Region:Middle East

Author(s):Shubham

Product Code:KRAC4949

Pages:93

Published On:October 2025

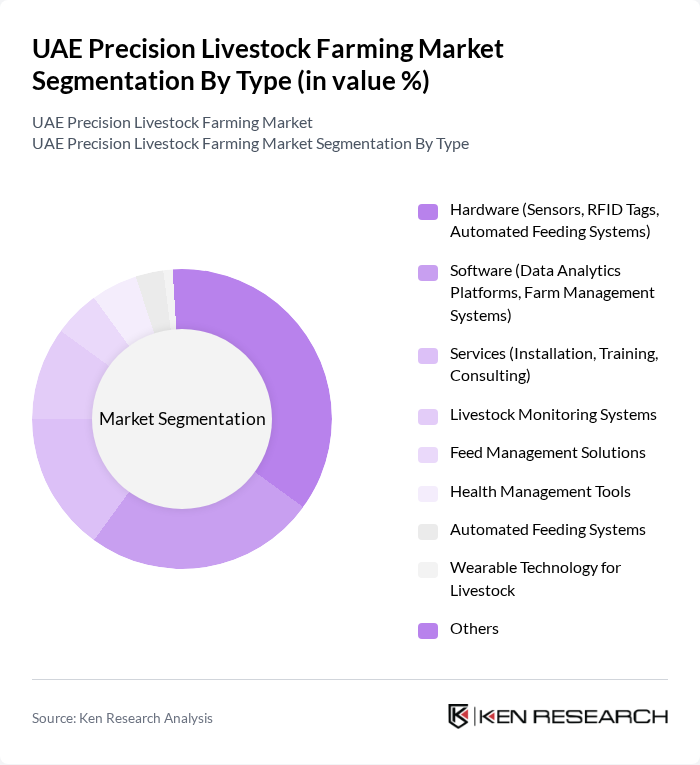

By Type:The market is segmented into hardware, software, services, livestock monitoring systems, feed management solutions, health management tools, automated feeding systems, wearable technology for livestock, and others. Hardware solutions—including sensors, RFID tags, and automated feeding systems—lead the market due to their essential role in enabling real-time data collection, automation, and operational efficiency. Software platforms for data analytics and farm management are rapidly gaining traction, supporting predictive insights and decision-making. Services such as installation, training, and consulting are increasingly important as farms transition to technology-driven operations .

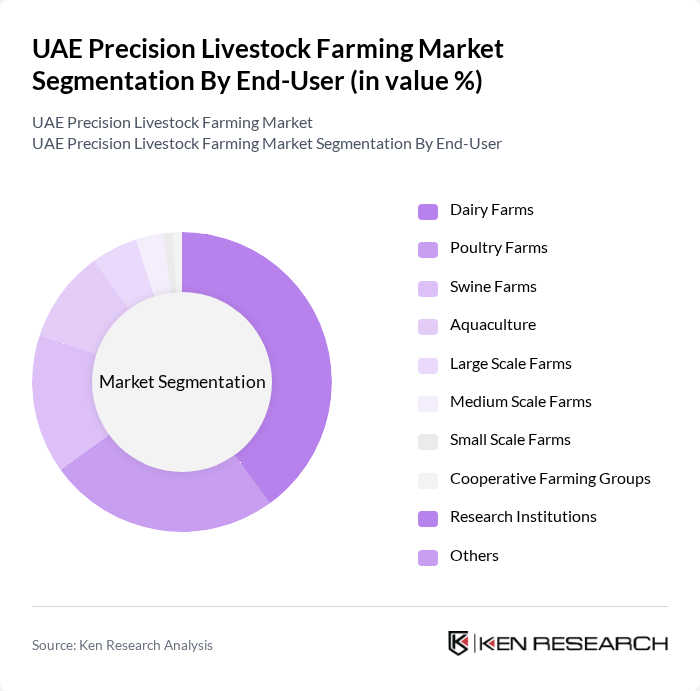

By End-User:The end-user segmentation includes dairy farms, poultry farms, swine farms, aquaculture, large scale farms, medium scale farms, small scale farms, cooperative farming groups, research institutions, and others. Dairy farms are the dominant segment, driven by rising demand for milk and dairy products and the need for efficient management practices to enhance productivity and animal welfare. Poultry and swine farms are also major adopters, leveraging PLF technologies for health monitoring, feed optimization, and disease prevention. Aquaculture and large-scale farms are increasingly integrating IoT and automation to improve yield and sustainability .

The UAE Precision Livestock Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Afimilk Ltd., Nedap Livestock Management, Gallagher Group, DeLaval, GEA Group, Lely International, Merck Animal Health, Zoetis Inc., Cargill, JBS S.A., Allflex Livestock Intelligence (MSD Animal Health), Smartbow GmbH, Connecterra, Livestock Water Recycling, FarmWizard contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE precision livestock farming market appears promising, driven by technological advancements and government support. The integration of IoT and AI technologies is expected to revolutionize livestock management, enhancing productivity and sustainability. Additionally, as consumer awareness of food quality continues to rise, farmers will increasingly adopt precision farming practices to meet market demands. This trend will likely lead to a more efficient agricultural sector, contributing to the UAE's food security goals and economic diversification efforts.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware (Sensors, RFID Tags, Automated Feeding Systems) Software (Data Analytics Platforms, Farm Management Systems) Services (Installation, Training, Consulting) Livestock Monitoring Systems Feed Management Solutions Health Management Tools Automated Feeding Systems Wearable Technology for Livestock Others |

| By End-User | Dairy Farms Poultry Farms Swine Farms Aquaculture Large Scale Farms Medium Scale Farms Small Scale Farms Cooperative Farming Groups Research Institutions Others |

| By Application | Dairy Farming Meat Production Egg Production Aquaculture Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Technology | IoT Solutions AI and Machine Learning Blockchain for Traceability Drones for Monitoring Others |

| By Investment Source | Private Investments Government Grants International Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farming Technologies | 60 | Dairy Farm Owners, Herd Managers |

| Beef Cattle Precision Farming | 50 | Cattle Ranchers, Livestock Managers |

| Poultry Farming Innovations | 50 | Poultry Farm Managers, Veterinary Experts |

| Smart Feeding Systems | 40 | Feedlot Operators, Agricultural Engineers |

| Livestock Health Monitoring Solutions | 40 | Veterinarians, Farm Health Officers |

The UAE Precision Livestock Farming Market is valued at approximately USD 550 million, reflecting its position as a leading adopter of precision livestock technologies in the Middle East and Africa region.