerospace), mechanical engineering, construction, and industrial equipment. The Automotive & Commercial Vehicles sector is the leading segment in terms of global metal shim consumption, driven by the increasing production of vehicles, the use of shims in braking systems, powertrain assemblies, chassis components, body alignment, and NVH (noise, vibration, and harshness) control, and the expansion of regional vehicle fleets supported by aftermarket maintenance. The Aerospace & Defense industry also shows significant demand due to stringent quality requirements, certification needs, and the use of high-performance metallic shims in airframe assembly, engine mounting, landing gear, and structural alignment in both commercial and defense platforms.

The UAE Metal Shim Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Futtaim Engineering & Technologies LLC, Emirates Steel Arkan PJSC, Arabian International Co. for Steel Structures LLC (UAE), Dutco Tennant LLC – Engineering & Fabrication Division, Techno Steel Construction LLC, Al Shirawi Steel LLC, KHK Scaffolding & Formwork LLC (Shim & Packing Plates), Danube Building Materials FZCO (Metal Shims & Packers Distribution), Reliance Steel Works LLC, Dubai Industrial Gasket LLC (Metal Shims & Spacers), Flexitallic UAE (Gaskets, Spiral Wound & Shim Materials), Hilti Emirates LLC (Construction Alignment Shims & Packs), Emirates Industrial Panel LLC, Abu Dhabi Metal Pipes & Profiles Industries Complex LLC, Al Ghurair Iron & Steel LLC contribute to innovation, geographic expansion, and service delivery in this space, leveraging UAE’s role as a regional fabrication, distribution, and export hub for metal products and industrial consumables.

The UAE metal shim market is poised for significant growth, driven by advancements in manufacturing technologies and increasing demand from key sectors such as automotive and construction. As the government continues to invest in infrastructure and smart manufacturing, the market is expected to adapt to emerging trends, including sustainability and lightweight materials. Companies that embrace innovation and focus on quality will likely thrive in this evolving landscape, positioning themselves for long-term success in the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Slotted Shims Shim Stock / Shim Sheets Arbor Shims & Ring Shims Custom CNC?Machined Shims Others (Step, Wave, and Laminated Shims) |

| By End-User Industry | Automotive & Commercial Vehicles Aerospace & Defense Manufacturing & Industrial Machinery Construction & Infrastructure Oil & Gas, Power, and Utilities Electronics & Precision Equipment Others |

| By Material | Carbon Steel Stainless Steel Aluminum Brass Copper Engineered Plastics and Composites Others |

| By Thickness Range | ? 0.05 mm (Ultra-Thin Precision Shims) mm – 0.25 mm mm – 1.0 mm > 1.0 mm |

| By Application | Precision Alignment and Leveling Tolerance Compensation and Spacing Vibration and Noise Damping Load Distribution and Structural Support Tooling, Fixtures, and Jig Setup Others |

| By Distribution Channel | Direct Sales to OEMs Industrial Distributors and Stockists Online Industrial Marketplaces Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Metal Shim Applications | 80 | Product Managers, Quality Assurance Engineers |

| Aerospace Component Manufacturing | 60 | Supply Chain Managers, Design Engineers |

| Electronics Industry Usage | 50 | Procurement Specialists, R&D Managers |

| Construction Sector Applications | 40 | Project Managers, Material Engineers |

| General Manufacturing Insights | 70 | Operations Managers, Production Supervisors |

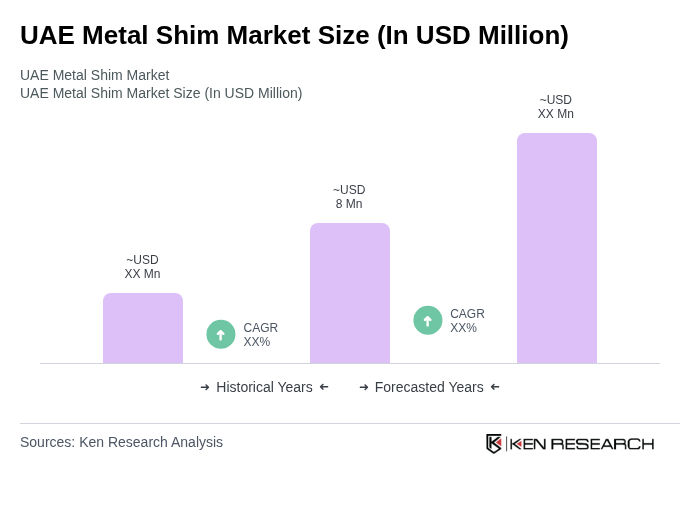

The UAE Metal Shim Market is valued at approximately USD 8 million, reflecting its growth driven by increasing demand for precision components across various industries, including automotive, aerospace, and construction.