Region:Middle East

Author(s):Shubham

Product Code:KRAD0888

Pages:95

Published On:November 2025

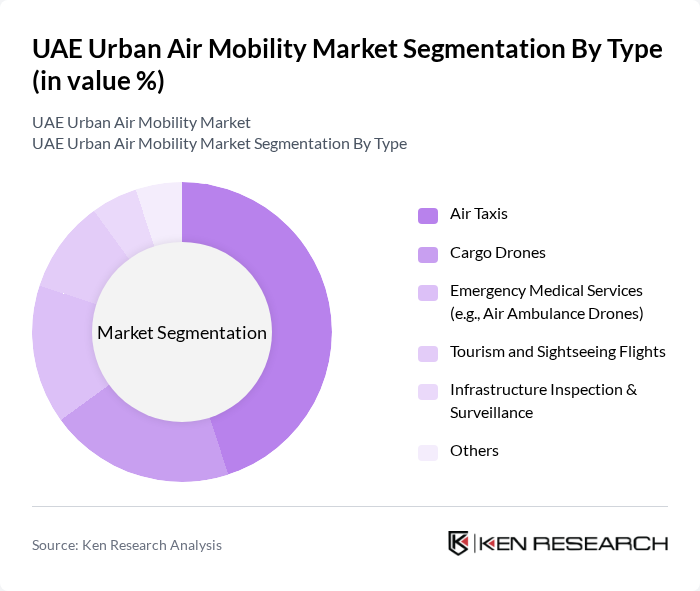

By Type:The market is segmented into various types, including Air Taxis, Cargo Drones, Emergency Medical Services (e.g., Air Ambulance Drones), Tourism and Sightseeing Flights, Infrastructure Inspection & Surveillance, and Others. Among these, Air Taxis are leading the market due to their potential to revolutionize urban transportation by providing quick and efficient travel options, especially in congested cities. The increasing demand for on-demand transportation services and advancements in eVTOL technology are driving the growth of this segment. Passenger air taxis currently account for the largest share of revenue in the UAE Urban Air Mobility market, reflecting strong consumer interest and government support for pilot programs and commercial launches.

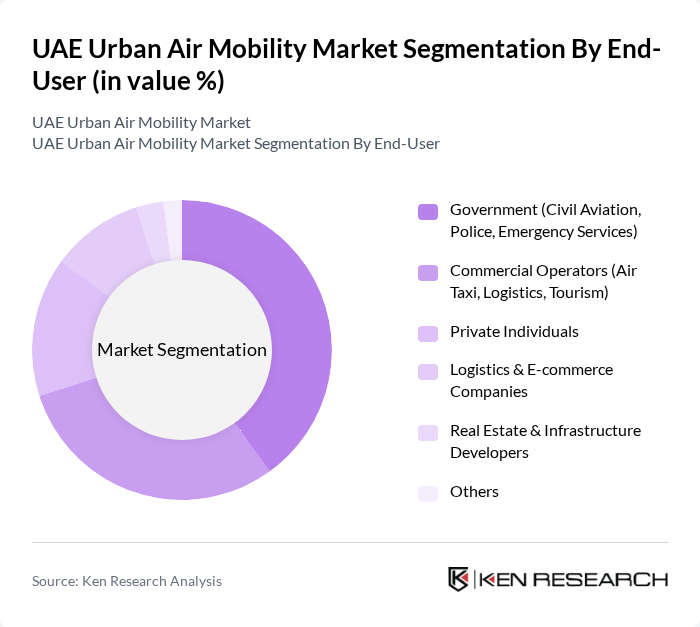

By End-User:The end-user segmentation includes Government (Civil Aviation, Police, Emergency Services), Commercial Operators (Air Taxi, Logistics, Tourism), Private Individuals, Logistics & E-commerce Companies, Real Estate & Infrastructure Developers, and Others. The Government segment is currently the most significant contributor, driven by initiatives to enhance public safety and emergency response capabilities through aerial services. The increasing collaboration between government entities and private operators is also fostering growth in this segment. Government and public sector adoption is further supported by strategic investments in emergency response and smart city infrastructure.

