UAE Premium Luxury Sunglasses Retail Market Overview

- The UAE Premium Luxury Sunglasses Retail Market is valued at AED 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising trend in luxury fashion, and a growing awareness of eye protection among consumers. The market has seen a surge in demand for high-quality sunglasses that combine style with functionality, catering to a discerning clientele.

- Dubai and Abu Dhabi are the dominant cities in the UAE Premium Luxury Sunglasses Retail Market. Dubai's status as a global shopping hub, coupled with its luxury tourism sector, attracts affluent consumers from around the world. Abu Dhabi, with its growing number of luxury retail outlets and high-income residents, also plays a significant role in driving market growth.

- In 2023, the UAE government implemented regulations to enhance consumer protection in the luxury goods sector. This includes stricter guidelines on the authenticity of luxury products, ensuring that consumers are safeguarded against counterfeit goods. The initiative aims to bolster consumer confidence and promote a fair trading environment in the luxury retail market.

UAE Premium Luxury Sunglasses Retail Market Segmentation

By Type:The market is segmented into various types of sunglasses, including Designer Sunglasses, Sports Sunglasses, Fashion Sunglasses, Polarized Sunglasses, Prescription Sunglasses, Limited Edition Sunglasses, and Others. Among these, Designer Sunglasses dominate the market due to their association with luxury brands and high-quality materials. Consumers are increasingly inclined towards designer labels that offer exclusivity and status, driving the demand for this sub-segment.

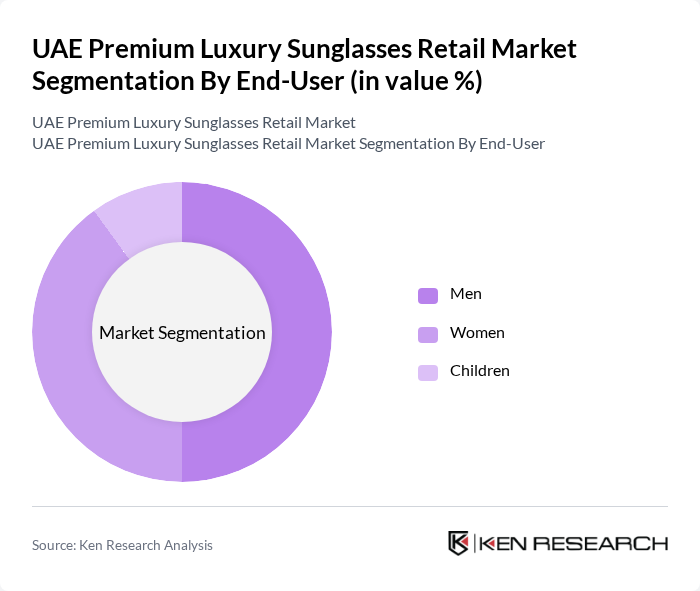

By End-User:The end-user segmentation includes Men, Women, and Children. The market is predominantly driven by the male demographic, which shows a strong inclination towards luxury brands and designer sunglasses. However, the female segment is rapidly growing, fueled by fashion trends and increased marketing efforts targeting women. Children’s sunglasses are also gaining traction as parents become more aware of the importance of UV protection for their children.

UAE Premium Luxury Sunglasses Retail Market Competitive Landscape

The UAE Premium Luxury Sunglasses Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Luxottica Group S.p.A., Safilo Group S.p.A., Kering Eyewear, Ray-Ban, Prada S.p.A., Chanel S.A., Dior, Gucci, Versace, Tom Ford, Oakley, Maui Jim, Fendi, Bvlgari, Jimmy Choo contribute to innovation, geographic expansion, and service delivery in this space.

UAE Premium Luxury Sunglasses Retail Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The UAE's GDP per capita is projected to reach approximately $45,000 in future, reflecting a robust economic environment. This increase in disposable income allows consumers to spend more on luxury items, including premium sunglasses. The affluent population, which constitutes about 20% of the UAE's demographic, is driving demand for high-end eyewear, as luxury goods are often seen as status symbols. This trend is expected to continue, bolstering the luxury sunglasses market significantly.

- Rising Fashion Consciousness:The UAE's fashion retail sector is anticipated to grow to $22 billion in future, indicating a heightened awareness of fashion trends among consumers. This growth is fueled by a young, cosmopolitan population that prioritizes brand recognition and luxury items. As consumers increasingly seek to express their individuality through fashion, premium sunglasses are becoming essential accessories, further driving market growth. The influence of social media and celebrity endorsements also plays a crucial role in shaping consumer preferences.

- Growth of E-commerce:E-commerce sales in the UAE are expected to reach $30 billion in future, significantly impacting the retail landscape. The convenience of online shopping, coupled with the rise of digital marketing strategies, has made luxury sunglasses more accessible to a broader audience. Online platforms allow brands to showcase their products effectively, reaching tech-savvy consumers who prefer shopping from home. This shift towards e-commerce is expected to enhance sales and brand visibility in the premium sunglasses market.

Market Challenges

- Intense Competition:The UAE premium luxury sunglasses market is characterized by fierce competition, with over 55 international brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants to establish themselves. Established brands like Ray-Ban and Gucci dominate the market, capturing significant consumer attention. The competitive landscape necessitates continuous innovation and differentiation to attract discerning customers, posing a challenge for emerging brands.

- Fluctuating Currency Exchange Rates:The UAE dirham is pegged to the US dollar, but fluctuations in global currency markets can impact the pricing of imported luxury sunglasses. In future, the exchange rate is projected to experience volatility due to geopolitical tensions and economic shifts. This unpredictability can lead to increased costs for retailers, affecting profit margins and pricing strategies. Brands must navigate these challenges to maintain competitiveness while ensuring affordability for consumers.

UAE Premium Luxury Sunglasses Retail Market Future Outlook

The UAE premium luxury sunglasses market is poised for significant growth, driven by increasing disposable incomes and a rising fashion-conscious consumer base. As e-commerce continues to expand, brands will need to adapt their strategies to leverage online platforms effectively. Additionally, the integration of technology in eyewear, such as smart sunglasses, is expected to attract tech-savvy consumers. Overall, the market is likely to evolve, presenting both challenges and opportunities for brands aiming to capture the attention of discerning customers.

Market Opportunities

- Demand for Sustainable Products:The growing consumer preference for eco-friendly products presents a significant opportunity for luxury sunglasses brands. In future, approximately 65% of consumers in the UAE are expected to prioritize sustainability in their purchasing decisions. Brands that incorporate sustainable materials and practices can differentiate themselves and attract environmentally conscious consumers, enhancing their market position.

- Collaborations with Fashion Designers:Collaborations between luxury eyewear brands and renowned fashion designers can create unique product offerings that appeal to niche markets. Such partnerships can leverage the designer's brand equity, driving consumer interest and sales. In future, collaborations are projected to increase by 35%, providing brands with opportunities to innovate and expand their customer base through exclusive collections.