Region:Middle East

Author(s):Rebecca

Product Code:KRAD7562

Pages:94

Published On:December 2025

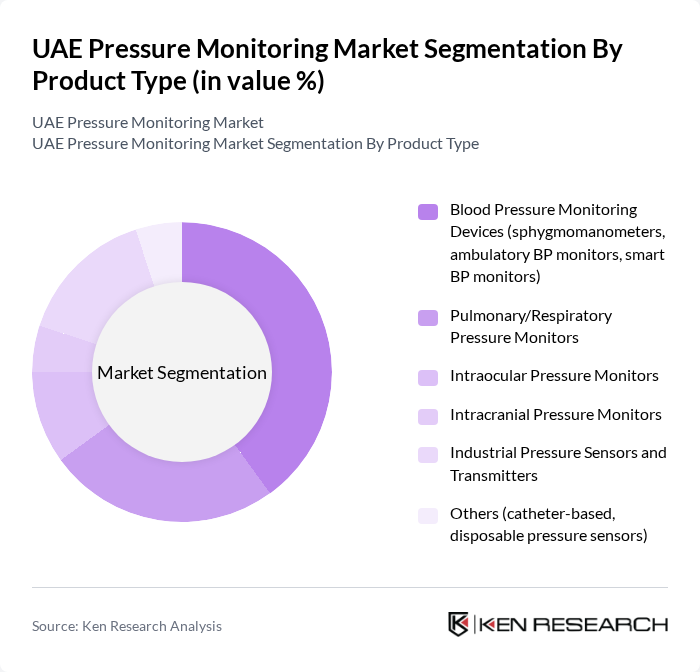

By Product Type:The product type segmentation includes various devices used for monitoring pressure in different medical and industrial applications. The subsegments are Blood Pressure Monitoring Devices, Pulmonary/Respiratory Pressure Monitors, Intraocular Pressure Monitors, Intracranial Pressure Monitors, Industrial Pressure Sensors and Transmitters, and Others.

The Blood Pressure Monitoring Devices segment is the leading subsegment, driven by the increasing prevalence of hypertension and cardiovascular diseases. The demand for these devices is further fueled by the growing trend of home healthcare and remote patient monitoring, allowing patients to manage their health more effectively. The rise in awareness regarding the importance of regular health check-ups has also contributed to the growth of this segment.

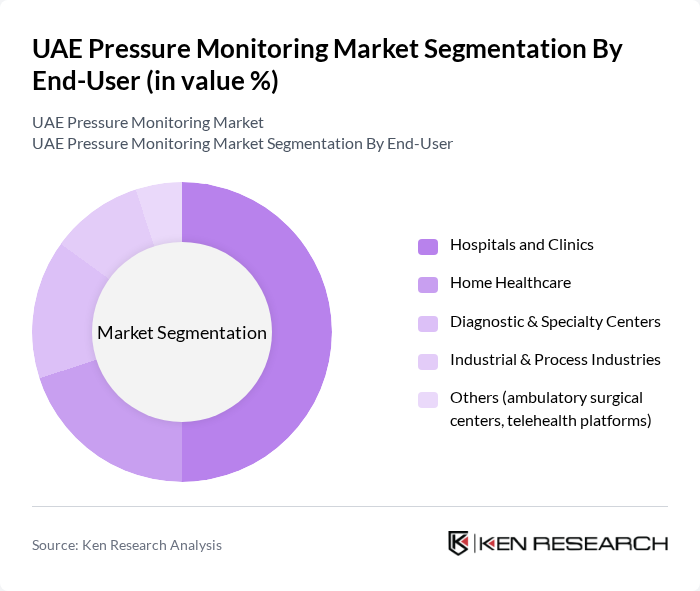

By End-User:The end-user segmentation includes various sectors that utilize pressure monitoring devices. The subsegments are Hospitals and Clinics, Home Healthcare, Diagnostic & Specialty Centers, Industrial & Process Industries, and Others.

The Hospitals and Clinics segment dominates the market due to the high volume of patients requiring pressure monitoring for various medical conditions. The increasing number of healthcare facilities and the growing focus on patient safety and quality of care are driving the demand in this segment. Additionally, the rise in outpatient services and telehealth solutions is contributing to the growth of home healthcare, which is also gaining traction.

The UAE Pressure Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as OMRON Healthcare Middle East & Africa FZE, Koninklijke Philips N.V., GE HealthCare Technologies Inc., Abbott Laboratories, Siemens Healthineers AG, Medtronic plc, Nihon Kohden Corporation, Drägerwerk AG & Co. KGaA, Masimo Corporation, BD (Becton, Dickinson and Company), Smiths Medical (ICU Medical, Inc.), WIKA Alexander Wiegand SE & Co. KG, Emerson Electric Co., Honeywell International Inc., Endress+Hauser AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE pressure monitoring market appears promising, driven by ongoing technological innovations and increased regulatory focus on safety. As industries adopt predictive maintenance strategies, the demand for real-time data analytics will grow, enhancing operational efficiency. Furthermore, the integration of IoT technologies is expected to revolutionize monitoring systems, providing seamless connectivity and data management. These trends will likely foster a competitive landscape, encouraging further investments and advancements in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Blood Pressure Monitoring Devices (sphygmomanometers, ambulatory BP monitors, smart BP monitors) Pulmonary/Respiratory Pressure Monitors Intraocular Pressure Monitors Intracranial Pressure Monitors Industrial Pressure Sensors and Transmitters Others (catheter-based, disposable pressure sensors) |

| By End-User | Hospitals and Clinics Home Healthcare Diagnostic & Specialty Centers Industrial & Process Industries Others (ambulatory surgical centers, telehealth platforms) |

| By Industry (Non?medical) | Oil & Gas and Petrochemicals Power, Water & Wastewater Utilities Manufacturing & Industrial Automation Food & Beverage Processing Others (marine, aviation, building management) |

| By Technology | Piezoresistive / Strain Gauge Pressure Sensors Capacitive Pressure Sensors Piezoelectric Pressure Sensors Optical / MEMS-based Pressure Sensors Others (electromagnetic, resonant solid-state) |

| By Application | Hypertension and Cardiovascular Monitoring Respiratory and Critical Care Monitoring Industrial Process & Safety Control Remote & Ambulatory Patient Monitoring Others (research, clinical trials) |

| By Connectivity / Interface | Wired Pressure Monitoring Devices Wireless / IoT-enabled Pressure Monitoring Devices App-integrated / Cloud-connected Devices Standalone Non-connected Digital Devices Others |

| By Setting / Care Environment | Acute Care (ICUs, emergency departments, operating theatres) Primary Care & Outpatient Settings Home & Community-based Care Corporate Wellness & Occupational Health Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Pressure Monitoring | 100 | Field Engineers, Operations Managers |

| Manufacturing Industry Applications | 80 | Production Supervisors, Quality Control Managers |

| Water Management Systems | 70 | Environmental Engineers, Water Resource Managers |

| Healthcare Equipment Monitoring | 60 | Biomedical Engineers, Hospital Facility Managers |

| Research & Development in Pressure Technologies | 50 | R&D Managers, Product Development Engineers |

The UAE Pressure Monitoring Market is valued at approximately USD 170 million, driven by factors such as the increasing prevalence of chronic diseases, rising healthcare expenditure, and advancements in medical technology.