Region:Middle East

Author(s):Shubham

Product Code:KRAB0713

Pages:89

Published On:August 2025

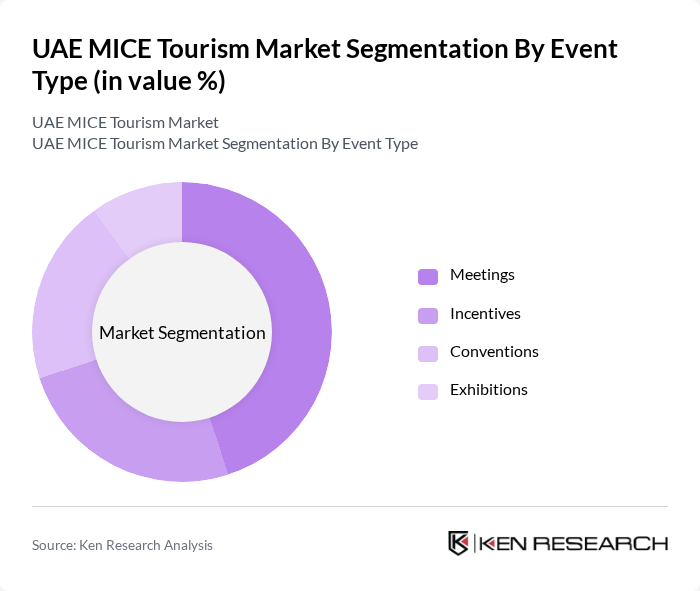

By Event Type:The event type segmentation includes meetings, incentives, conventions, and exhibitions. Meetings remain the most prevalent, driven by the growing need for corporate gatherings, strategic discussions, and business networking. Incentives are increasingly significant as organizations use travel experiences to reward and motivate employees. Conventions and exhibitions play a vital role in showcasing products and services, attracting a diverse audience from both regional and international markets .

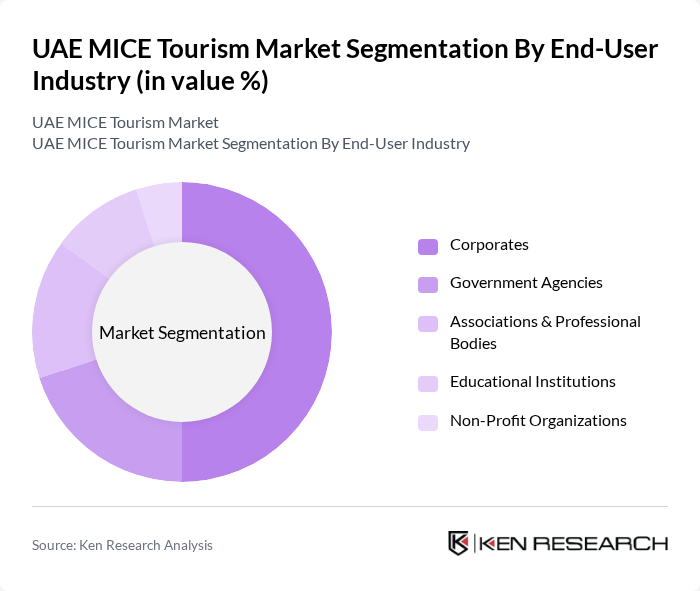

By End-User Industry:The end-user industry segmentation encompasses corporates, government agencies, associations & professional bodies, educational institutions, and non-profit organizations. Corporates dominate this segment, reflecting the rising importance of face-to-face interactions for networking and collaboration. Government agencies also play a significant role, hosting events to promote national initiatives and policies. Associations, educational institutions, and non-profits contribute to the diversity of the sector by organizing specialized conferences and knowledge-sharing forums .

The UAE MICE Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Group, Dubai World Trade Centre, Abu Dhabi National Exhibitions Company (ADNEC Group), Etihad Airways, Jumeirah Group, AccorHotels, Hilton Worldwide, Marriott International, InterContinental Hotels Group, MCI Group, Reed Exhibitions, Informa Markets, dmg events, Emaar Hospitality Group, Rotana Hotel Management Corporation PJSC, Hyatt Hotels Corporation, Radisson Hotel Group, Wyndham Hotels & Resorts, JA Resorts & Hotels, Millennium & Copthorne Hotels, Majid Al Futtaim, Sharjah Commerce and Tourism Development Authority, Ascott Limited, TIME Hotels, Habtoor Hospitality, Action Hotels, and Cvent contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE MICE tourism market appears promising, driven by ongoing investments in infrastructure and a focus on sustainability. As the region continues to recover from the pandemic, hybrid events are likely to become the norm, blending in-person and virtual experiences. Additionally, the emphasis on health and safety will shape event planning, ensuring a secure environment for participants. The UAE's strategic initiatives will further enhance its position as a leading global MICE destination, attracting diverse events and international attendees.

| Segment | Sub-Segments |

|---|---|

| By Event Type | Meetings Incentives Conventions Exhibitions |

| By End-User Industry | Corporates Government Agencies Associations & Professional Bodies Educational Institutions Non-Profit Organizations |

| By Event Size | Small Scale Events Medium Scale Events Large Scale Events Mega Events |

| By Location | Urban Venues Resort Venues Convention & Exhibition Centers |

| By Duration | One-Day Events Multi-Day Events Series/Recurring Events |

| By Service Type | Venue Management Event Planning & Management Catering & Hospitality Services Audio-Visual & Technology Services Transportation & Logistics |

| By Budget Range | Economy Mid-Range Premium Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Planners | 100 | Event Managers, Corporate Travel Coordinators |

| Exhibition Organizers | 80 | Exhibition Managers, Marketing Directors |

| Venue Managers | 60 | Facility Managers, Operations Directors |

| Corporate Clients | 90 | Procurement Officers, HR Managers |

| Tourism Board Officials | 50 | Policy Makers, Tourism Development Managers |

The UAE MICE tourism market is valued at approximately USD 6.0 billion, driven by significant investments in infrastructure, including convention centers and luxury hotels, as well as the country's strategic location as a global business hub.