Region:Middle East

Author(s):Rebecca

Product Code:KRAD8433

Pages:93

Published On:December 2025

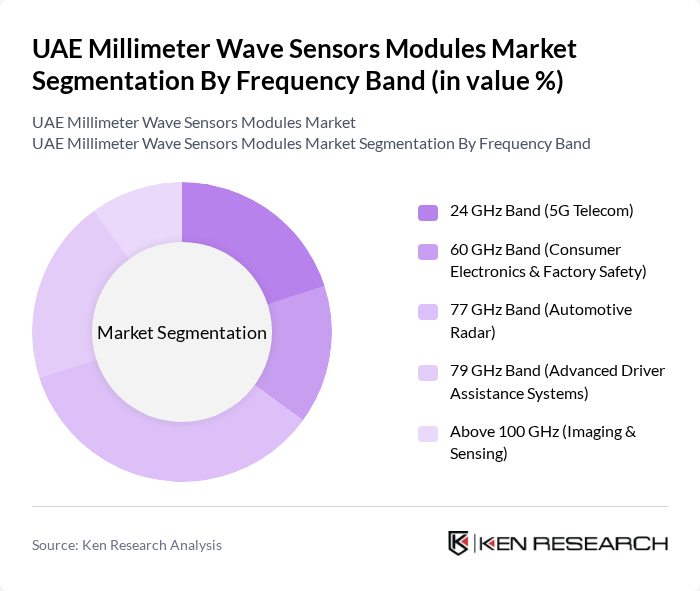

By Frequency Band:The frequency band segmentation includes various ranges that cater to different applications. The 24 GHz band is primarily used for 5G telecommunications, while the 60 GHz band finds applications in consumer electronics and factory safety. The 77 GHz band is crucial for automotive radar systems, and the 79 GHz band is utilized in advanced driver assistance systems (ADAS). Additionally, bands above 100 GHz are employed for imaging and sensing applications. The 77 GHz band is currently dominating the market due to the increasing demand for automotive safety features and autonomous driving technologies.

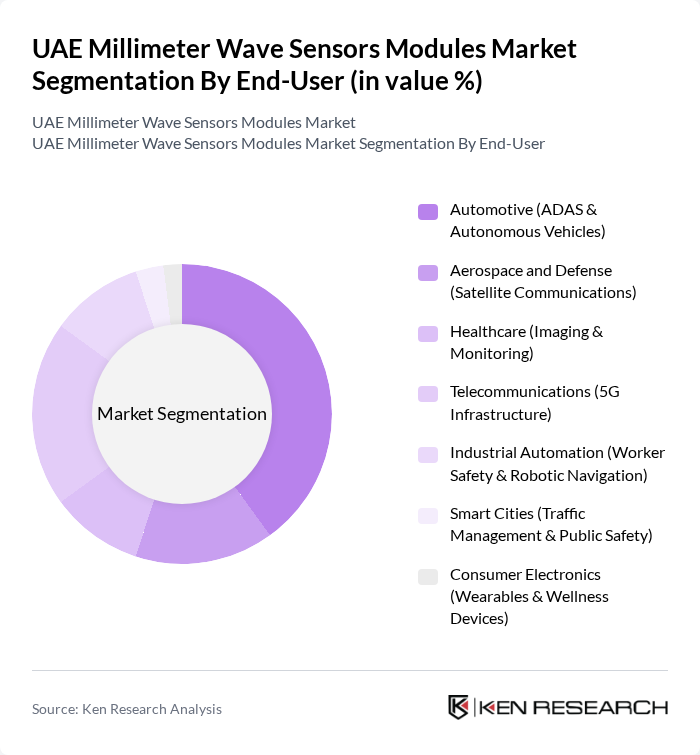

By End-User:The end-user segmentation encompasses various industries utilizing millimeter wave sensors. The automotive sector, particularly in advanced driver assistance systems (ADAS) and autonomous vehicles, is a significant contributor, with the global ADAS mmWave radar market projected to grow at a CAGR of 19.7%. Aerospace and defense applications, including satellite communications, also play a vital role. The healthcare sector is increasingly adopting mmWave technology for imaging and monitoring, while telecommunications is focused on 5G infrastructure. Industrial automation and smart city initiatives further drive demand, with consumer electronics also emerging as a notable segment. The automotive sector is leading the market due to the growing emphasis on safety and automation in vehicles.

The UAE Millimeter Wave Sensors Modules Market is characterized by a dynamic mix of regional and international players. Leading participants such as Keysight Technologies, Texas Instruments, Analog Devices Inc., NXP Semiconductors, Infineon Technologies AG, Qualcomm Technologies Inc., STMicroelectronics, Rohde & Schwarz, NEC Corporation, Thales Group, L3Harris Technologies Inc., Mitsubishi Electric Corporation, Ericsson AB, Huawei Technologies Co., Ltd., ZTE Corporation, Smiths Interconnect, Farran Technology Ltd., Millimeter Wave Products Inc., Ducommun Incorporated, Mobileye (Intel Subsidiary), Valeo SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE millimeter wave sensors market appears promising, driven by technological advancements and increasing integration into various sectors. As the demand for high-speed data transmission and IoT applications continues to rise, the market is expected to evolve rapidly. Additionally, the push for smart city initiatives and autonomous vehicles will further enhance the relevance of millimeter wave sensors. Companies that invest in R&D and strategic partnerships will likely lead the market, capitalizing on emerging opportunities and addressing existing challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Frequency Band | GHz Band (5G Telecom) GHz Band (Consumer Electronics & Factory Safety) GHz Band (Automotive Radar) GHz Band (Advanced Driver Assistance Systems) Above 100 GHz (Imaging & Sensing) |

| By End-User | Automotive (ADAS & Autonomous Vehicles) Aerospace and Defense (Satellite Communications) Healthcare (Imaging & Monitoring) Telecommunications (5G Infrastructure) Industrial Automation (Worker Safety & Robotic Navigation) Smart Cities (Traffic Management & Public Safety) Consumer Electronics (Wearables & Wellness Devices) |

| By Application | Automotive Radar (Collision Avoidance & Adaptive Cruise Control) Traffic Management & Monitoring Security & Surveillance Systems Industrial Process Monitoring Healthcare Imaging & Vital Sign Monitoring G Backhaul & Small Cell Deployment Gesture Recognition & Wellness Wearables |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| By Technology Type | Radar Technology (Automotive & Industrial) Imaging Technology (Medical & Security) Communication Technology (5G & Satellite) Sensing Technology (IoT & Wearables) AI-Integrated Signal Processing |

| By Investment Source | Private Investments Government Funding (UAE Space Agency & ISRO-equivalent initiatives) Public-Private Partnerships Venture Capital & Tech Innovation Funds Strategic Corporate Partnerships |

| By Policy Support | Subsidies for R&D in mmWave Technology Tax Incentives for Tech Manufacturing Grants for Smart City & 5G Development Spectrum Licensing & Regulatory Support Innovation Hub & Free Zone Incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Sector | 100 | Network Engineers, Product Development Managers |

| Automotive Industry Applications | 80 | R&D Engineers, Automotive Safety Analysts |

| Healthcare Technology Integration | 70 | Biomedical Engineers, Hospital IT Managers |

| Smart City Initiatives | 90 | Urban Planners, IoT Solutions Architects |

| Security and Surveillance Systems | 60 | Security System Integrators, Risk Management Officers |

The UAE Millimeter Wave Sensors Modules Market is valued at approximately USD 1.15 billion, driven by the demand for high-speed communication technologies and advanced automotive safety systems, particularly in smart city initiatives and industrial automation.