Region:Middle East

Author(s):Shubham

Product Code:KRAC3587

Pages:90

Published On:October 2025

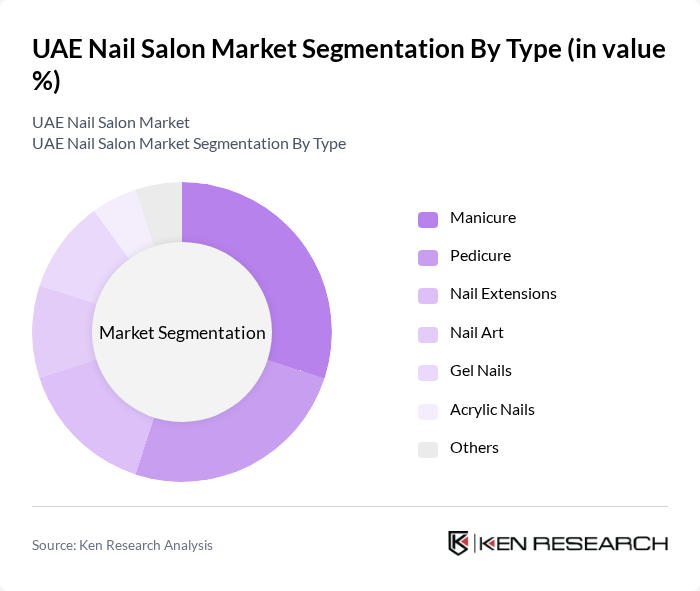

By Type:The market is segmented into various types of nail services, including manicure, pedicure, nail extensions, nail art, gel nails, acrylic nails, and others. Each segment caters to distinct consumer preferences and seasonal trends, with certain services gaining popularity due to fashion cycles and social media influence. Manicures and pedicures remain the most sought-after services, reflecting their role as essential components of personal grooming routines among UAE consumers.

The manicure segment dominates the market, driven by its popularity among women, especially in urban areas. Regular manicures are considered a basic necessity for personal grooming, with frequent visits to salons for nail health and aesthetics. The growing influence of social media and beauty influencers showcasing nail art trends has further boosted demand, making manicures a staple service in UAE nail salons.

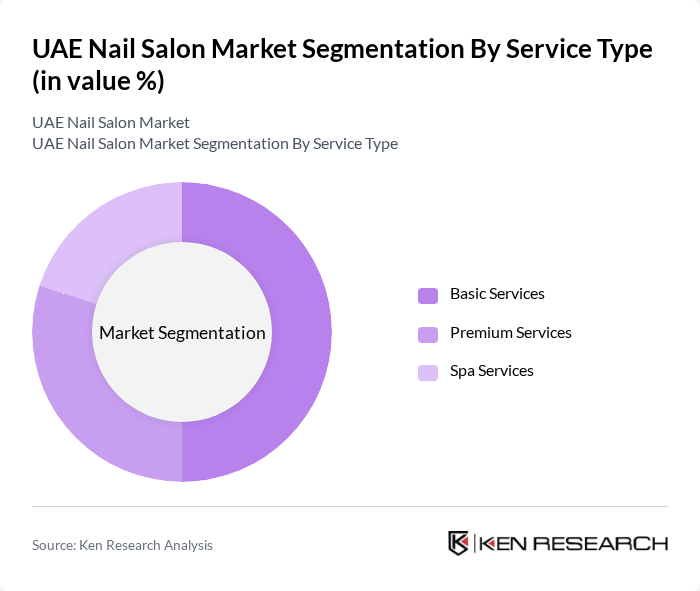

By Service Type:The market is categorized into basic services, premium services, and spa services. Each service type offers varying levels of luxury and care, appealing to different customer segments based on their preferences and budgets. Basic services remain the most accessible and widely used, while premium and spa services are increasingly favored by affluent consumers seeking enhanced experiences in high-end salons.

Basic services lead the market, as they are more accessible and affordable for a larger segment of the population. Many consumers prefer these services for regular maintenance, while premium and spa services are gaining traction among affluent customers seeking a more indulgent experience, particularly in high-end salons.

The UAE Nail Salon Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tips & Toes, The Nail Spa (TNS), N.Bar, Nail It!, Glossy Nails, The White Room, The Nail Lounge, En Vogue Beauty Center, La Femme Beauty Salon, Pinky Nail Bar, The Nail Bar, Beauty & The Beach, The Nail Room, Urban Nail Bar, The Nail Studio contribute to innovation, geographic expansion, and service delivery in this space.

The UAE nail salon market is poised for continued growth, driven by increasing disposable incomes and a rising beauty consciousness among consumers. As the tourism sector expands and the expatriate population continues to thrive, nail salons will likely see a surge in demand for diverse and innovative services. Additionally, the integration of technology in service delivery and booking processes will enhance customer experiences, positioning salons for success in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Manicure Pedicure Nail Extensions Nail Art Gel Nails Acrylic Nails Others |

| By Service Type | Basic Services Premium Services Spa Services |

| By Customer Demographics | Women (primary segment, especially ages 19-40) Men (growing segment for male grooming) Children (occasional, e.g., for events) |

| By Location | Urban Areas (Dubai, Abu Dhabi, Sharjah) Suburban Areas Tourist Areas (hotels, resorts, malls) |

| By Pricing Strategy | Budget Mid-Range Luxury (premium/luxury salons prevalent in UAE) |

| By Distribution Channel | Standalone Salons Salon Chains Online Booking Platforms (e.g., Fresha, Vaniday) |

| By Product Usage | Professional Use Home Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nail Salon Owners | 60 | Salon Owners, Franchise Operators |

| Regular Nail Salon Customers | 100 | Frequent Customers, Occasional Visitors |

| Beauty Industry Experts | 40 | Beauty Consultants, Industry Analysts |

| Cosmetic Product Suppliers | 50 | Suppliers, Distributors, Brand Representatives |

| Market Research Professionals | 40 | Market Analysts, Research Directors |

The UAE Nail Salon Market is valued at approximately USD 300 million, reflecting significant growth driven by increasing disposable income, a rising trend in personal grooming, and the influence of social media on beauty standards.