Region:Middle East

Author(s):Shubham

Product Code:KRAB4466

Pages:95

Published On:October 2025

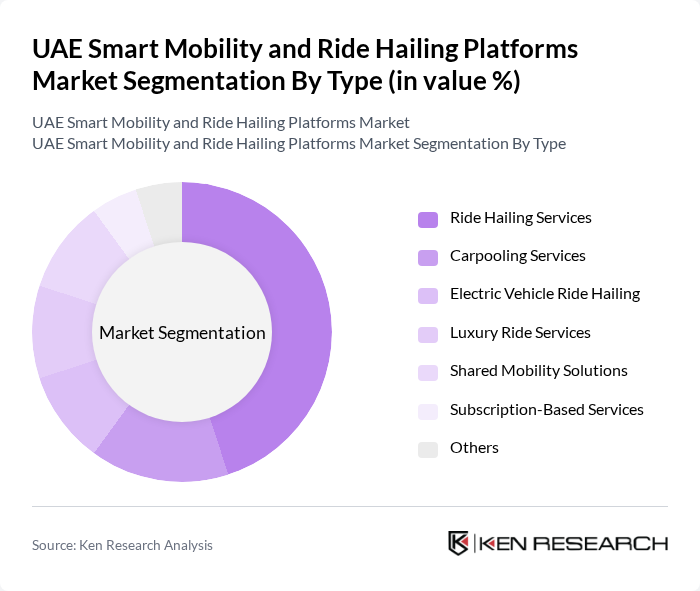

By Type:The market is segmented into various types, including Ride Hailing Services, Carpooling Services, Electric Vehicle Ride Hailing, Luxury Ride Services, Shared Mobility Solutions, Subscription-Based Services, and Others. Among these, Ride Hailing Services dominate the market due to their convenience and widespread adoption among consumers. The increasing preference for on-demand transportation solutions has led to a significant rise in the usage of ride-hailing apps, making them the most popular choice for urban commuters.

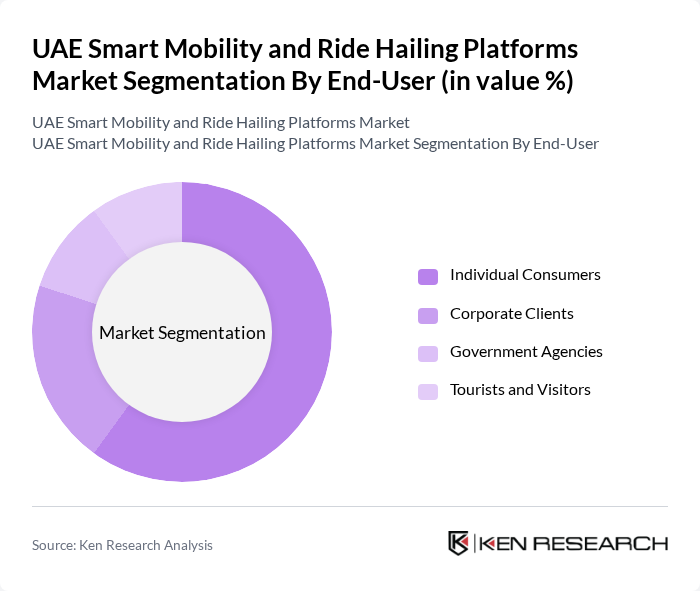

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Government Agencies, and Tourists and Visitors. Individual Consumers represent the largest segment, driven by the growing trend of urban mobility and the increasing reliance on ride-hailing services for daily commutes. The convenience and flexibility offered by these services make them particularly appealing to urban dwellers, contributing to their dominance in the market.

The UAE Smart Mobility and Ride Hailing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber, OTaxi, Fenix, Yango, Bolt, Zain Ride, RTA (Roads and Transport Authority), Udrive, Smart Taxi, Hala, Careem Bus, Rideshare, Easy Taxi, Taxis in Dubai contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE smart mobility and ride-hailing market appears promising, driven by technological advancements and a growing emphasis on sustainability. As urbanization continues to rise, the integration of smart technologies, such as AI and big data, will enhance operational efficiency. Additionally, the collaboration between ride-hailing services and public transport systems is expected to create seamless mobility solutions, further improving user experience and accessibility across urban areas in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride Hailing Services Carpooling Services Electric Vehicle Ride Hailing Luxury Ride Services Shared Mobility Solutions Subscription-Based Services Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tourists and Visitors |

| By Vehicle Type | Sedans SUVs Vans Electric Vehicles |

| By Service Model | On-Demand Services Pre-Booked Services |

| By Payment Model | Pay-Per-Ride Subscription-Based Payments |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Business Travelers Daily Commuters Occasional Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ride-Hailing User Experience | 150 | Regular Users, Occasional Users, Non-Users |

| Smart Mobility Policy Insights | 100 | Urban Planners, Transportation Officials |

| Technology Adoption in Mobility | 80 | IT Managers, Product Development Leads |

| Market Trends in Ride-Hailing | 120 | Business Analysts, Market Researchers |

| Consumer Preferences for Mobility Solutions | 90 | General Public, Commuters, Students |

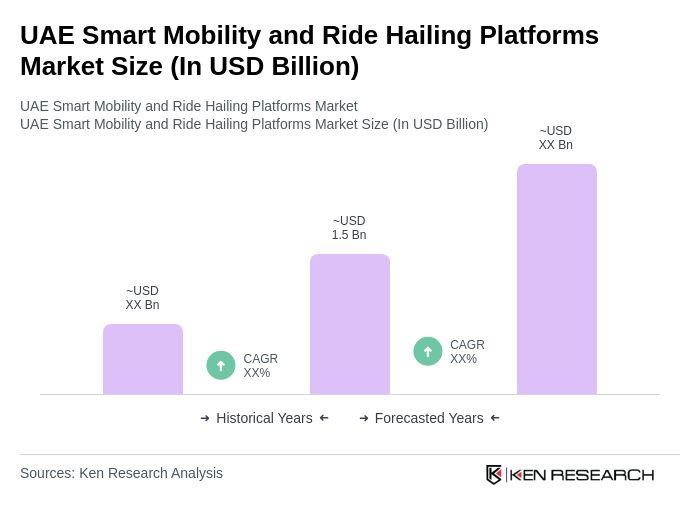

The UAE Smart Mobility and Ride Hailing Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by urbanization, smartphone penetration, and a shift towards sustainable transportation solutions.