Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4845

Pages:84

Published On:December 2025

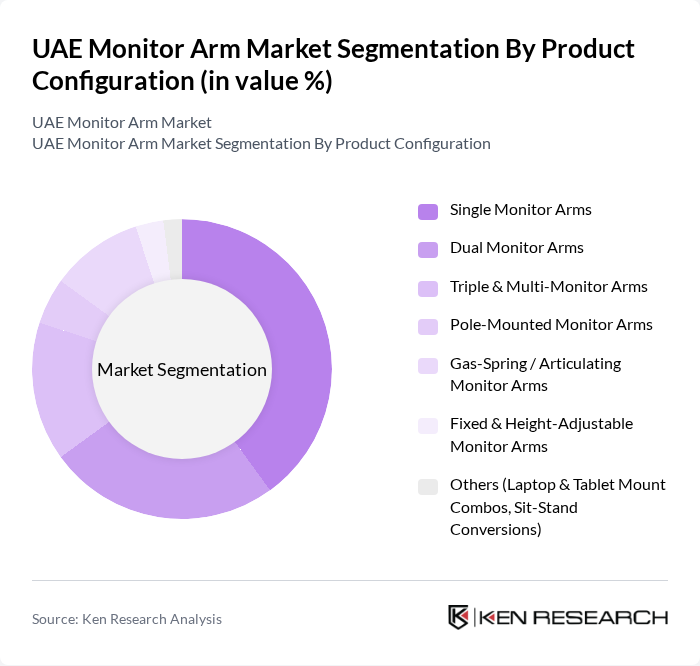

By Product Configuration:The product configuration segment includes various types of monitor arms designed to cater to different user needs and preferences. The subsegments are Single Monitor Arms, Dual Monitor Arms, Triple & Multi-Monitor Arms, Pole-Mounted Monitor Arms, Gas-Spring / Articulating Monitor Arms, Fixed & Height-Adjustable Monitor Arms, and Others (Laptop & Tablet Mount Combos, Sit-Stand Conversions). Among these, Single Monitor Arms hold the largest share of global unit demand and similarly dominate the UAE market due to their versatility, compatibility with standard VESA displays, and affordability, making them a popular choice for both home and office setups. The increasing trend of remote and hybrid work, together with growing adoption of dual?use home offices, has further fueled the demand for these products, as individuals seek to create ergonomic, space?efficient workspaces at home using single?arm mounts that can be installed without professional fit?out.

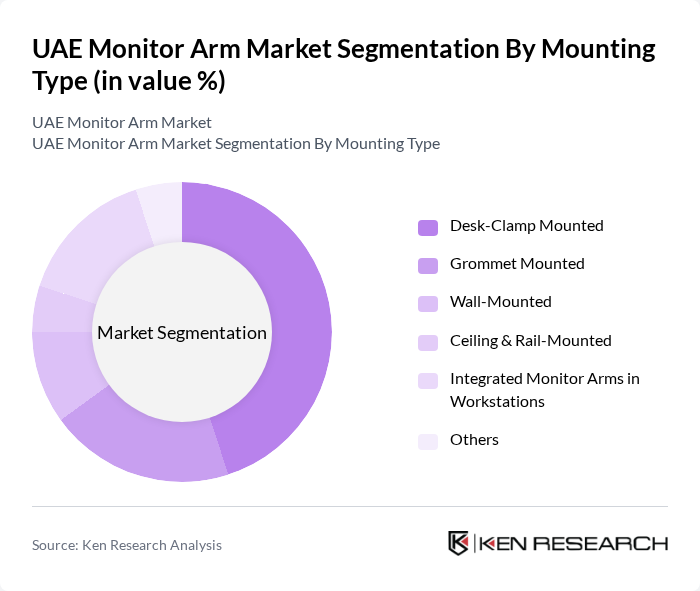

By Mounting Type:The mounting type segment encompasses various methods of attaching monitor arms to surfaces. This includes Desk-Clamp Mounted, Grommet Mounted, Wall-Mounted, Ceiling & Rail-Mounted, Integrated Monitor Arms in Workstations, and Others. Desk-Clamp Mounted monitor arms are particularly popular due to their ease of installation, compatibility with a wide range of desk types, and flexibility, allowing users to adjust their workspace without permanent modifications or drilling. The growing trend of flexible and activity?based workspaces, hot?desking, and co?working environments in the UAE, along with higher penetration of online retail channels for IT accessories, has contributed to the increasing preference for this mounting type.

The UAE Monitor Arm Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ergotron, Inc., Humanscale Corporation, Loctek Ergonomic Technology Corp. (FlexiSpot), Fellowes Brands, 3M Company, VIVO US, LLC, Mount-It (MI Industries Inc.), Amazon Basics (Amazon.com, Inc.), Hama GmbH & Co KG, StarTech.com Ltd., Kensington Computer Products Group (ACCO Brands), Atdec Pty Ltd, Chief (Legrand AV), Uncaged Ergonomics, Colebrook Bosson Saunders (CBS – a Herman Miller Group Company) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE monitor arm market is poised for significant growth, driven by the increasing emphasis on workplace ergonomics and the ongoing trend of remote work. As companies continue to prioritize employee well-being, the demand for innovative and customizable monitor arm solutions is expected to rise. Additionally, the integration of smart technology into ergonomic products will likely enhance user experience, making these solutions more appealing. The market is set to evolve, reflecting broader trends in health, wellness, and technology integration in workspaces.

| Segment | Sub-Segments |

|---|---|

| By Product Configuration | Single Monitor Arms Dual Monitor Arms Triple & Multi?Monitor Arms Pole?Mounted Monitor Arms Gas?Spring / Articulating Monitor Arms Fixed & Height?Adjustable Monitor Arms Others (Laptop & Tablet Mount Combos, Sit?Stand Conversions) |

| By Mounting Type | Desk?Clamp Mounted Grommet Mounted Wall?Mounted Ceiling & Rail?Mounted Integrated Monitor Arms in Workstations Others |

| By End?User Sector | Corporate & Commercial Offices Government & Public Sector Offices IT, BPO & Shared Service Centers Healthcare & Hospitals (Nurse Stations, Diagnostics, ORs) Education & Training Centers Trading Floors, Control Rooms & Command Centers Home Offices & Gaming Set?ups Others (Hospitality, Retail POS, Airports) |

| By Distribution Channel | Offline – Specialized Office Furniture Dealers Offline – IT & Electronics Retailers Project / Contract Sales via System Integrators Online – E?Commerce Marketplaces Online – Direct?to?Customer Brand Websites Others (B2B Procurement Platforms) |

| By Material | Aluminum Steel Plastic & ABS Composite & Hybrid Materials Others |

| By Load Capacity | Up to 8 kg kg – 15 kg kg – 25 kg Above 25 kg Heavy?Duty Arms for Large & Curved Monitors |

| By Price Range | Entry?Level / Budget Mid?Range Premium & Enterprise?Grade Customized & Project?Based Solutions |

| By Emirate | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Ergonomics | 110 | Facilities Managers, HR Directors |

| Co-working Space Design | 90 | Space Planners, Community Managers |

| Educational Institutions | 70 | IT Administrators, Procurement Officers |

| Healthcare Facilities | 80 | Office Managers, Ergonomics Specialists |

| Retail Sector Office Setup | 60 | Store Managers, Operations Directors |

The UAE Monitor Arm Market is valued at approximately USD 10 million, reflecting a significant share of the broader Middle East and Africa market, which is valued at around USD 30 million. This growth is driven by increased demand for ergonomic office solutions.