Region:Middle East

Author(s):Shubham

Product Code:KRAB7109

Pages:100

Published On:October 2025

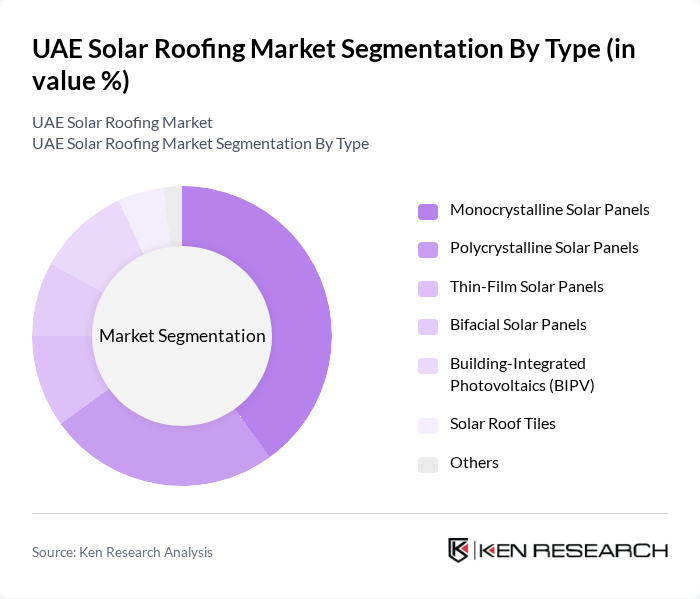

By Type:The market is segmented into various types of solar roofing technologies, including Monocrystalline Solar Panels, Polycrystalline Solar Panels, Thin-Film Solar Panels, Bifacial Solar Panels, Building-Integrated Photovoltaics (BIPV), Solar Roof Tiles, and Others. Among these, Monocrystalline Solar Panels are leading due to their high efficiency and space-saving design, making them a preferred choice for residential and commercial installations. The demand for BIPV is also rising as it integrates seamlessly into building designs, appealing to architects and builders.

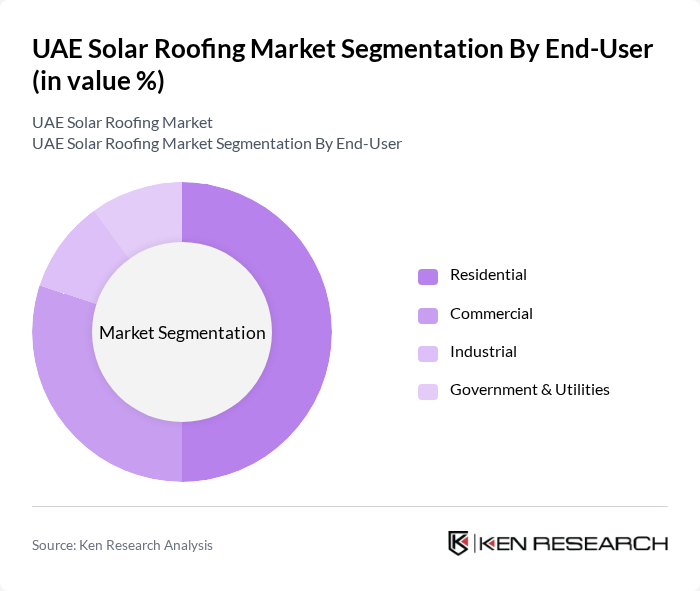

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the largest due to increasing consumer interest in energy independence and sustainability. The Commercial sector is also growing as businesses seek to reduce operational costs through solar energy. Government initiatives further support the adoption of solar technologies across all segments.

The UAE Solar Roofing Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Inc., JinkoSolar Holding Co., Ltd., Canadian Solar Inc., Trina Solar Limited, SunPower Corporation, Hanwha Q CELLS, LONGi Green Energy Technology Co., Ltd., SMA Solar Technology AG, ABB Ltd., Enphase Energy, Inc., Risen Energy Co., Ltd., REC Group, Solaria Energía y Medio Ambiente, S.A., Sunrun Inc., Ecolibrium Solar contribute to innovation, geographic expansion, and service delivery in this space.

The UAE solar roofing market is poised for significant growth, driven by increasing energy demands and a strong governmental push towards renewable energy. As technological advancements continue to lower costs and improve efficiency, more consumers are likely to adopt solar solutions. Additionally, the expansion of incentive programs and community solar initiatives will further enhance market penetration. The focus on sustainable building practices and energy independence will also play a crucial role in shaping the future landscape of solar roofing in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Monocrystalline Solar Panels Polycrystalline Solar Panels Thin-Film Solar Panels Bifacial Solar Panels Building-Integrated Photovoltaics (BIPV) Solar Roof Tiles Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Rooftop Installations Ground-Mounted Systems Utility-Scale Projects Off-Grid Solutions |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Price Range | Budget-Friendly Options Mid-Range Options Premium Options |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Roofing Adoption | 150 | Homeowners, Property Managers |

| Commercial Solar Roofing Projects | 100 | Facility Managers, Business Owners |

| Government Incentive Awareness | 80 | Policy Makers, Energy Consultants |

| Installation and Maintenance Feedback | 70 | Solar Installers, Technicians |

| Market Trends and Future Outlook | 90 | Industry Analysts, Market Researchers |

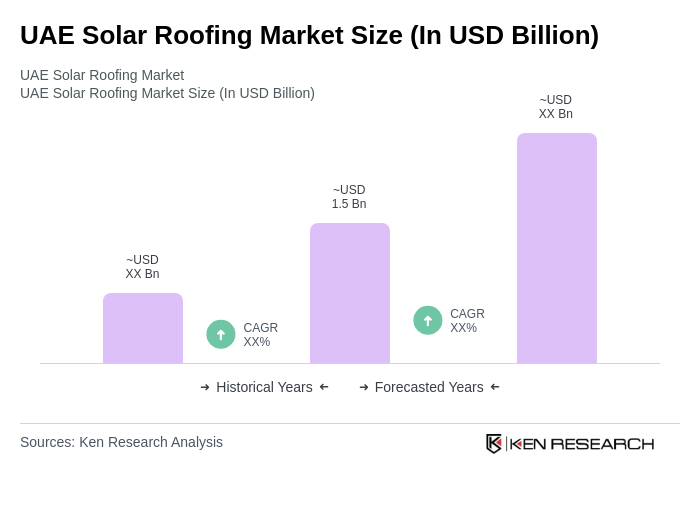

The UAE Solar Roofing Market is valued at approximately USD 1.5 billion, driven by increasing demand for renewable energy solutions, government initiatives, and rising consumer awareness regarding sustainability. This growth reflects a significant trend towards adopting solar energy technologies in the region.