Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4903

Pages:94

Published On:December 2025

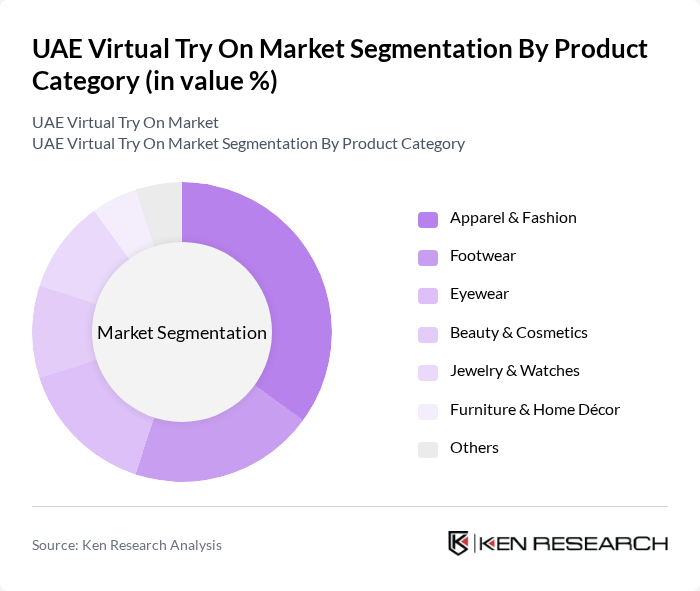

By Product Category:The product category segmentation of the UAE Virtual Try On Market includes various segments such as Apparel & Fashion, Footwear, Eyewear, Beauty & Cosmetics, Jewelry & Watches, Furniture & Home Décor, and Others. Among these, the Apparel & Fashion segment is leading due to the increasing demand for online shopping and the need for consumers to visualize clothing and fit before purchase, supported by global advances in virtual fitting room and virtual try-on technologies. The rise of social media influencers, fashion e-commerce platforms, and live-shopping formats in the UAE, along with AR-enabled apparel and footwear try-on features offered by leading online fashion platforms, has also significantly contributed to the growth of this segment.

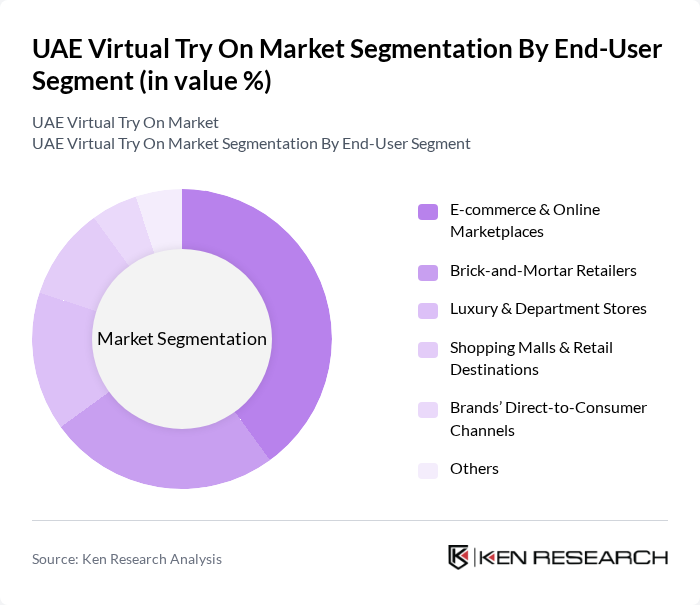

By End-User Segment:The end-user segment of the UAE Virtual Try On Market includes E-commerce & Online Marketplaces, Brick-and-Mortar Retailers, Luxury & Department Stores, Shopping Malls & Retail Destinations, Brands’ Direct-to-Consumer Channels, and Others. The E-commerce & Online Marketplaces segment is currently the most significant due to the rapid growth of online shopping, strong penetration of fashion and beauty e-commerce in the UAE, and the increasing preference for virtual try-on solutions to reduce product return rates and increase conversion. This trend is driven by the convenience of online and omnichannel shopping, the integration of AR try-on tools into mobile apps and web stores, and the need for enhanced, personalized customer experiences across beauty, eyewear, and fashion categories.

The UAE Virtual Try On Market is characterized by a dynamic mix of regional and international players. Leading participants such as Perfect Corp., ModiFace Inc. (L'Oréal Group), Snapchat / Snap Inc. (Lens Studio & AR Try-on), 3DLOOK Inc., FittingBox, Vue.ai (Mad Street Den Inc.), Zero10, Wanna Fashion (Wanna Kicks), Avataar.ai, Obsess, Amazon.com Inc. (Amazon AR View & Virtual Try-On), L'Oréal Middle East (including NYX, Maybelline virtual try-on), Majid Al Futtaim Holding LLC (VOX, Mall-based VTO & Retail Innovation), Noon.com, Namshi contribute to innovation, geographic expansion, and service delivery in this space.

The UAE virtual try-on market is poised for significant growth, driven by technological advancements and changing consumer behaviors. As retailers increasingly integrate AR and VR solutions into their platforms, the demand for personalized shopping experiences will continue to rise. Additionally, the expansion of e-commerce and omnichannel strategies will further enhance the market landscape. By future, the focus on sustainability and ethical practices in fashion will also shape consumer preferences, creating new avenues for innovation and engagement in the virtual try-on space.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Apparel & Fashion Footwear Eyewear Beauty & Cosmetics Jewelry & Watches Furniture & Home Décor Others |

| By End-User Segment | E-commerce & Online Marketplaces Brick-and-Mortar Retailers Luxury & Department Stores Shopping Malls & Retail Destinations Brands’ Direct-to-Consumer Channels Others |

| By User Demographics | Age Group (13–17, 18–24, 25–34, 35–44, 45+) Gender Income Level (Mass, Premium, Luxury) Tourist vs Resident Users |

| By Technology Stack | Smartphone-based AR (apps & webAR) In-store Smart Mirrors & Kiosks Social AR Filters (Snap, Instagram, TikTok, etc.) AI/ML-based 3D Body & Face Scanning VR/MR Experiences Others |

| By Use Case | Online Product Visualization In-store Experience Enhancement Social Commerce & Influencer-led Try-ons Marketing & Campaign-based Activations Size & Fit Recommendation Others |

| By Deployment Model | Cloud-based Solutions On-premise / In-store Installations Hybrid Deployments SDK/API Integrations |

| By Buyer Type | Large Enterprise Retailers & Groups SMEs & Boutique Retailers Pure-play E-commerce Platforms Social Sellers & Marketplaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retailers Using Virtual Try-On | 90 | Retail Managers, E-commerce Directors |

| Cosmetics Brands Implementing AR Solutions | 70 | Marketing Managers, Product Development Heads |

| Technology Providers for Virtual Fitting | 40 | Product Managers, Technical Leads |

| Consumers Engaging with Virtual Try-On | 140 | Online Shoppers, Fashion Enthusiasts |

| Market Analysts and Industry Experts | 40 | Market Researchers, Industry Consultants |

The UAE Virtual Try On Market is valued at approximately USD 900 million, reflecting significant growth driven by the adoption of augmented reality (AR) and artificial intelligence (AI) technologies in retail, particularly in fashion and beauty sectors.