UAE Packaging Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD5169

November 2024

98

About the Report

UAE Packaging Market Overview

- The UAE packaging industry is valued at USD 9 billion, driven by the regions growing e-commerce sector and increasing demand for sustainable and innovative packaging solutions. The industrys robust growth stems from an expanding consumer base, particularly in food and beverage, pharmaceuticals, and personal care sectors. The rise in disposable income and consumer awareness about environmental sustainability has also played a role in pushing the demand for eco-friendly packaging solutions. Moreover, governmental regulations focusing on reducing plastic waste have led to a shift towards biodegradable and recyclable materials.

- Dominant cities like Dubai and Abu Dhabi have emerged as key contributors to the UAE packaging market due to their strategic positioning as global logistics hubs and industrial centers. These cities host a diverse range of industries, including pharmaceuticals, cosmetics, and fast-moving consumer goods (FMCG), which heavily rely on high-quality packaging solutions. Additionally, the region's proximity to emerging markets in Asia and Africa positions it as a central hub for re-exports, further driving the demand for advanced packaging materials and solutions.

- The UAE Packaging Sustainability Charter, introduced in 2023, mandates businesses to align their packaging practices with the country's sustainability goals. The charter outlines specific guidelines for reducing plastic use, promoting biodegradable materials, and improving recycling rates. Companies are required to comply with these regulations to minimize environmental impacts. As of 2024, businesses not meeting the charters requirements are subject to penalties for driving changes in packaging practices. The governments commitment to sustainability is central to its broader environmental policies

