Region:Middle East

Author(s):Rebecca

Product Code:KRAC8513

Pages:95

Published On:November 2025

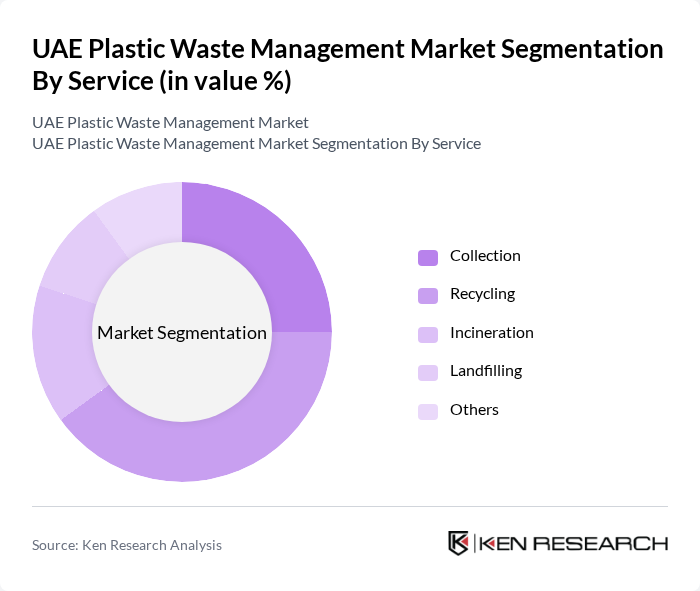

By Service:The market is segmented into various services including collection, recycling, incineration, landfilling, and others. Among these, landfilling is the largest revenue-generating service segment, accounting for the majority of market share in 2024, followed by collection and recycling. Incineration is the fastest-growing segment due to increasing investments in waste-to-energy projects and stricter regulations on landfill use. The growing emphasis on sustainability and the circular economy is driving innovation in recycling technologies and encouraging businesses to adopt more environmentally friendly waste management practices .

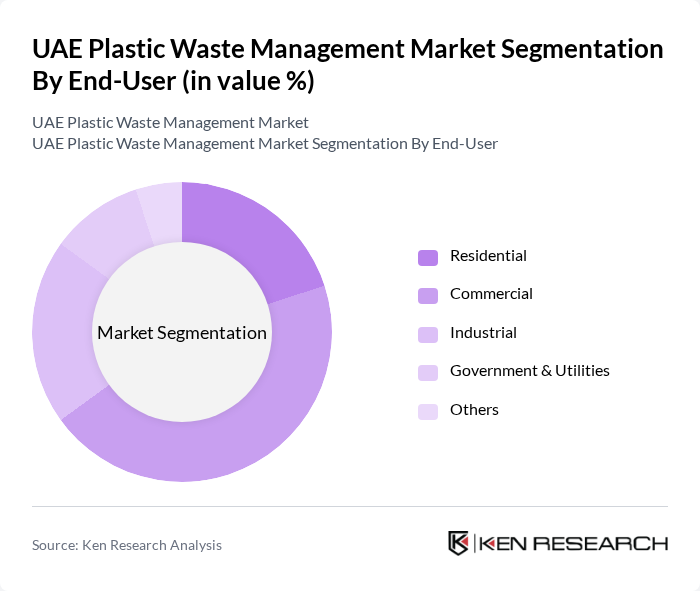

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The commercial sector is the leading end-user, driven by the high volume of plastic waste generated from businesses, retail, and hospitality industries. The increasing regulatory pressure on businesses to manage waste sustainably has further propelled the demand for effective waste management solutions in this sector. The industrial sector is also a significant contributor, with manufacturing and construction activities generating substantial amounts of plastic waste .

The UAE Plastic Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bee'ah, Averda, Dulsco, Emirates Waste Management Company, EcoWaste, Veolia, Waste Management Middle East, Green Planet, Al Dhafra Recycling Industries, Cleanaway, Recology, SUEZ, TerraCycle, Republic Services, Waste Management Inc., Farz (Imdaad LLC), DGrade, Interpolymer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE plastic waste management market appears promising, driven by increasing government support and technological advancements. With the UAE's commitment to achieving a circular economy, investments in recycling facilities and biodegradable alternatives are expected to rise significantly. The integration of smart waste management solutions will enhance operational efficiency, while public awareness campaigns will further encourage participation in recycling initiatives. Overall, the market is poised for substantial growth as sustainability becomes a national priority.

| Segment | Sub-Segments |

|---|---|

| By Service | Collection Recycling Incineration Landfilling Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Waste Source | Plastic Bags Plastic Bottles Plastic Containers & Cutlery Wrappers Plastic Caps & Closures Industrial Packaging Others |

| By Collection Method | Curbside Collection Drop-off Centers Collection Events Others |

| By Treatment Method | Mechanical Recycling Chemical Recycling Energy Recovery Landfilling Others |

| By Material Type | Polypropylene (PP) Low-Density Polyethylene (LDPE) High-Density Polyethylene (HDPE) Polyvinyl Chloride (PVC) Polyurethane (PUR) Polyethylene Terephthalate (PET) Polystyrene Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 60 | City Waste Managers, Environmental Policy Makers |

| Recycling Facility Operations | 50 | Facility Managers, Operations Directors |

| Consumer Behavior Studies | 100 | Household Representatives, Environmental Advocates |

| Corporate Sustainability Initiatives | 40 | Sustainability Managers, CSR Specialists |

| Retail Sector Plastic Usage | 45 | Retail Managers, Supply Chain Coordinators |

The UAE Plastic Waste Management Market is valued at approximately USD 960 million, reflecting a significant growth driven by increased environmental awareness, government initiatives, and rising demand for recycling services.