Region:Middle East

Author(s):Dev

Product Code:KRAD1757

Pages:94

Published On:November 2025

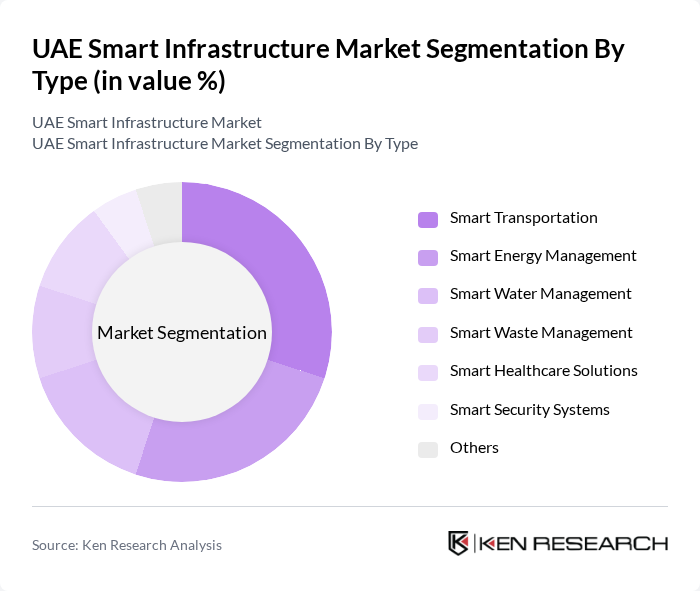

By Type:The segmentation of the UAE Smart Infrastructure Market by type includes various categories such as Smart Transportation, Smart Energy Management, Smart Water Management, Smart Waste Management, Smart Healthcare Solutions, Smart Security Systems, and Others. Each of these segments plays a crucial role in enhancing the overall efficiency and sustainability of urban infrastructure. Smart Transportation and Smart Energy Management remain the largest segments, driven by ongoing investments in public mobility, renewable energy, and grid modernization .

The Smart Transportation segment is leading the market due to the increasing demand for efficient public transport systems and smart mobility solutions. The UAE's focus on reducing traffic congestion and enhancing connectivity through smart technologies has driven significant investments in this area. Additionally, the integration of IoT and AI in transportation systems is improving operational efficiency and user experience, making it a key area of growth. Recent projects include high-speed rail links and adaptive traffic signal systems .

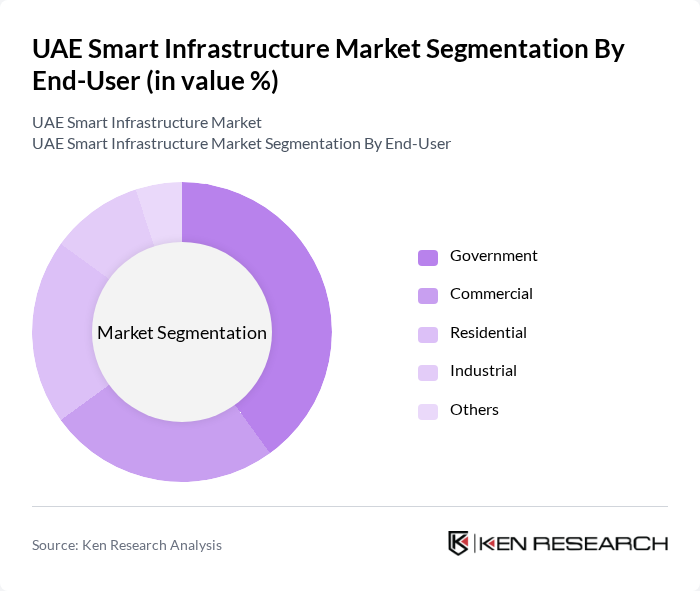

By End-User:The segmentation of the UAE Smart Infrastructure Market by end-user includes Government, Commercial, Residential, Industrial, and Others. Each segment reflects the diverse applications of smart infrastructure solutions across different sectors, catering to the unique needs of each user group. The Government segment remains the largest, reflecting sustained public investment in smart city and infrastructure projects .

