Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8307

Pages:92

Published On:October 2025

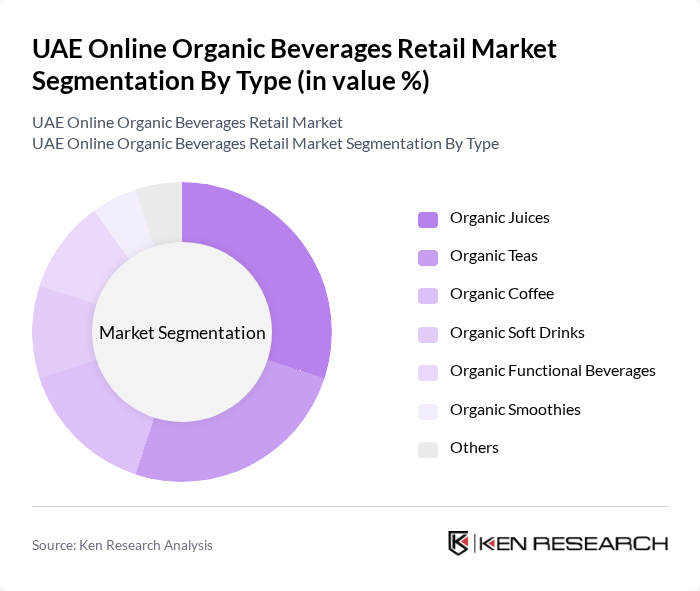

By Type:The market is segmented into various types of organic beverages, including organic juices, organic teas, organic coffee, organic soft drinks, organic functional beverages, organic smoothies, and others. Among these, organic juices and organic teas are particularly popular due to their perceived health benefits and natural ingredients. The increasing demand for refreshing and nutritious drinks has led to a surge in the availability of these products online.

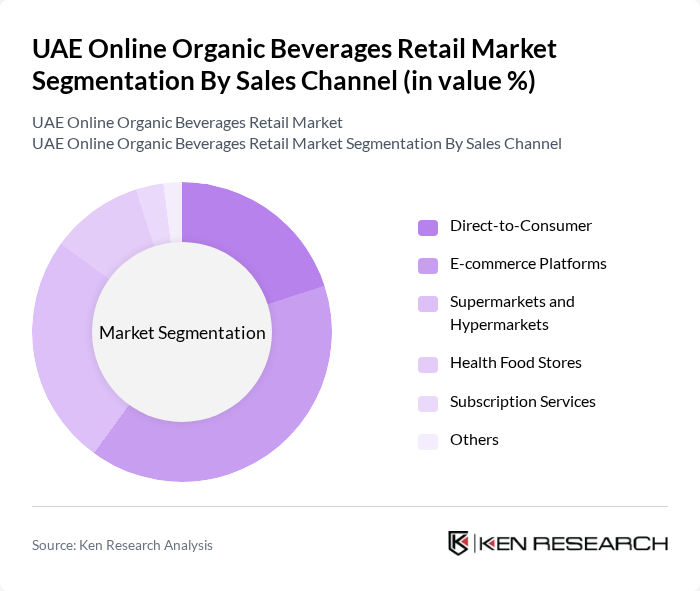

By Sales Channel:The sales channels for organic beverages include direct-to-consumer, e-commerce platforms, supermarkets and hypermarkets, health food stores, subscription services, and others. E-commerce platforms are gaining traction as consumers prefer the convenience of online shopping, especially for organic products. This shift is driven by the increasing penetration of smartphones and internet access in the UAE.

The UAE Online Organic Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Farms, Organic Foods and Café, Ripe Organic, The Organic Company, Biogreen, Pure Harvest Smart Farms, Greenheart Organic Farms, Organic Oasis, The Greenhouse, Fresh Organic, Organic Valley, The Organic Farm, Eco-Organic, Organic Life, Nature's Way contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE online organic beverages market appears promising, driven by increasing health awareness and a shift towards sustainable consumption. As e-commerce continues to expand, brands that leverage digital platforms effectively will likely capture a larger market share. Additionally, the growing trend of personalized nutrition and functional beverages will create new avenues for product innovation, allowing companies to cater to diverse consumer preferences and enhance their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Juices Organic Teas Organic Coffee Organic Soft Drinks Organic Functional Beverages Organic Smoothies Others |

| By Sales Channel | Direct-to-Consumer E-commerce Platforms Supermarkets and Hypermarkets Health Food Stores Subscription Services Others |

| By Packaging Type | Bottles Cans Tetra Packs Pouches Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences Others |

| By Distribution Mode | Online Retail Offline Retail Direct Delivery Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers New Entrants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Organic Beverages | 150 | Health-conscious Consumers, Organic Product Buyers |

| Retailer Insights on Organic Beverage Sales | 100 | Retail Managers, E-commerce Directors |

| Supplier Perspectives on Organic Beverage Trends | 80 | Producers, Distributors, Supply Chain Managers |

| Market Trends from Health and Wellness Experts | 60 | Nutritionists, Fitness Trainers, Wellness Coaches |

| Consumer Awareness of Organic Certifications | 90 | General Consumers, Eco-conscious Shoppers |

The UAE Online Organic Beverages Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness and a preference for organic products among consumers.