Region:Middle East

Author(s):Rebecca

Product Code:KRAB8380

Pages:85

Published On:October 2025

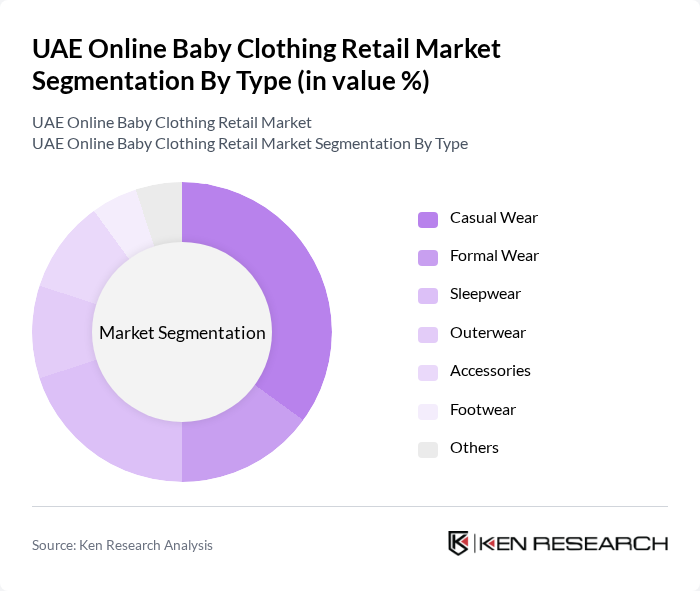

By Type:The market is segmented into various types of baby clothing, including casual wear, formal wear, sleepwear, outerwear, accessories, footwear, and others. Each of these segments caters to different consumer needs and preferences, with casual wear being the most popular due to its comfort and versatility.

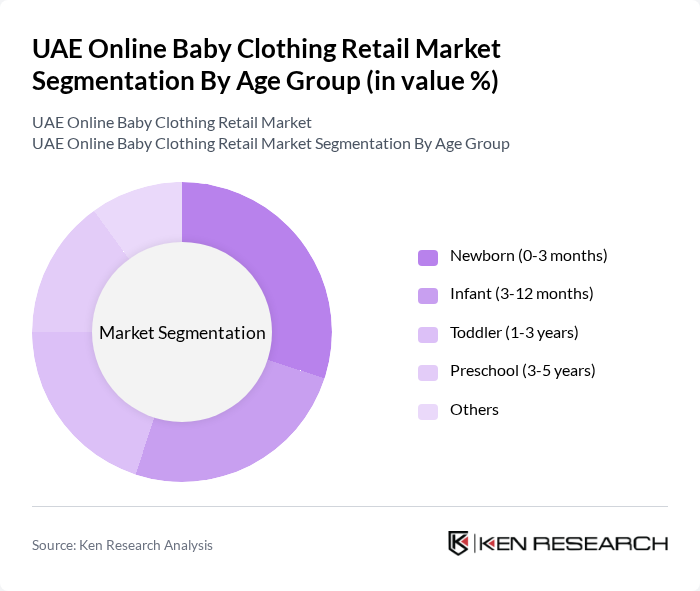

By Age Group:The market is also segmented by age group, including newborns (0-3 months), infants (3-12 months), toddlers (1-3 years), preschoolers (3-5 years), and others. The newborn segment is particularly significant as it represents the initial phase of a child's life, where parents are more likely to invest in quality clothing.

The UAE Online Baby Clothing Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Babyshop, Mumzworld, Namshi, Ounass, Carrefour, FirstCry, Sprii, Little Majlis, H&M, Zara, Next, Mothercare, The Children's Place, Petit Bateau, Gap Kids contribute to innovation, geographic expansion, and service delivery in this space.

The UAE online baby clothing market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As mobile shopping continues to gain traction, retailers are expected to enhance their digital platforms, integrating features like augmented reality for virtual try-ons. Additionally, the focus on sustainability will likely lead to increased offerings of eco-friendly products, aligning with consumer preferences for responsible purchasing. This dynamic landscape presents both challenges and opportunities for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Wear Formal Wear Sleepwear Outerwear Accessories Footwear Others |

| By Age Group | Newborn (0-3 months) Infant (3-12 months) Toddler (1-3 years) Preschool (3-5 years) Others |

| By Gender | Boys Girls Unisex |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Social Media Platforms Mobile Apps |

| By Price Range | Budget Mid-range Premium |

| By Material | Cotton Polyester Organic Fabrics Blends |

| By Brand | Local Brands International Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Baby Clothing Purchases | 150 | Parents with children aged 0-3 years |

| Consumer Preferences in Baby Apparel | 100 | Caregivers and expectant parents |

| Brand Loyalty and Shopping Habits | 80 | Frequent online shoppers of baby products |

| Impact of Social Media on Purchases | 70 | Parents engaged with parenting blogs and social media groups |

| Price Sensitivity and Promotions | 90 | Budget-conscious parents and caregivers |

The UAE Online Baby Clothing Retail Market is valued at approximately USD 1.2 billion, driven by factors such as increasing birth rates, rising disposable incomes, and the growing trend of online shopping among parents.