The UAE Urban Air Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Volocopter GmbH, Joby Aviation, Archer Aviation, EHang Holdings Limited, Lilium GmbH, Bell Textron Inc., Airbus Urban Mobility, Boeing NeXt, Skyports Infrastructure Ltd., Abu Dhabi Aviation, Jetex, Autoflight, TransFuture Aviation, Lodd Autonomous, Vertical Aerospace contribute to innovation, geographic expansion, and service delivery in this space.

The future of urban air mobility in the UAE appears promising, driven by ongoing technological advancements and supportive government policies. As the country invests in infrastructure and regulatory frameworks, the market is likely to witness increased adoption of eVTOL aircraft. Furthermore, the integration of urban air mobility with smart city initiatives will enhance urban transportation efficiency. By in future, the UAE aims to have operational air taxi services, positioning itself as a global leader in this innovative transportation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Taxis Cargo Drones Emergency Medical Services (e.g., Air Ambulance Drones) Tourism and Sightseeing Flights Infrastructure Inspection & Surveillance Others |

| By End-User | Government (Civil Aviation, Police, Emergency Services) Commercial Operators (Air Taxi, Logistics, Tourism) Private Individuals Logistics & E-commerce Companies Real Estate & Infrastructure Developers Others |

| By Region | Dubai Abu Dhabi Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| By Technology | Electric Propulsion (eVTOL) Hybrid Propulsion Systems Autonomous Navigation & AI Remote Piloted Systems Others |

| By Application | Passenger Transport Cargo & Parcel Delivery Emergency & Medical Services Infrastructure Monitoring Tourism & Leisure Others |

| By Investment Source | Private Investments (VCs, Corporate Investors) Government Funding (Federal, Emirate-level) Public-Private Partnerships Sovereign Wealth Funds Others |

| By Policy Support | Subsidies for R&D and Innovation Tax Incentives for UAM Operators Regulatory Sandboxes & Fast-Track Approvals Infrastructure Development Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Urban Air Mobility Services | 100 | Commuters, Business Travelers, Urban Planners |

| Logistics and Cargo Delivery | 60 | Logistics Managers, Supply Chain Executives |

| Infrastructure Development | 50 | Urban Developers, Transportation Engineers |

| Regulatory Framework and Policy | 40 | Government Officials, Policy Advisors |

| Technology Providers and Innovators | 50 | Tech Entrepreneurs, R&D Managers |

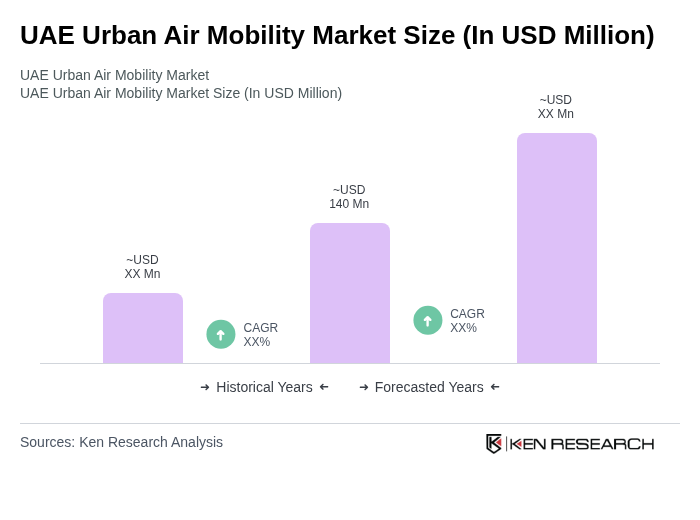

The UAE Urban Air Mobility market is valued at approximately USD 140 million, driven by rapid urbanization, technological advancements in eVTOL aircraft, and significant investments in infrastructure aimed at enhancing urban transportation solutions.