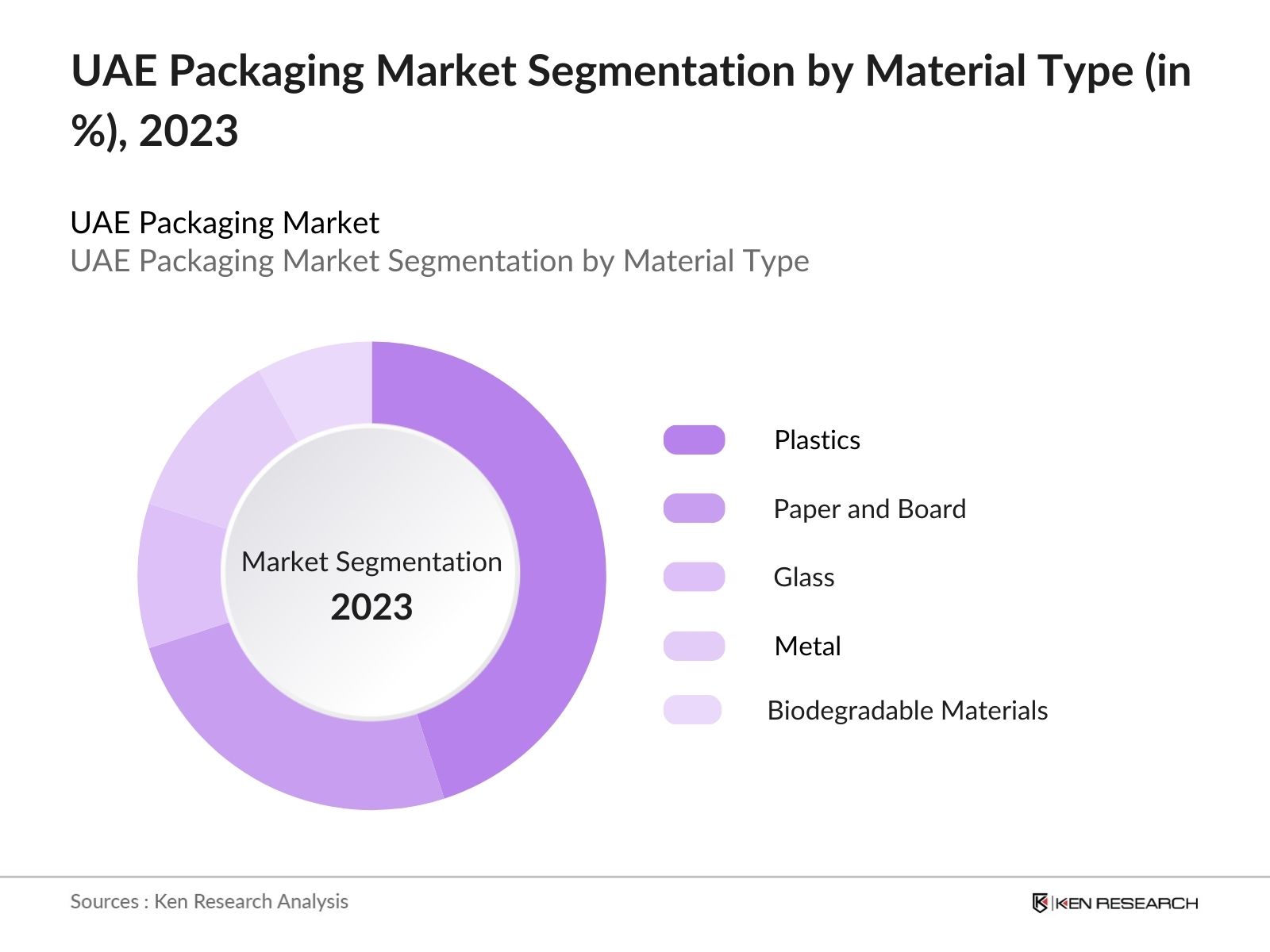

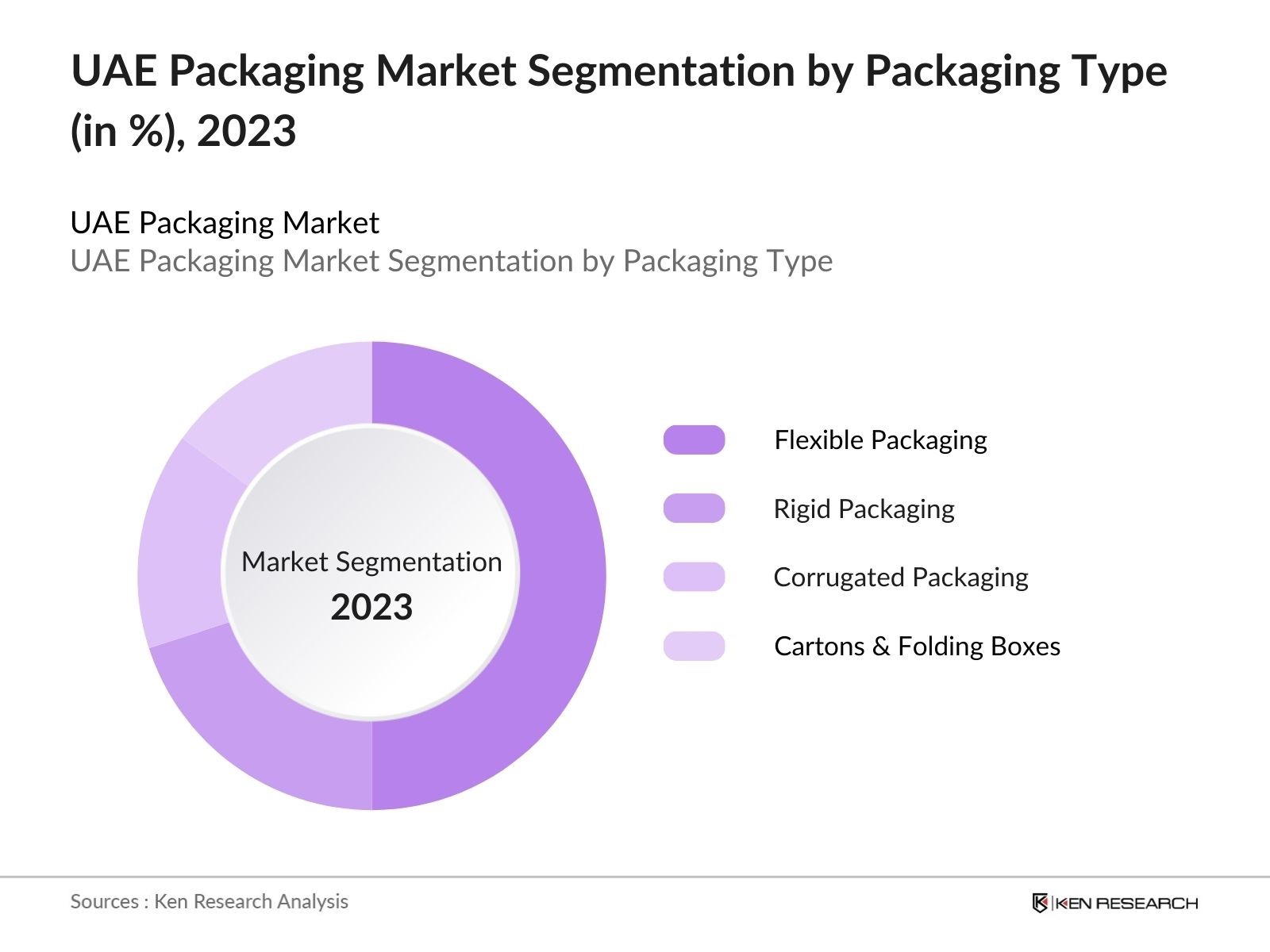

UAE Packaging Market Segmentation

By Material Type: The market is segmented by material type into plastics, paper and board, glass, metal, and biodegradable materials. Among these, plastics dominate the market due to their versatility and cost-effectiveness. Despite environmental concerns, plastics are widely used in food packaging, healthcare, and logistics due to their durability, flexibility, and ability to preserve product quality. Biodegradable materials, while gaining traction due to regulatory pressures, still face challenges in terms of cost and production scalability compared to conventional plastic materials.

By Packaging Type: The market is also segmented by packaging type into flexible packaging, rigid packaging, corrugated packaging, and cartons & folding boxes. Flexible packaging holds the largest market share, primarily because of its lightweight nature, lower transportation costs, and ability to preserve product integrity, particularly in the food and beverage sector. Flexible packaging is also widely used in personal care and pharmaceutical products, where product safety and longevity are crucial. The dominance of flexible packaging is reinforced by its increasing use in the fast-growing e-commerce sector, where lightweight, durable, and easily customizable packaging is required to reduce shipping costs and enhance consumer experience.

UAE Packaging Market Competitive Landscape

The UAE packaging industry is highly competitive, with several local and international players vying for market share. The market is dominated by a few key companies that offer a wide range of packaging solutions, from basic materials like plastics and metals to advanced, sustainable alternatives. This concentration of key players has resulted in innovation within the industry, particularly in the area of biodegradable and recyclable materials. The UAE packaging market is shaped by a few prominent players who focus on sustainability, innovation, and expanding their market presence in both local and international markets.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Product Portfolio |

Sustainability Initiatives |

R&D Investment |

Key Markets |

|

ENPI Group |

1995 |

UAE |

||||||

|

Falcon Pack |

1992 |

UAE |

||||||

|

Hotpack Global |

1995 |

UAE |

||||||

|

Arabian Packaging |

1982 |

UAE |

||||||

|

Al Bayader International |

1991 |

UAE |

