Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4503

Pages:87

Published On:October 2025

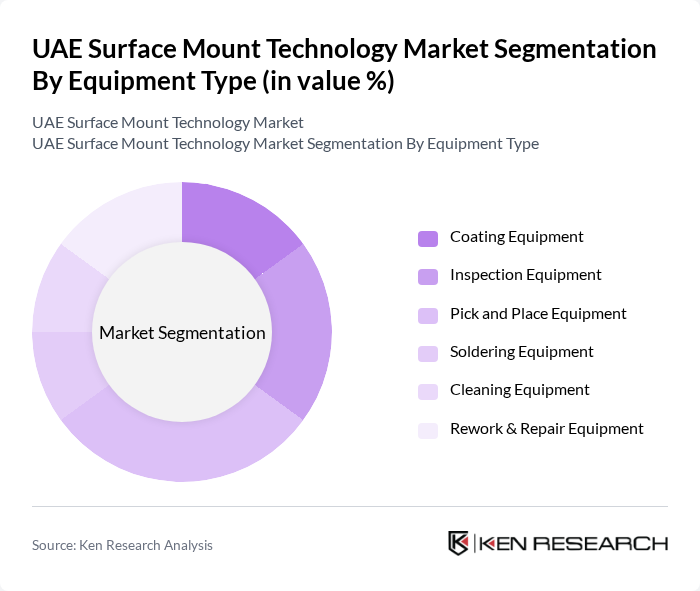

By Equipment Type:The equipment type segmentation includes categories essential for surface mount technology processes: Coating Equipment, Inspection Equipment, Pick and Place Equipment, Soldering Equipment, Cleaning Equipment, and Rework & Repair Equipment. Among these, Pick and Place Equipment leads the market due to its critical role in high-speed, high-precision assembly. The increasing complexity and miniaturization of electronic devices have driven demand for advanced pick and place systems that enhance productivity, reduce errors, and support flexible manufacturing lines .

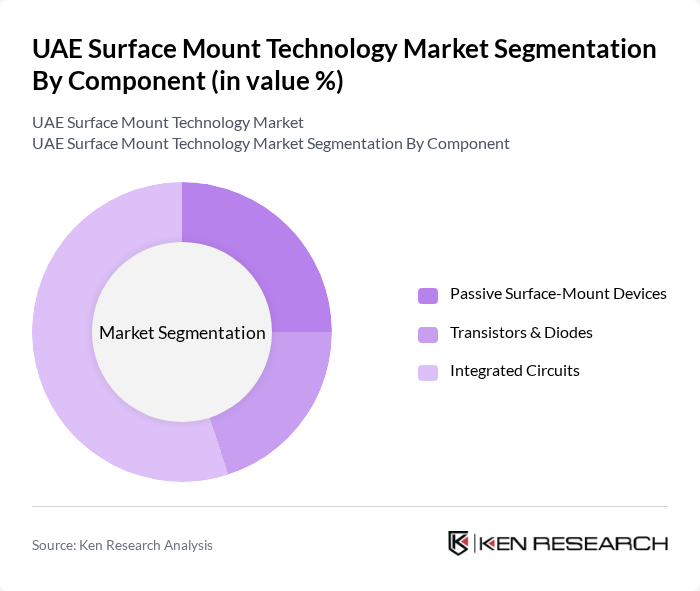

By Component:The component segmentation includes Passive Surface-Mount Devices, Transistors & Diodes, and Integrated Circuits. Integrated Circuits dominate the market due to their widespread application in consumer electronics, automotive, and industrial systems. The proliferation of smart devices, IoT applications, and advanced computing platforms has significantly increased the demand for high-performance integrated circuits, making them a critical component in the surface mount technology landscape .

The UAE Surface Mount Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jabil Circuit, Inc., Flex Ltd., Celestica Inc., Sanmina Corporation, Benchmark Electronics, Inc., Universal Scientific Industrial Co., Ltd., Wistron Corporation, Foxconn Technology Group, Nordson Corporation, CyberOptics Corporation, Orbotech Ltd., Cicor Group, Linx Technologies, Viscom AG, Assembly Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Surface Mount Technology market appears promising, driven by ongoing technological advancements and government support. As the demand for compact and efficient electronic devices continues to rise, manufacturers are likely to adopt innovative SMT solutions. Additionally, the integration of AI and automation in production processes is expected to enhance efficiency and reduce costs. With a focus on sustainability, companies are also likely to explore eco-friendly manufacturing practices, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Coating Equipment Inspection Equipment Pick and Place Equipment Soldering Equipment Cleaning Equipment Rework & Repair Equipment |

| By Component | Passive Surface-Mount Devices Transistors & Diodes Integrated Circuits |

| By Application | Telecommunication Consumer Electronics Automotive Aerospace & Defense Healthcare Industrial Automation |

| By End-User Industry | Electronics Manufacturing Services (EMS) OEMs Distributors |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturing | 120 | Production Managers, Quality Assurance Leads |

| Automotive Electronics Suppliers | 90 | Supply Chain Managers, Engineering Directors |

| Telecommunications Equipment Producers | 80 | Product Development Managers, Technical Directors |

| Medical Device Manufacturers | 60 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Electronics Sector | 100 | Operations Managers, Procurement Officers |

The UAE Surface Mount Technology market is valued at approximately USD 120 million, reflecting its significant role within the Middle East and Africa region, driven by the demand for compact electronic devices and advancements in manufacturing technologies.