Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3811

Pages:92

Published On:September 2025

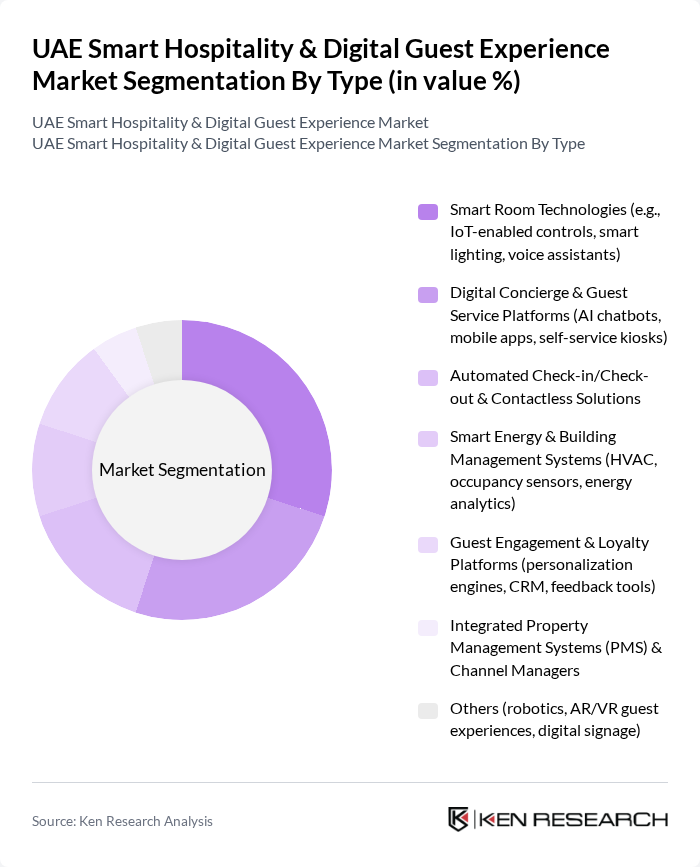

By Type:The market is segmented into various types, including Smart Room Technologies, Digital Concierge & Guest Service Platforms, Automated Check-in/Check-out & Contactless Solutions, Smart Energy & Building Management Systems, Guest Engagement & Loyalty Platforms, In-room Entertainment & Connectivity Solutions, Security & Access Control Systems, and Others. Among these, Smart Room Technologies are leading due to the growing consumer preference for IoT-enabled solutions that enhance comfort and convenience. The demand for personalized experiences and the need for operational efficiency are driving the adoption of these technologies, making them a significant focus for hospitality providers. Digital Concierge platforms and contactless solutions are also experiencing rapid uptake, reflecting the sector’s emphasis on safety, convenience, and seamless guest interactions .

By End-User:The end-user segmentation includes Luxury Hotels & Resorts, Mid-Scale & Upscale Hotels, Budget & Economy Hotels, Serviced Apartments & Residences, Vacation Rentals & Short-Term Stays, and Others. Luxury Hotels & Resorts dominate this segment, driven by their focus on providing high-end, personalized experiences that leverage advanced technologies. The increasing expectations of affluent travelers for seamless and innovative services are pushing these establishments to invest heavily in smart hospitality solutions. Mid-scale and upscale hotels are also accelerating digital adoption to remain competitive, while serviced apartments are expanding rapidly due to extended-stay demand .

The UAE Smart Hospitality & Digital Guest Experience Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International, Hilton Worldwide, Accor Hotels, InterContinental Hotels Group (IHG), Hyatt Hotels Corporation, Radisson Hotel Group, Jumeirah Group, Emaar Hospitality Group, Atlantis The Palm, Rove Hotels, Address Hotels + Resorts, Anantara Hotels, Resorts & Spas, Four Seasons Hotels and Resorts, Shangri-La Hotels and Resorts, Taj Hotels, Rotana Hotels & Resorts, Millennium Hotels and Resorts, Sofitel Hotels & Resorts, Minor Hotels, Burj Al Arab Jumeirah, Bab Al Shams Desert Resort, Qasr Al Sarab Desert Resort by Anantara, Fairmont Hotels & Resorts, Kempinski Hotels, Dusit Thani Hotels & Resorts contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE smart hospitality market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As hotels increasingly adopt AI and machine learning, personalized guest experiences will become more prevalent, enhancing customer satisfaction. Additionally, the integration of sustainable practices will likely gain momentum, aligning with global trends towards eco-friendly operations. The ongoing development of smart cities will further facilitate the adoption of innovative solutions, positioning the UAE as a leader in the digital hospitality landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Room Technologies (e.g., IoT-enabled controls, smart lighting, voice assistants) Digital Concierge & Guest Service Platforms (e.g., AI chatbots, mobile apps) Automated Check-in/Check-out & Contactless Solutions Smart Energy & Building Management Systems Guest Engagement & Loyalty Platforms In-room Entertainment & Connectivity Solutions Security & Access Control Systems Others |

| By End-User | Luxury Hotels & Resorts Mid-Scale & Upscale Hotels Budget & Economy Hotels Serviced Apartments & Residences Vacation Rentals & Short-Term Stays Others (e.g., Boutique Hotels, Heritage Properties) |

| By Application | Guest Experience Enhancement (personalization, digital amenities) Operational Efficiency (automation, predictive maintenance) Revenue Management & Dynamic Pricing Marketing, CRM & Promotions Sustainability & Energy Optimization Others |

| By Distribution Channel | Direct (Hotel-owned Digital Platforms) Online Travel Agencies (OTAs) Technology Solution Providers & Integrators Third-Party Vendors & Marketplaces Others |

| By Customer Segment | Business Travelers Leisure Travelers Group & MICE Travelers Family Travelers Digital Nomads & Long-Stay Guests Others |

| By Service Type | Room Automation & Controls Food and Beverage Digital Services Housekeeping & Facility Management Automation Maintenance & Predictive Analytics Services Guest Communication & Support Services Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Digital Services | 100 | General Managers, IT Directors |

| Mid-Scale Hotel Guest Experience | 80 | Operations Managers, Guest Relations Officers |

| Resort Technology Integration | 70 | Technology Managers, Marketing Directors |

| Restaurant Digital Ordering Systems | 50 | Restaurant Managers, Digital Marketing Specialists |

| Travel Agency Digital Engagement | 60 | Travel Consultants, Customer Experience Managers |

The UAE Smart Hospitality & Digital Guest Experience Market is valued at approximately USD 23.9 billion, driven by the increasing adoption of digital technologies and the rise in international tourism, supported by government initiatives and strategic investments in infrastructure.