Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3914

Pages:80

Published On:November 2025

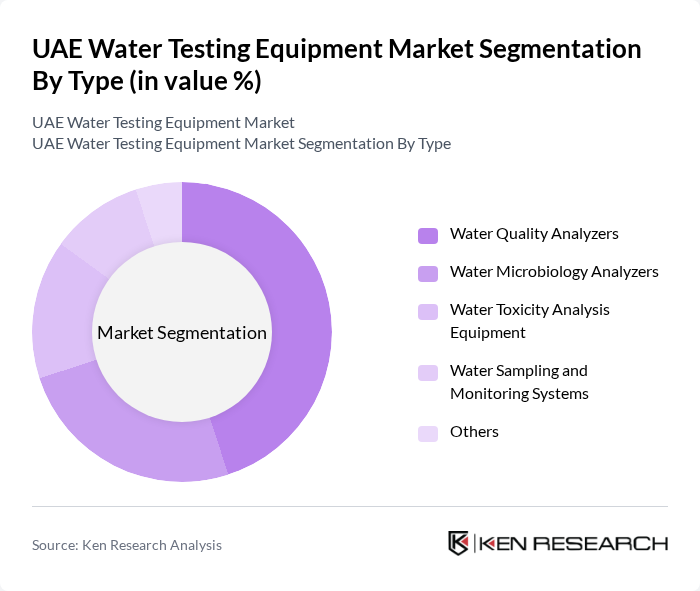

By Type:The market is segmented into various types of water testing equipment, including Water Quality Analyzers, Water Microbiology Analyzers, Water Toxicity Analysis Equipment, Water Sampling and Monitoring Systems, and Others. Among these, Water Quality Analyzers are the most prominent due to their essential role in ensuring safe drinking water and compliance with health regulations. The increasing focus on water quality in both municipal and industrial sectors drives the demand for these analyzers, making them a critical component of the market. The adoption of real-time and remote water quality analyzers is a key trend, supporting rapid decision-making and regulatory compliance .

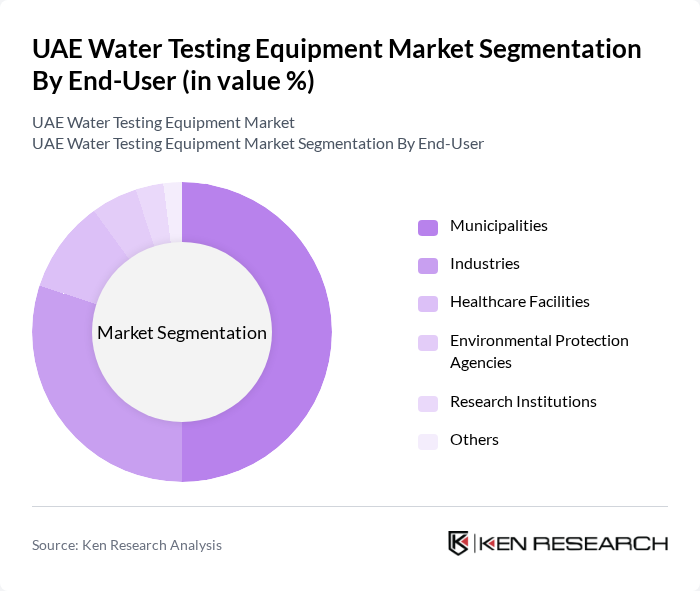

By End-User:The end-user segmentation includes Municipalities, Industries, Healthcare Facilities, Environmental Protection Agencies, Research Institutions, and Others. Municipalities are the leading end-users, driven by the need for regular water quality assessments to ensure public health and safety. The increasing population and urbanization in the UAE necessitate robust water testing solutions, making municipalities a key driver of market growth. Industrial end-users are also increasing their adoption of water testing equipment to comply with environmental regulations and support sustainable operations .

The UAE Water Testing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hach Company, Thermo Fisher Scientific Inc., Xylem Inc., Agilent Technologies, Horiba Ltd., Palintest Ltd., LaMotte Company, Eurofins Scientific, SGS SA, Bureau Veritas, Intertek Group, Aqualab, Ecolab Inc., IDEXX Laboratories, Merck KGaA, Danaher Corporation, General Electric Company, ABB Ltd., Emerson Electric Co., Kurita Water Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE water testing equipment market appears promising, driven by increasing regulatory pressures and technological innovations. As the government continues to prioritize water safety, investments in advanced testing solutions are expected to rise. Additionally, the integration of IoT technologies will likely enhance monitoring capabilities, making water testing more efficient. The growing emphasis on sustainable practices will further propel the demand for reliable water testing equipment, ensuring compliance with environmental standards and public health requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Water Quality Analyzers Water Microbiology Analyzers Water Toxicity Analysis Equipment Water Sampling and Monitoring Systems Others |

| By End-User | Municipalities Industries Healthcare Facilities Environmental Protection Agencies Research Institutions Others |

| By Application | Drinking Water Testing Wastewater Analysis Industrial Water Monitoring Medical Water Testing Environmental Water Testing Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Technology | Immunoassay-based Analyzers Electrochemical Sensors Optical Sensors Chromatography Spectroscopy Others |

| By Service Type | On-site Testing Services Laboratory Testing Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Testing Facilities | 60 | Water Quality Managers, Laboratory Technicians |

| Industrial Water Quality Control | 50 | Environmental Compliance Officers, Process Engineers |

| Private Water Testing Laboratories | 40 | Laboratory Directors, Quality Assurance Managers |

| Research Institutions and Universities | 40 | Research Scientists, Academic Professors |

| Distributors of Water Testing Equipment | 45 | Sales Managers, Product Specialists |

The UAE Water Testing Equipment Market is valued at approximately USD 50 million, driven by regulatory requirements for water quality monitoring, public awareness of water safety, and industrial activities necessitating stringent testing protocols.