Region:Middle East

Author(s):Dev

Product Code:KRAA9607

Pages:97

Published On:November 2025

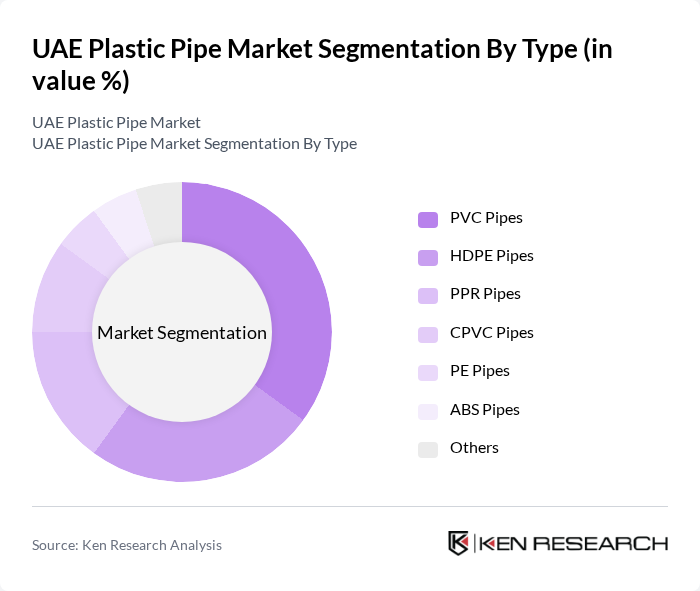

By Type:The market is segmented into various types of plastic pipes, including PVC Pipes, HDPE Pipes, PPR Pipes, CPVC Pipes, PE Pipes, ABS Pipes, and Others. Each type serves different applications and industries, with varying demand based on their properties and suitability for specific uses. PVC pipes are widely used for plumbing, irrigation, and wastewater management due to their durability and cost-effectiveness. HDPE and PPR pipes are preferred for their high pressure and temperature resistance, while CPVC pipes are used in hot and cold water distribution. PE and ABS pipes find applications in specialized industrial and electrical conduit systems .

The PVC Pipes segment dominates the market due to their versatility, cost-effectiveness, and resistance to corrosion, making them ideal for plumbing, drainage, and irrigation applications. The ongoing surge in construction activities and infrastructure projects across the UAE has further fueled the demand for PVC pipes, reinforcing their position as the leading type in the market .

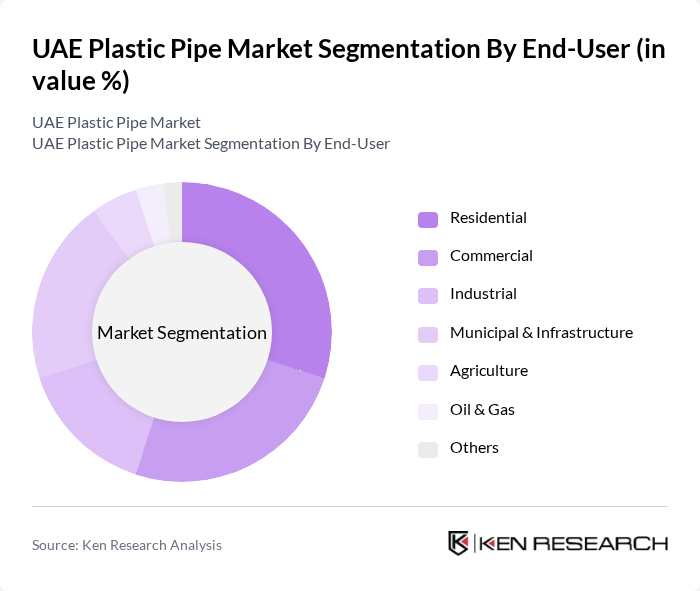

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, Municipal & Infrastructure, Agriculture, Oil & Gas, and Others. Each end-user category has distinct requirements and applications for plastic pipes, shaping market dynamics. Residential and commercial sectors primarily utilize plastic pipes for plumbing and water supply, while municipal and infrastructure segments focus on large-scale water distribution and sewage systems. Industrial and oil & gas sectors require specialized, high-performance piping solutions, and agriculture relies on efficient irrigation systems .

The Residential segment is the largest end-user category, driven by a growing population and increasing housing projects in the UAE. The demand for plumbing and drainage solutions in new residential developments, along with the government's focus on sustainable urban expansion, significantly contributes to the market's growth in this segment .

The UAE Plastic Pipe Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cosmoplast Industrial Company (L.L.C.), Hepworth PME LLC, National Plastic & Building Material Industries LLC, Polyfab Plastic Industry LLC, Union Pipes Industry LLC, Future Pipe Industries, Shamo Plast Industries Ltd., Emirates Plastic Industries, Al Gawas Plastic Industries LLC, Al Mufeed Plastic Factory, Al Shams Plastic Factory, Al Jazeera Plastic Products Company, Gulf Plastic Industries, Al Falah Group, and Dubai Investments PJSC contribute to innovation, geographic expansion, and service delivery in this space .

The UAE plastic pipe market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As the government continues to invest in water management and infrastructure projects, the demand for high-performance plastic pipes will likely increase. Additionally, the integration of smart technologies in irrigation and water supply systems will enhance efficiency and monitoring capabilities, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | PVC Pipes HDPE Pipes PPR Pipes CPVC Pipes PE Pipes ABS Pipes Others |

| By End-User | Residential Commercial Industrial Municipal & Infrastructure Agriculture Oil & Gas Others |

| By Application | Water Supply Sewerage and Drainage Plumbing Irrigation HVAC Systems Electrical & Telecommunication Cable Protection Oil & Gas Chemical Transport Others |

| By Material | Polyvinyl Chloride (PVC) High-Density Polyethylene (HDPE) Polypropylene (PP) Acrylonitrile Butadiene Styrene (ABS) Chlorinated Polyvinyl Chloride (CPVC) Others |

| By Diameter | Small Diameter Pipes (<50mm) Medium Diameter Pipes (50mm–200mm) Large Diameter Pipes (>200mm) Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retailers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Architects |

| Commercial Infrastructure Developments | 80 | Construction Managers, Procurement Officers |

| Agricultural Irrigation Systems | 60 | Agronomists, Irrigation Specialists |

| Industrial Applications of Plastic Pipes | 50 | Facility Managers, Operations Directors |

| Government Infrastructure Projects | 70 | Public Works Officials, Policy Makers |

The UAE Plastic Pipe Market is valued at approximately USD 280 million, driven by rapid urbanization, infrastructural development, and increasing demand for water supply and drainage systems in the region.