Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3928

Pages:96

Published On:November 2025

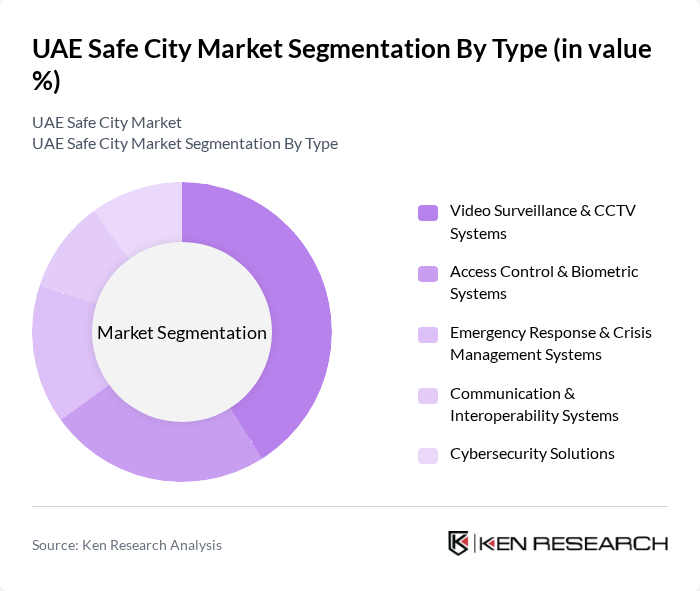

By Type:The market can be segmented into various types, including Video Surveillance & CCTV Systems, Access Control & Biometric Systems, Emergency Response & Crisis Management Systems, Communication & Interoperability Systems, and Cybersecurity Solutions. Among these, Video Surveillance & CCTV Systems remain the most dominant due to their critical role in enhancing public safety, crime prevention, and real-time monitoring. The rapid adoption of AI-powered surveillance, facial recognition, and smart analytics, driven by urbanization and security concerns, has led to a significant rise in demand for these systems.

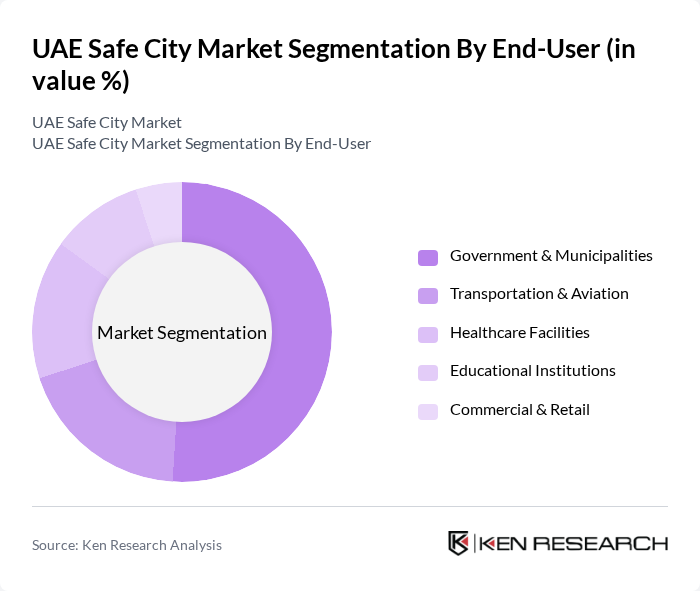

By End-User:The end-user segmentation includes Government & Municipalities, Transportation & Aviation, Healthcare Facilities, Educational Institutions, and Commercial & Retail sectors. Government & Municipalities are the leading end-users, driven by the need for enhanced public safety, efficient urban management, and compliance with national smart city regulations. The increasing focus on digital transformation and public safety mandates has led to substantial investments in safe city technologies by government entities, with transportation and healthcare sectors also accelerating adoption for critical infrastructure protection.

The UAE Safe City Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Cisco Systems, Inc., IBM Corporation, Johnson Controls International plc, Thales Group, Bosch Security Systems, Hikvision Digital Technology Co., Ltd., Axis Communications AB, NEC Corporation, Genetec Inc., Avigilon Corporation, FLIR Systems, Inc., Motorola Solutions, Inc., Tyco International plc, Emirates Integrated Telecommunications Company (du), Etisalat by e&, Dubai Police General Command, Abu Dhabi Police General Command, Dubai Smart City Authority, Abu Dhabi Digital Authority, Integrated Security Solutions LLC, Al Futtaim Technologies, G4S UAE, Securitas UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE Safe City Market is poised for significant advancements, driven by technological innovations and increasing urbanization. The integration of AI and machine learning into security systems will enhance real-time monitoring capabilities, improving public safety. Furthermore, the growth of public-private partnerships will facilitate resource sharing and expertise, accelerating the development of smart city projects. As the government continues to prioritize sustainable urban infrastructure, the market will likely see a surge in investments aimed at enhancing safety and security in urban environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance & CCTV Systems Access Control & Biometric Systems Emergency Response & Crisis Management Systems Communication & Interoperability Systems Cybersecurity Solutions |

| By End-User | Government & Municipalities Transportation & Aviation Healthcare Facilities Educational Institutions Commercial & Retail |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Umm Al Quwain Fujairah |

| By Technology | Cloud-based Solutions Edge Computing Big Data Analytics IoT Devices Artificial Intelligence & Machine Learning |

| By Application | Traffic & Mobility Management Public Safety & Law Enforcement Environmental & Disaster Monitoring Smart Lighting & Infrastructure Urban Surveillance |

| By Investment Source | Government Funding Private Investments International Aid Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development Regulatory Sandboxes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Safety Technology Providers | 100 | Product Managers, Business Development Executives |

| City Planning Authorities | 80 | Urban Planners, Policy Makers |

| Community Safety Stakeholders | 60 | Community Leaders, Local Government Officials |

| Public Safety Agencies | 90 | Law Enforcement Officers, Emergency Response Coordinators |

| Technology Adoption in Smart Cities | 50 | IT Managers, Smart City Consultants |

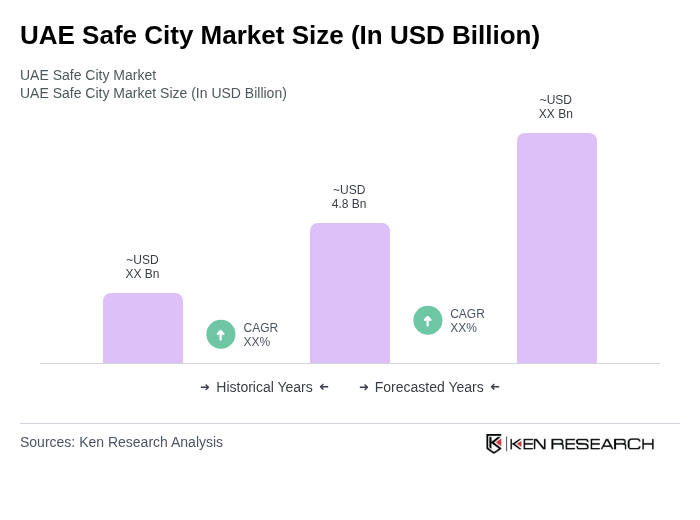

The UAE Safe City Market is valued at approximately USD 4.8 billion, driven by urbanization, government initiatives for smart city development, and the demand for advanced public safety solutions, including IoT and AI technologies.