Region:Middle East

Author(s):Rebecca

Product Code:KRAD5069

Pages:89

Published On:December 2025

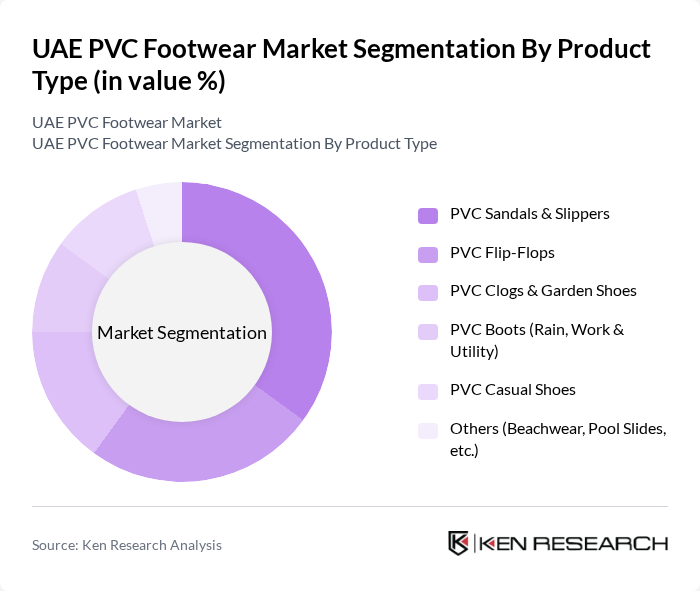

By Product Type:The product type segmentation includes various categories such as PVC Sandals & Slippers, PVC Flip-Flops, PVC Clogs & Garden Shoes, PVC Boots (Rain, Work & Utility), PVC Casual Shoes, and Others (Beachwear, Pool Slides, etc.). This structure aligns with the global PVC footwear product mix, where sandals, slippers, and flip-flops account for a major share due to their low price point and everyday usability in warm climates. Among these, PVC Sandals & Slippers dominate the market in the UAE, supported by year-round hot weather, strong demand for casual open footwear, and extensive distribution through value fashion retailers, supermarkets, and beachwear outlets. The trend towards casualization in fashion, growing athleisure adoption, and frequent beach and outdoor leisure activities in coastal cities have further boosted the demand for these products.

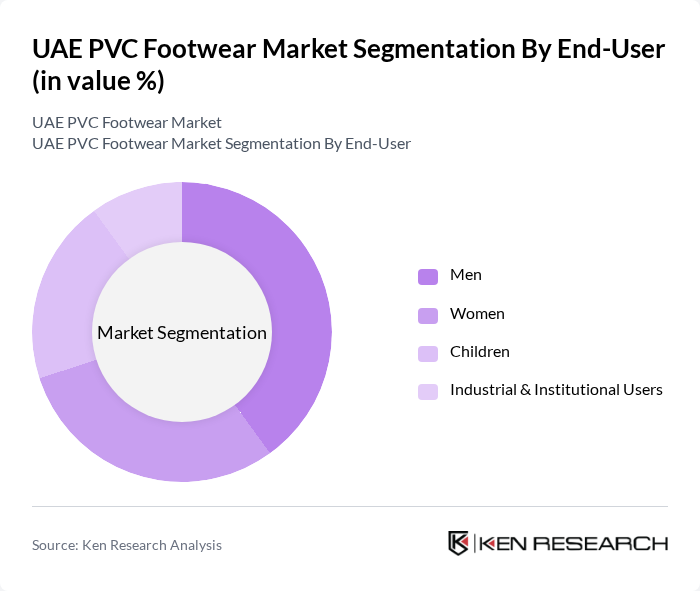

By End-User:The end-user segmentation includes Men, Women, Children, and Industrial & Institutional Users, which is consistent with typical footwear market breakdowns used in global and regional analyses. The men’s segment leads the market, driven by the increasing demand for durable and practical footwear for work, daily commuting, and outdoor use, especially in construction, logistics, and services where PVC safety and utility footwear are widely used. At the same time, growing participation in sports and outdoor recreation, combined with the popularity of athleisure and casual styles among men in the UAE, has also contributed to the rise in demand for PVC sandals, slides, and flip-flops in both branded and private-label ranges.

The UAE PVC Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crocs, Inc., Bata Shoe Company LLC (UAE), Centre Point (Landmark Group), Shoe Mart (Landmark Group), Sun & Sand Sports (Gulf Marketing Group), MAX Fashion (Landmark Group), Carrefour UAE (Majid Al Futtaim Retail), Lulu Hypermarket (Lulu Group International), Aldo Group (UAE Operations), Skechers Gulf LLC, Adidas Emerging Markets LLC (UAE), Nike Stores UAE (Sun and Sand Sports Franchise), Decathlon UAE, Nasser Bin Abdullatif Alserkal Est. (Industrial & PVC Safety Footwear), Local Private-Label Importers & Distributors (Dubai & Sharjah) contribute to innovation, geographic expansion, omnichannel retail penetration, and portfolio diversification in this space, often combining PVC footwear with broader casual, sports, and value footwear assortments.

The UAE PVC footwear market is poised for significant transformation driven by sustainability and technological advancements. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in innovative materials and production processes. The growth of e-commerce will further enhance market accessibility, allowing brands to reach a broader audience. Additionally, collaborations with fashion brands may create unique offerings, appealing to the growing demand for personalized products. Overall, the market is expected to adapt to these trends, fostering resilience and growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | PVC Sandals & Slippers PVC Flip-Flops PVC Clogs & Garden Shoes PVC Boots (Rain, Work & Utility) PVC Casual Shoes Others (Beachwear, Pool Slides, etc.) |

| By End-User | Men Women Children Industrial & Institutional Users |

| By Distribution Channel | Hypermarkets & Supermarkets Specialty Footwear Stores Multi-Brand Retailers & Department Stores Online Marketplaces & Brand E-Stores Wholesale & B2B Channels |

| By Price Range | Economy (Mass Market) Mid-range Premium & Branded PVC Footwear |

| By Material Type | Virgin PVC Recycled PVC PVC–Rubber Blends PVC–EVA and Other Blended Materials |

| By Application | Everyday Casual & Fashion Wear Occupational & Protective Use Beachwear & Resort Wear Hospitality & Healthcare Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Footwear Outlets | 120 | Store Managers, Sales Executives |

| Manufacturers of PVC Footwear | 90 | Production Managers, Quality Control Officers |

| Consumer Insights on Footwear Preferences | 150 | General Consumers, Fashion Enthusiasts |

| Distributors and Wholesalers | 80 | Distribution Managers, Supply Chain Coordinators |

| Market Analysts and Industry Experts | 40 | Market Researchers, Industry Consultants |

The UAE PVC Footwear Market is valued at approximately USD 0.9 billion, reflecting a significant share of the overall footwear market in the UAE. This valuation is based on historical analysis and market trends, indicating robust growth driven by demand for affordable and durable footwear options.