Region:Middle East

Author(s):Shubham

Product Code:KRAD5437

Pages:95

Published On:December 2025

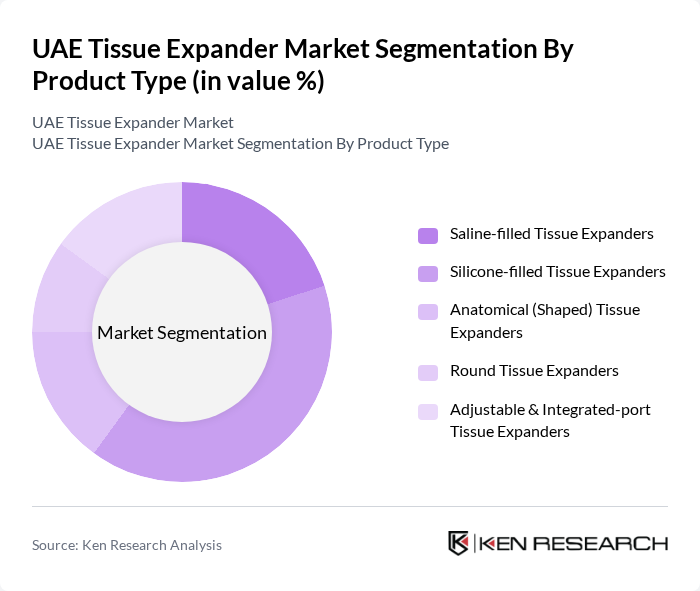

By Product Type:The product type segmentation includes various categories of tissue expanders, each catering to specific medical needs and patient preferences. The subsegments are Saline-filled Tissue Expanders, Silicone-filled Tissue Expanders, Anatomical (Shaped) Tissue Expanders, Round Tissue Expanders, and Adjustable & Integrated-port Tissue Expanders. Among these, silicone-filled tissue expanders are gaining popularity due to their natural feel and aesthetic outcomes.

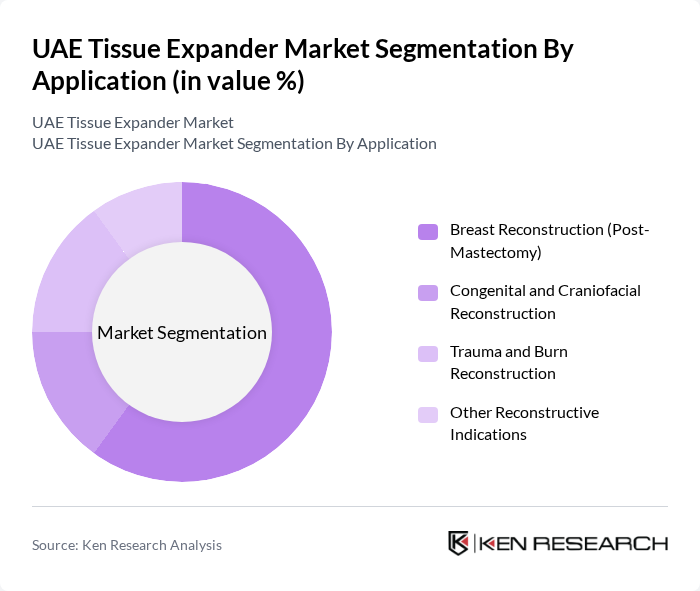

By Application:The application segmentation encompasses various medical procedures where tissue expanders are utilized. This includes Breast Reconstruction (Post-Mastectomy), Congenital and Craniofacial Reconstruction, Trauma and Burn Reconstruction, and Other Reconstructive Indications. Breast reconstruction remains the leading application due to the increasing number of mastectomies performed and the growing awareness of reconstructive options.

The UAE Tissue Expander Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allergan Aesthetics (AbbVie Inc.), Mentor Worldwide LLC (Johnson & Johnson MedTech), Sientra, Inc., GC Aesthetics PLC, Establishment Labs Holdings Inc., Groupe Sebbin SAS, POLYTECH Health & Aesthetics GmbH, HansBiomed Co., Ltd., Guangzhou Wanhe Plastic Materials Co., Ltd., PMT Corporation, Koken Co., Ltd., Shanghai Kangning Medical Supplies Co., Ltd., Eurosilicone (GC Aesthetics brand), Nagor (GC Aesthetics brand), Local UAE Distributors & Importers of Tissue Expanders contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE tissue expander market appears promising, driven by ongoing advancements in medical technology and an increasing focus on patient-centered care. As healthcare infrastructure continues to expand, more facilities will be equipped to offer advanced reconstructive procedures. Additionally, the integration of digital technologies in surgical practices is expected to enhance the efficiency and effectiveness of tissue expansion, further attracting patients and healthcare providers alike to this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Saline-filled Tissue Expanders Silicone-filled Tissue Expanders Anatomical (Shaped) Tissue Expanders Round Tissue Expanders Adjustable & Integrated-port Tissue Expanders |

| By Application | Breast Reconstruction (Post-Mastectomy) Congenital and Craniofacial Reconstruction Trauma and Burn Reconstruction Other Reconstructive Indications |

| By End-User | Public Hospitals Private Hospitals Specialized Plastic & Reconstructive Surgery Centers Aesthetic & Cosmetic Surgery Clinics |

| By Material | Silicone Elastomer Shells Biologic & Acellular Dermal Matrix-assisted Systems Others |

| By Distribution Channel | Direct Tender / Institutional Sales Local Distributors & Importers Online / E-procurement Platforms Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Patient Demographics | Female Breast Cancer Patients Male Breast Reconstruction & Other Indications Pediatric Patients Medical Tourists |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastic Surgery Clinics | 100 | Plastic Surgeons, Clinic Managers |

| Hospitals with Reconstructive Surgery Departments | 90 | Surgeons, Procurement Officers |

| Dermatology Practices | 60 | Dermatologists, Practice Administrators |

| Patient Advocacy Groups | 50 | Patient Representatives, Healthcare Advocates |

| Medical Device Distributors | 70 | Sales Managers, Product Specialists |

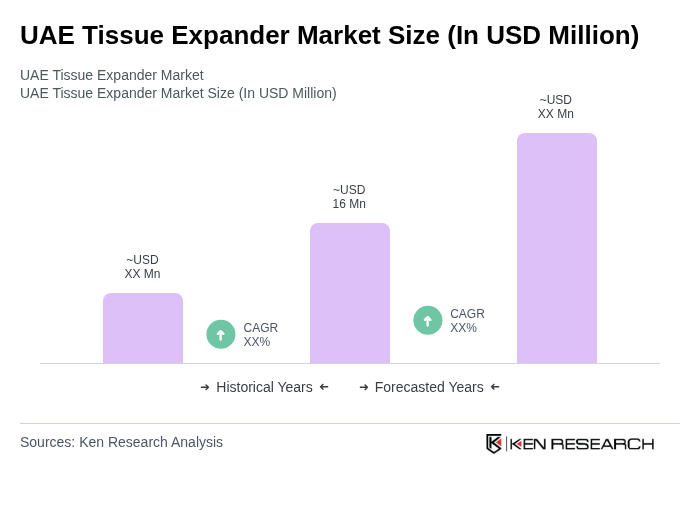

The UAE Tissue Expander Market is valued at approximately USD 16 million, reflecting a significant growth driven by factors such as the rising prevalence of breast cancer, increased awareness of reconstructive surgeries, and advancements in medical technology.