Region:Middle East

Author(s):Shubham

Product Code:KRAD0993

Pages:90

Published On:November 2025

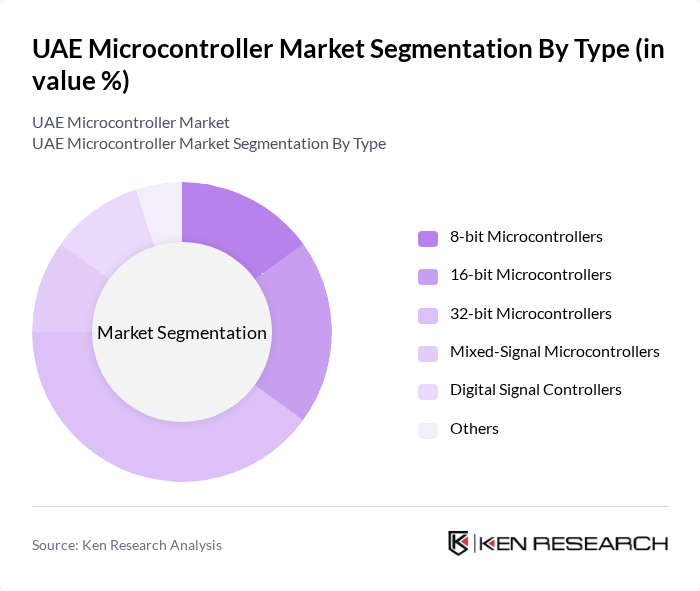

By Type:The microcontroller market can be segmented into various types, including 8-bit, 16-bit, 32-bit, mixed-signal microcontrollers, digital signal controllers, and others. Among these, 32-bit microcontrollers are leading the market due to their enhanced processing capabilities and efficiency, making them suitable for complex applications in automotive and industrial automation. The demand for 32-bit microcontrollers is driven by the increasing need for high-performance computing in embedded systems.

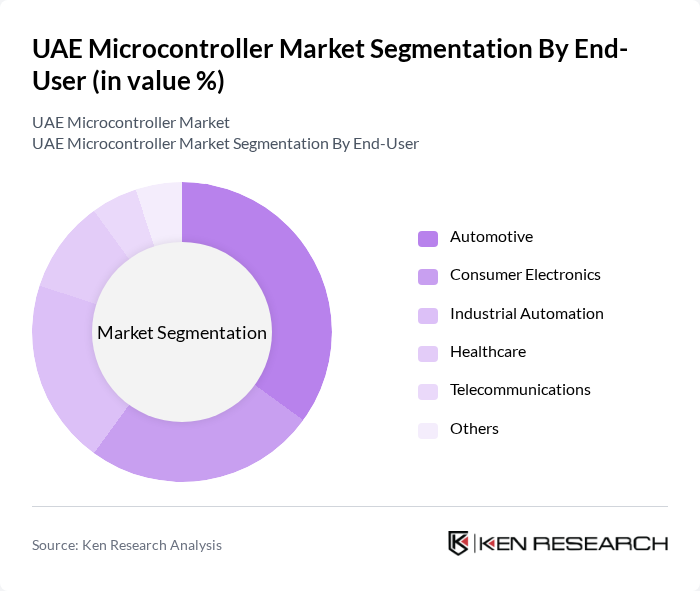

By End-User:The end-user segmentation includes automotive, consumer electronics, industrial automation, healthcare, telecommunications, and others. The automotive sector is the leading end-user of microcontrollers, driven by the increasing integration of advanced technologies in vehicles, such as driver assistance systems and infotainment. The growing trend towards electric vehicles and smart transportation solutions further enhances the demand for microcontrollers in this sector.

The UAE Microcontroller Market is characterized by a dynamic mix of regional and international players. Leading participants such as STMicroelectronics, Microchip Technology Inc., NXP Semiconductors, Texas Instruments Incorporated, Infineon Technologies AG, Renesas Electronics Corporation, Analog Devices, Inc., Cypress Semiconductor (now part of Infineon Technologies), Silicon Laboratories Inc., onsemi (ON Semiconductor), Atmel Corporation (now part of Microchip Technology Inc.), Maxim Integrated (now part of Analog Devices, Inc.), Broadcom Inc., Nordic Semiconductor ASA, Espressif Systems Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE microcontroller market is poised for significant advancements, driven by technological innovations and increasing investments in smart technologies. As industries adopt automation and IoT solutions, the demand for low-power microcontrollers will rise, enhancing energy efficiency. Furthermore, the integration of artificial intelligence in microcontroller applications is expected to revolutionize product capabilities, leading to smarter devices. The government's focus on fostering a digital economy will further support the growth of this sector, creating a favorable environment for innovation and development.

| Segment | Sub-Segments |

|---|---|

| By Type | bit Microcontrollers bit Microcontrollers bit Microcontrollers Mixed-Signal Microcontrollers Digital Signal Controllers Others |

| By End-User | Automotive Consumer Electronics Industrial Automation Healthcare Telecommunications Others |

| By Application | Embedded Systems Robotics Smart Home Devices Wearables Telecommunications Infrastructure Industrial Control Systems Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Technology | Analog Microcontrollers Digital Microcontrollers Hybrid Microcontrollers Others |

| By Market Segment | Consumer Market Commercial Market Industrial Market Government Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Microcontroller Applications | 60 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Integration | 50 | Product Managers, Electronics Designers |

| Industrial Automation Solutions | 40 | Operations Managers, Automation Engineers |

| IoT Device Development | 45 | IoT Specialists, Software Developers |

| Smart Home Technology | 40 | Home Automation Experts, Product Strategists |

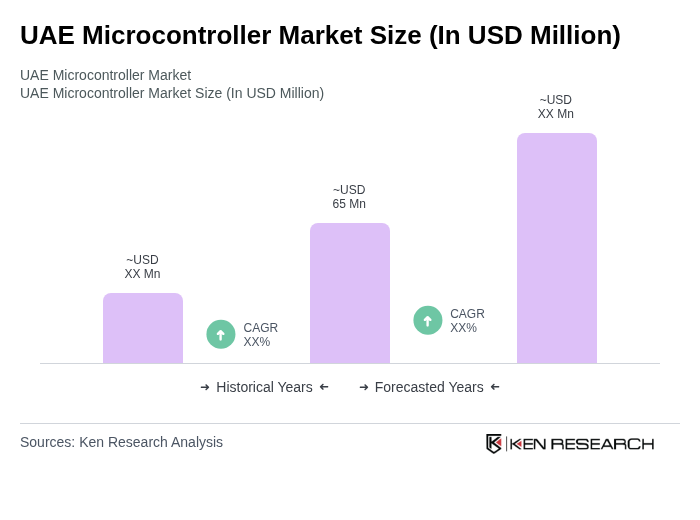

The UAE Microcontroller Market is valued at approximately USD 65 million, reflecting a five-year historical analysis. This growth is driven by increasing automation demands across various sectors, including automotive, healthcare, and consumer electronics.