UAE Packaging Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Packaging: Sustainable packaging is gaining traction in the UAE, driven by a focus on reducing environmental impacts and advancing the circular economy. The UAE government has launched initiatives under its Green Agenda 2030, targeting sustainability in packaging. The demand for biodegradable and recyclable materials is being fueled by government-backed campaigns to reduce plastic waste. In 2023, over 2.5 million tonnes of waste were generated, with packaging contributing. Sustainable packaging is now becoming a key focus, reducing reliance on single-use plastics in the region.

- Government Regulations on Packaging Waste: The UAE has implemented stringent regulations to tackle packaging waste under its Green Strategy. The UAE's Vision 2021 targets diverting 75% of solid waste from landfills, which includes packaging waste. In line with this, the government has introduced measures to restrict the use of plastic, particularly single-use plastics, and mandates packaging recycling. A 2024 update of the UAEs plastic waste management laws now requires companies to utilize environmentally friendly packaging. These regulations push businesses to innovate and adopt sustainable practices in their packaging operations.

- Rising Consumer Demand for Convenience Packaging: Consumer preferences are shifting toward convenient packaging, particularly in fast-moving consumer goods (FMCG) and ready-to-eat meals. The UAEs growing urban population and a rise in dual-income households are fueling demand for ready-made and convenient packaging solutions. In 2024, its estimated that the FMCG sector accounted for a portion of this demand, with the sector growing by over 10% in recent years. This trend is also reflected in consumer habits, where convenience, hygiene, and portability are key drivers for packaging innovation.

Market Challenges

- High Initial Costs for Sustainable Solutions: The high upfront cost of adopting sustainable packaging materials presents a challenge in the UAE market. Biodegradable materials and advanced sustainable solutions tend to be more expensive than conventional packaging options. Compostable plastics used in the UAE are still priced 2-3 times higher than traditional plastics. Furthermore, integrating sustainable practices into the supply chain adds complexity, as it requires investment in new technologies and infrastructure. As companies face these challenges, the government has started offering incentives to ease the transition, but high costs remain a barrier.

