Region:Middle East

Author(s):Dev

Product Code:KRAA3582

Pages:88

Published On:September 2025

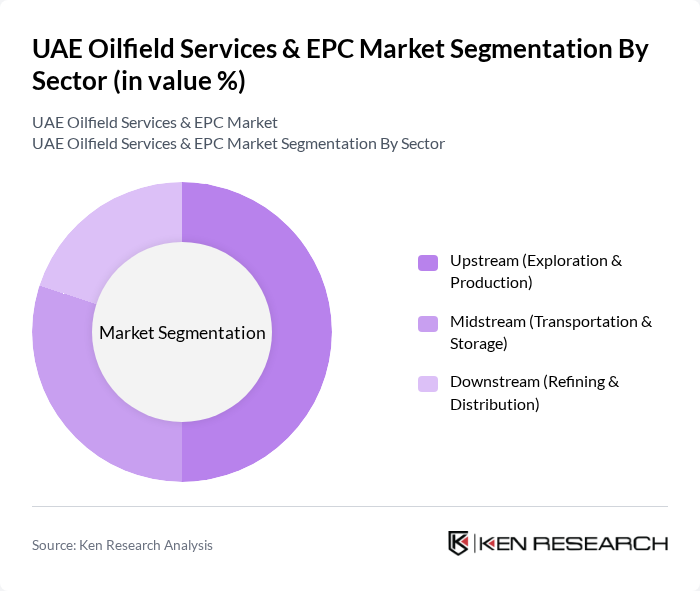

By Sector:The segmentation by sector includes three main categories: Upstream (Exploration & Production), Midstream (Transportation & Storage), and Downstream (Refining & Distribution). Each of these sectors plays a crucial role in the overall oilfield services and EPC market, with specific trends and demands influencing their growth. The upstream sector particularly benefits from enhanced oil recovery technologies and increased offshore exploration activities.

The Upstream sector, which includes exploration and production activities, is the dominant segment in the UAE Oilfield Services & EPC Market. This is primarily due to the UAE's vast oil reserves and ongoing exploration projects aimed at increasing production capacity. The Midstream sector, focusing on transportation and storage, is also significant, driven by the need for efficient logistics and infrastructure to support oil and gas distribution. The Downstream sector, while smaller, remains essential for refining and distributing petroleum products.

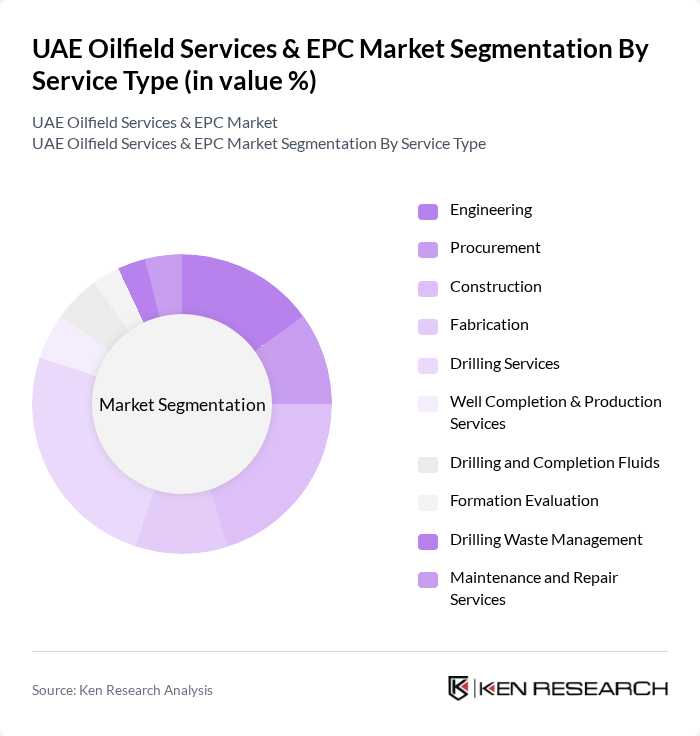

By Service Type:The service type segmentation encompasses various categories, including Engineering, Procurement, Construction, Fabrication, Drilling Services, Well Completion & Production Services, Drilling and Completion Fluids, Formation Evaluation, Drilling Waste Management, and Maintenance and Repair Services. Each service type addresses specific needs within the oilfield services and EPC market, with drilling services experiencing particular growth due to advanced horizontal drilling and hydraulic fracturing technologies.

Among the service types, Drilling Services is the leading segment, driven by the high demand for drilling operations in the UAE's oilfields. The Construction segment also plays a vital role, as ongoing infrastructure projects require extensive construction services. Engineering and Procurement services are essential for project planning and resource acquisition, while Maintenance and Repair Services ensure operational efficiency and longevity of equipment.

The UAE Oilfield Services & EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Oil Company (ADNOC), Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Petroleum Construction Company (NPCC), Gulf Marine Services PLC, Petrofac Limited, Saipem S.p.A., KBR, Inc., TechnipFMC plc, McDermott International, Ltd., JGC Corporation, Al Mansoori Specialized Engineering, Welltec A/S, Swire Oilfield Services Ltd., Lamprell plc, Emirates National Oil Company (ENOC), Dubai Petroleum, Dragon Oil (a subsidiary of ENOC) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE oilfield services and EPC market is poised for significant transformation, driven by a combination of technological advancements and a shift towards sustainable practices. As the government emphasizes diversification and renewable energy integration, companies are expected to adapt by investing in innovative solutions. The anticipated growth in automation and AI integration will enhance operational efficiency, while the focus on health, safety, and environmental standards will shape future project developments, ensuring a resilient and competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) |

| By Service Type | Engineering Procurement Construction Fabrication Drilling Services Well Completion & Production Services Drilling and Completion Fluids Formation Evaluation Drilling Waste Management Maintenance and Repair Services |

| By Location | Onshore Offshore |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Government Agencies Industrial Sector |

| By Application | Pipeline Construction Facility Construction Enhanced Oil Recovery (EOR) Digital Oilfield Solutions |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Service Model | Turnkey Projects Contractual Services Joint Ventures |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Services Market | 120 | Operations Managers, Business Development Executives |

| EPC Projects in Oil & Gas | 85 | Project Managers, Engineering Directors |

| Maintenance and Repair Services | 75 | Maintenance Supervisors, Technical Leads |

| Drilling Services | 65 | Drilling Engineers, Field Supervisors |

| Regulatory Compliance in Oilfield Operations | 55 | Compliance Officers, Safety Managers |

The UAE Oilfield Services & EPC Market is valued at approximately USD 27 billion, driven by increasing energy demand and significant investments in oil and gas infrastructure, particularly through initiatives by ADNOC and advanced drilling technologies.