Region:Middle East

Author(s):Shubham

Product Code:KRAA8962

Pages:82

Published On:November 2025

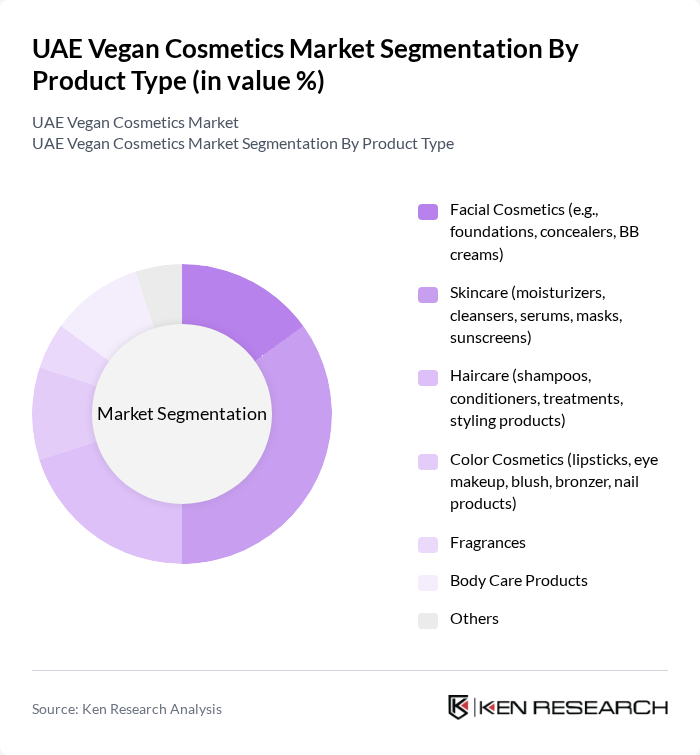

By Product Type:The product type segmentation of the UAE Vegan Cosmetics Market includes various categories such as Facial Cosmetics, Skincare, Haircare, Color Cosmetics, Fragrances, Body Care Products, and Others. Among these, Skincare products are currently dominating the market due to the increasing focus on personal care and wellness. Consumers are increasingly seeking products that not only enhance their appearance but also provide health benefits, leading to a surge in demand for moisturizers, cleansers, and serums that are vegan and cruelty-free. The organic and natural cosmetics segment is also experiencing significant growth, as consumers prefer products with minimal chemical ingredients .

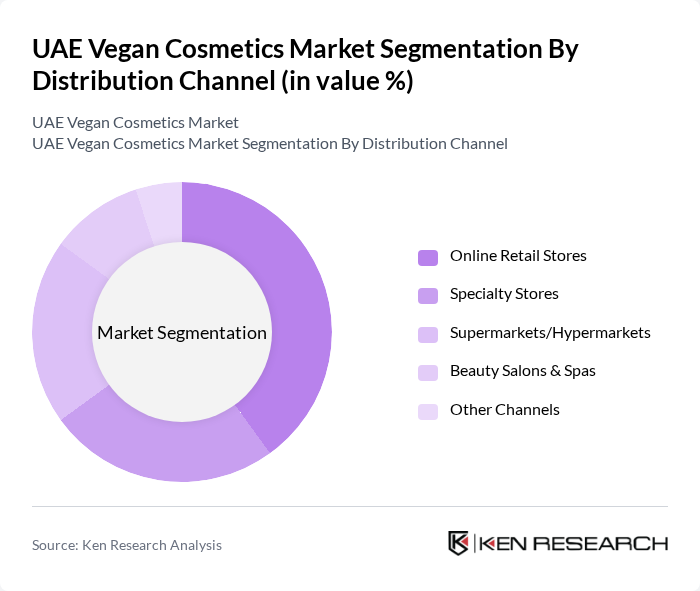

By Distribution Channel:The distribution channel segmentation includes Online Retail Stores, Specialty Stores, Supermarkets/Hypermarkets, Beauty Salons & Spas, and Other Channels. Online Retail Stores are leading this segment, driven by the convenience of shopping and the growing trend of e-commerce. Consumers are increasingly turning to online platforms for their beauty purchases, attracted by a wider selection of vegan products and the ability to compare prices easily. E-commerce sales of vegan cosmetics in the UAE have seen a marked increase, with major platforms expanding their vegan offerings and providing greater accessibility .

The UAE Vegan Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lush Retail Ltd., The Body Shop International Limited, Herbivore Botanicals, 100% Pure, Ecco Bella, Pacifica Beauty, Alima Pure, RMS Beauty, Axiology, Kjaer Weis, Bite Beauty, Tarte Cosmetics, Urban Decay (L'Oréal), Too Faced Cosmetics, Fenty Beauty, e.l.f. Cosmetics, Revolution Beauty, MuLondon, Beauty Without Cruelty, Hourglass Cosmetics, KVD Vegan Beauty, Elate Beauty, Groupe Rocher (Yves Rocher), Natura &Co, Heimish contribute to innovation, geographic expansion, and service delivery in this space.

The UAE vegan cosmetics market is poised for significant growth, driven by increasing consumer demand for ethical and sustainable products. As awareness of clean beauty continues to rise, brands are likely to innovate with new formulations and eco-friendly packaging. Additionally, the expansion of e-commerce will facilitate greater access to vegan products, allowing brands to reach a wider audience. Collaborations with influencers and a focus on transparency in ingredient sourcing will further enhance brand credibility and consumer trust in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Facial Cosmetics (e.g., foundations, concealers, BB creams) Skincare (moisturizers, cleansers, serums, masks, sunscreens) Haircare (shampoos, conditioners, treatments, styling products) Color Cosmetics (lipsticks, eye makeup, blush, bronzer, nail products) Fragrances Body Care Products Others |

| By Distribution Channel | Online Retail Stores Specialty Stores Supermarkets/Hypermarkets Beauty Salons & Spas Other Channels |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender (Women, Men, Unisex, Kids) Income Level Lifestyle Preferences |

| By Ingredient Type | Plant-Based Ingredients Synthetic-Free Ingredients Organic Ingredients Conventional Ingredients Others |

| By Packaging Type | Recyclable Packaging Biodegradable Packaging Refillable Packaging Eco-Friendly Materials Others |

| By Price Range | Premium Mass Market / Mid-Range Budget Others |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Vegan Cosmetics | 120 | Eco-conscious Consumers, Beauty Enthusiasts |

| Retail Insights from Vegan Cosmetic Brands | 60 | Brand Managers, Retail Buyers |

| Distribution Channel Effectiveness | 50 | Distributors, Wholesalers |

| Market Trends and Innovations | 40 | Product Development Managers, R&D Specialists |

| Regulatory Impact on Vegan Cosmetics | 40 | Regulatory Affairs Specialists, Compliance Officers |

The UAE Vegan Cosmetics Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of cruelty-free products and a rising demand for natural ingredients in beauty products.