The Government segment dominates the market, driven by substantial investments in smart city initiatives and infrastructure projects. The UAE government is actively promoting the adoption of smart technologies to enhance public services, improve urban living, and achieve sustainability goals. This focus on innovation and efficiency in public sector projects significantly contributes to the growth of the smart infrastructure market. Examples include large-scale energy retrofits and digital government service platforms .

The UAE Smart Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., Honeywell International Inc., Cisco Systems, Inc., General Electric Company, IBM Corporation, Oracle Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Johnson Controls International plc, Enel X, Veolia Environnement S.A., SUEZ S.A., Accenture plc, Etisalat Group (e&), Emirates Integrated Telecommunications Company (du), Farnek Services LLC, Pacific Controls Systems LLC, Honeywell Building Technologies Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE smart infrastructure market appears promising, driven by ongoing urbanization and government support for technological advancements. In the future, the integration of AI and machine learning in infrastructure management is expected to enhance operational efficiencies significantly. Additionally, the focus on sustainability will likely lead to increased investments in renewable energy and green building technologies, positioning the UAE as a leader in smart infrastructure development in the region.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Smart Transportation, Smart Energy Management, Smart Water Management, Smart Waste Management, Smart Healthcare Solutions, Smart Security Systems, Others) | Smart Transportation Smart Energy Management Smart Water Management Smart Waste Management Smart Healthcare Solutions Smart Security Systems Others |

| By End-User (Government, Commercial, Residential, Industrial) | Government Commercial Residential Industrial Others |

| By Region (Dubai, Abu Dhabi, Sharjah, Others) | Dubai Abu Dhabi Sharjah Others |

| By Technology (IoT, AI, Cloud Computing, Big Data Analytics, Blockchain, Others) | IoT AI Cloud Computing Big Data Analytics Blockchain Others |

| By Application (Energy Management, Building Automation, Smart Mobility, Environmental Monitoring, Public Safety, Others) | Energy Management Building Automation Smart Mobility Environmental Monitoring Public Safety Others |

| By Investment Source (Domestic Investment, Foreign Direct Investment (FDI), Public-Private Partnerships (PPP), Government Schemes, Others) | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, Grants, Regulatory Support, Others) | Subsidies Tax Exemptions Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Systems | 60 | Transport Planners, Smart Mobility Experts |

| Smart Energy Management Solutions | 50 | Energy Managers, Sustainability Consultants |

| Smart Waste Management Initiatives | 40 | Environmental Engineers, Waste Management Directors |

| Smart Water Management Systems | 40 | Water Resource Managers, Urban Infrastructure Specialists |

| Smart Building Technologies | 50 | Facility Managers, Building Automation Experts |

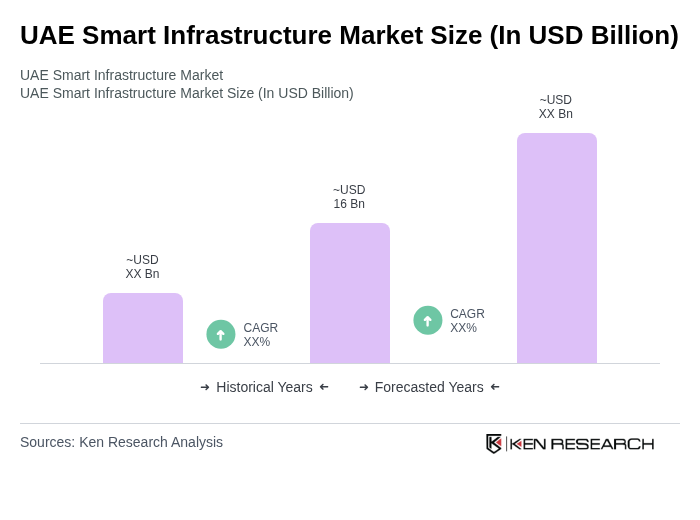

The UAE Smart Infrastructure Market is valued at approximately USD 16 billion, driven by rapid urbanization, government initiatives for smart city projects, and increased investments in technology aimed at enhancing infrastructure efficiency and sustainability.