Region:Middle East

Author(s):Shubham

Product Code:KRAD0894

Pages:100

Published On:November 2025

By Type:The market is segmented into various types, including mobile health applications, telehealth services, wearable health devices, digital health management platforms, mental health and wellness apps, and others. Among these, mobile health applications are leading due to their accessibility and user-friendly interfaces, allowing women to track their health metrics conveniently. Telehealth services are also gaining traction, especially post-pandemic, as they provide essential healthcare access without the need for physical visits. Wearable health devices are increasingly popular for tracking reproductive health, fitness, and chronic conditions, while digital health management platforms are being adopted for integrated care and chronic disease management .

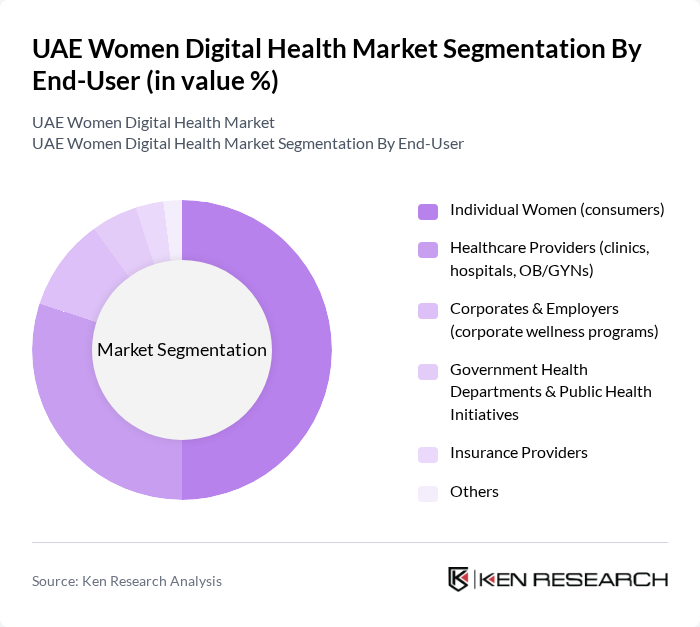

By End-User:The end-user segmentation includes individual women, healthcare providers, corporates and employers, government health departments, insurance providers, and others. Individual women are the primary users of digital health solutions, driven by a growing awareness of health issues and the convenience of accessing health information and services online. Healthcare providers are also significant users, leveraging digital tools to enhance patient care and streamline operations. Corporates and employers are increasingly adopting digital health platforms for employee wellness programs, while government health departments and insurance providers are integrating digital solutions into public health initiatives and coverage plans .

The UAE Women Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Okadoc, Vezeeta, Medcare, Healthigo, DoctorUna, Nabta Health, Altibbi, Malaffi, Health at Hand, 7keema, Shezlong, Yodawy, TruDoc 24x7, MyMedicNow, Nabidh contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE women digital health market appears promising, driven by technological advancements and increasing health awareness. The integration of artificial intelligence in health monitoring is expected to enhance personalized healthcare solutions, making them more accessible. Additionally, the expansion of telehealth services will likely bridge gaps in healthcare access, particularly for women in remote areas. As the government continues to support health initiatives, the market is poised for significant growth, fostering innovation and improving health outcomes for women.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Health Applications (e.g., menstrual tracking, fertility, pregnancy, menopause, fitness & nutrition) Telehealth & Virtual Care Services (including video consultations, remote monitoring) Wearable Health Devices (e.g., smartwatches, fitness trackers, biosensors) Digital Health Management Platforms (e.g., integrated care, EHR portals, chronic disease management) Mental Health & Wellness Apps Others |

| By End-User | Individual Women (consumers) Healthcare Providers (clinics, hospitals, OB/GYNs) Corporates & Employers (corporate wellness programs) Government Health Departments & Public Health Initiatives Insurance Providers Others |

| By Demographics | Age Group (18-25, 26-35, 36-45, 46+) