Region:Middle East

Author(s):Shubham

Product Code:KRAB7826

Pages:91

Published On:October 2025

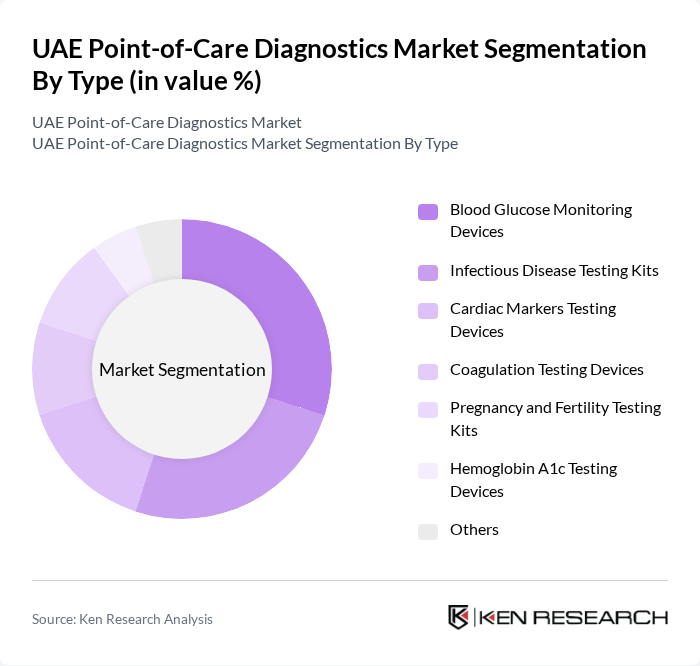

By Type:The market is segmented into various types of diagnostic devices and kits, each catering to specific healthcare needs. The key subsegments include Blood Glucose Monitoring Devices, Infectious Disease Testing Kits, Cardiac Markers Testing Devices, Coagulation Testing Devices, Pregnancy and Fertility Testing Kits, Hemoglobin A1c Testing Devices, and Others. Among these, Blood Glucose Monitoring Devices are particularly prominent due to the rising incidence of diabetes in the region.

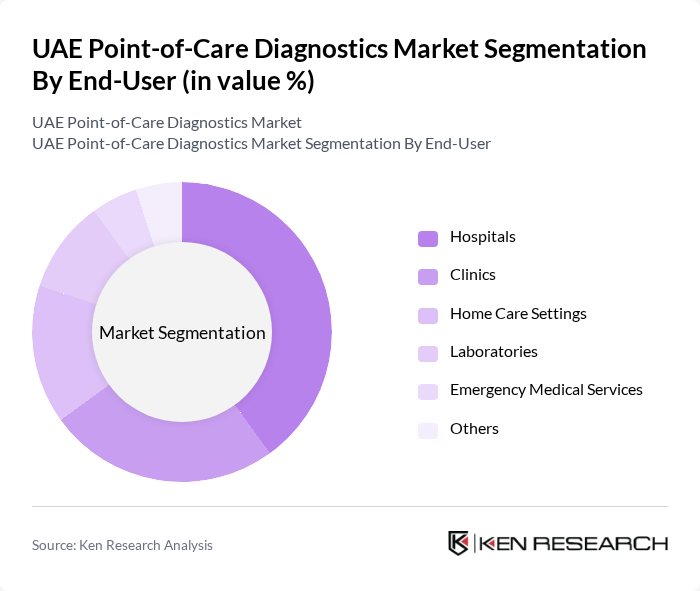

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Settings, Laboratories, Emergency Medical Services, and Others. Hospitals are the leading end-users due to their need for rapid diagnostic solutions to enhance patient care and streamline operations. The increasing adoption of point-of-care testing in emergency departments further solidifies their dominance in this segment.

The UAE Point-of-Care Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Becton, Dickinson and Company, Cepheid, Alere Inc., Quidel Corporation, Bio-Rad Laboratories, Hologic, Inc., Ortho Clinical Diagnostics, Danaher Corporation, Thermo Fisher Scientific, Medtronic, Sysmex Corporation, Mindray Medical International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE point-of-care diagnostics market appears promising, driven by ongoing technological advancements and a growing emphasis on personalized medicine. As healthcare providers increasingly adopt AI-driven diagnostic tools, the efficiency and accuracy of testing will improve. Additionally, the expansion of telemedicine services is expected to facilitate remote patient monitoring, further enhancing the demand for point-of-care solutions. These trends indicate a robust growth trajectory for the market, aligning with the UAE's healthcare objectives.

| Segment | Sub-Segments |

|---|---|

| By Type | Blood Glucose Monitoring Devices Infectious Disease Testing Kits Cardiac Markers Testing Devices Coagulation Testing Devices Pregnancy and Fertility Testing Kits Hemoglobin A1c Testing Devices Others |

| By End-User | Hospitals Clinics Home Care Settings Laboratories Emergency Medical Services Others |

| By Application | Diabetes Management Cardiovascular Monitoring Infectious Disease Diagnosis Pregnancy Testing Drug Testing Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Pharmacies Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Lateral Flow Assays Molecular Diagnostics Microfluidics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Point-of-Care Diagnostics | 150 | Clinical Laboratory Managers, Physicians |

| Home Healthcare Diagnostics | 100 | Home Care Nurses, Patient Care Coordinators |

| Pharmacy-Based Diagnostics | 80 | Pharmacists, Pharmacy Managers |

| Mobile Health Applications | 70 | Health Tech Developers, UX Designers |

| Diagnostic Device Manufacturers | 90 | Product Managers, Sales Executives |

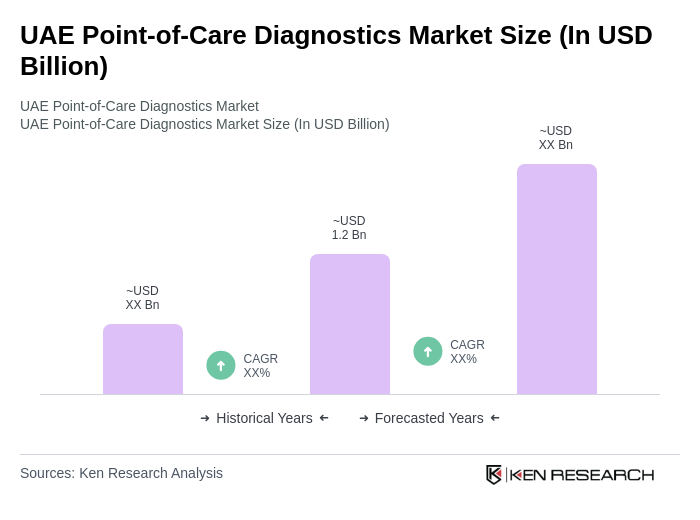

The UAE Point-of-Care Diagnostics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and the demand for rapid testing solutions, especially post-COVID-19.