- Limited Recycling Infrastructure: The UAE's recycling infrastructure, while growing, still faces limitations. Waste segregation at the source is low, and collection systems are fragmented across regions. This impacts the effectiveness of recycling packaging materials, especially in densely populated areas like Dubai and Abu Dhabi. In 2023, only 35% of packaging waste was recycled, far below government targets. The infrastructure challenge is compounded by a lack of awareness among consumers and insufficient recycling facilities for complex materials, such as multi-layer packaging. Efforts are ongoing to expand facilities and educate consumers on segregation.

UAE Packaging Market Future Outlook

Over the next five years, the UAE packaging industry is poised for robust growth, driven by increasing awareness of environmental issues, regulatory changes, and the rapid expansion of e-commerce. The industry will see a growing demand for biodegradable materials and innovations in smart packaging, which includes technologies such as RFID and digital printing. The UAEs commitment to reducing its carbon footprint, combined with its strategic positioning as a logistics hub, will continue to create opportunities for further investment and development in the packaging sector. The introduction of stringent regulations on single-use plastics will also push companies to innovate in recyclable and sustainable packaging options.

Future Market Opportunities

- Adoption of Biodegradable Packaging Materials: The UAE has an opportunity to lead in biodegradable packaging, driven by consumer demand for environmentally friendly options. Biodegradable materials, including plant-based and compostable plastics, are increasingly used by businesses aiming to reduce environmental impacts. In 2023, compostable plastic demand surged in industries such as food and beverage, with local manufacturers reporting a 40% increase in production. Additionally, the UAE government is providing incentives to companies that adopt these materials, opening new market opportunities in sustainable packaging.

- Expansion into Emerging Market Segments: Emerging market segments, particularly pharmaceutical and food and beverage packaging, present opportunities for growth in the UAE. The UAEs pharmaceutical industry is expected to benefit from the growing demand for sterile and tamper-proof packaging solutions. Meanwhile, the food and beverage industry is experiencing a surge in demand for packaging that preserves freshness and extends product shelf life. With the UAEs strong emphasis on food security, innovative packaging that supports sustainability is expected to drive growth in these segments.

Scope of the Report

|

Material Type |

Plastics Paper and Board Glass Metal Biodegradable Materials |

|

Packaging Type |

Flexible Packaging Rigid Packaging Corrugated Packaging Cartons & Folding Boxes |

|

End-Use Industry |

Food & Beverage Personal Care & Cosmetics Healthcare & Pharmaceuticals Industrial Packaging E-commerce |

|

Technology |

Digital Printing Sustainable Packaging Technologies Smart Packaging (RFID, QR Codes) |

|

Region |

Abu Dhabi Dubai Sharjah Northern Emirates |

Products

Key Target Audience

Packaging Manufacturers

Food & Beverage Companies

Personal Care & Cosmetics Brands

Healthcare & Pharmaceutical Companies

E-commerce Retailers

Banks and Financial Institutes

Government and Regulatory Bodies (e.g., Ministry of Climate Change and Environment, UAE)

Investors and Venture Capitalist Firms

Waste Management and Recycling Companies

Companies

Major Players

ENPI Group

Falcon Pack

Hotpack Global

Arabian Packaging

Al Bayader International

Gulf East Paper & Plastic Industries

Emirates Printing Press

Union Packaging

Horizon Group

Majan Printing & Packaging

Fine Hygienic Holding

Prime Pak Industries

Multipack

Interplast Co. Ltd.

Al Raqeem Industrial Packaging

Table of Contents

UAE Packaging Industry Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

UAE Packaging Industry Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

UAE Packaging Industry Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Sustainable Packaging (Environmental Focus, Circular Economy)

3.1.2 Growth of E-commerce Sector (Logistics, Consumer Preferences)

3.1.3 Government Regulations on Packaging Waste (UAE Green Strategy, Plastic Waste Management)

3.1.4 Rising Consumer Demand for Convenience Packaging (Fast-Moving Consumer Goods, Ready-to-Eat Meals)

3.2 Market Challenges

3.2.1 High Initial Costs for Sustainable Solutions (Material Costs, Supply Chain Complexity)

3.2.2 Limited Recycling Infrastructure (Waste Segregation, Collection Systems)

3.2.3 Technical Challenges in Advanced Packaging (Smart Packaging, Nanotechnology)

3.3 Opportunities

3.3.1 Adoption of Biodegradable Packaging Materials (Compostable Plastics, Plant-Based Materials)

3.3.2 Expansion into Emerging Market Segments (Pharmaceutical Packaging, Food & Beverage)

3.3.3 Technological Innovations in Smart Packaging (RFID, Augmented Reality Packaging)

3.4 Trends

3.4.1 Digital Printing Technology (Customization, Short Run Production)

3.4.2 Increased Usage of Recyclable Packaging (PET, Paper-Based Materials)

3.4.3 Growth in Flexible Packaging (Lightweight, Space-Saving)

3.5 Government Regulation

3.5.1 UAE Packaging Sustainability Charter

3.5.2 Green Building Regulations & Waste Minimization Policies

3.5.3 Compliance with Extended Producer Responsibility (EPR)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

UAE Packaging Industry Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Plastics

4.1.2 Paper and Board

4.1.3 Glass

4.1.4 Metal

4.1.5 Biodegradable Materials

4.2 By Packaging Type (In Value %)

4.2.1 Flexible Packaging

4.2.2 Rigid Packaging

4.2.3 Corrugated Packaging

4.2.4 Cartons & Folding Boxes

4.3 By End-Use Industry (In Value %)

4.3.1 Food & Beverage

4.3.2 Personal Care & Cosmetics

4.3.3 Healthcare & Pharmaceuticals

4.3.4 Industrial Packaging

4.3.5 E-commerce

4.4 By Technology (In Value %)

4.4.1 Digital Printing

4.4.2 Sustainable Packaging Technologies

4.4.3 Smart Packaging (RFID, QR Codes)

4.5 By Region (In Value %)

4.5.1 Abu Dhabi

4.5.2 Dubai

4.5.3 Sharjah

4.5.4 Northern Emirates

UAE Packaging Industry Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ENPI Group

5.1.2 Falcon Pack

5.1.3 Hotpack Global

5.1.4 Gulf East Paper & Plastic Industries

5.1.5 Arabian Packaging

5.1.6 Emirates Printing Press

5.1.7 Horizon Group

5.1.8 Majan Printing & Packaging

5.1.9 Multipack

5.1.10 Al Bayader International

5.1.11 Union Packaging

5.1.12 Prime Pak Industries

5.1.13 Fine Hygienic Holding

5.1.14 Interplast Co. Ltd.

5.1.15 Al Raqeem Industrial Packaging

5.2 Cross Comparison Parameters (Market Share, Headquarters, Revenue, Product Portfolio, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

UAE Packaging Industry Regulatory Framework

6.1 Environmental Packaging Standards

6.2 Compliance with Waste Management Regulations

6.3 Certification Processes for Sustainable Packaging

UAE Packaging Industry Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

UAE Packaging Industry Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Packaging Type (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

UAE Packaging Industry Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, a detailed mapping of the packaging industrys value chain is carried out, covering suppliers, manufacturers, and key consumers in the UAE market. Extensive desk research is performed, utilizing various proprietary databases to gather the necessary data on industry dynamics and packaging trends.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data is conducted, focusing on market penetration, demand drivers, and revenue generation within the UAE packaging industry. This includes an evaluation of the packaging sector's performance across various end-user industries such as food and beverage, healthcare, and personal care.

Step 3: Hypothesis Validation and Expert Consultation

After constructing the market hypotheses, consultations with key industry experts are conducted via computer-assisted telephone interviews (CATIs). These consultations provide invaluable insights into operational and financial trends, which are instrumental in refining and validating the market data.

Step 4: Research Synthesis and Final Output

In this final phase, the collected data is synthesized and cross-referenced with inputs from packaging manufacturers. This ensures the datas reliability and accuracy, resulting in a robust, comprehensive analysis of the UAE packaging industry.

Frequently Asked Questions

01. How big is the UAE Packaging Industry?

The UAE packaging market is valued at USD 9 billion, driven by growth in sectors such as food and beverage, pharmaceuticals, and e-commerce.

02. What are the challenges in the UAE Packaging Industry?

Challenges in the UAE packaging market include the high cost of sustainable materials, limited recycling infrastructure, and regulatory pressures surrounding single-use plastics.

03. Who are the major players in the UAE Packaging Industry?

Key players in the UAE packaging market include ENPI Group, Falcon Pack, Hotpack Global, Arabian Packaging, and Al Bayader International, all of which dominate due to their strong production capabilities and innovation in sustainability.

04. What are the growth drivers of the UAE Packaging Industry?

Growth in the UAE packaging market is driven by increasing demand for eco-friendly packaging, the expansion of e-commerce, and regulatory initiatives aimed at reducing plastic waste.

05. What innovations are expected in the UAE Packaging Industry?

Future innovations in the UAE packaging market include smart packaging technologies such as RFID, digital printing, and the increased use of biodegradable materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.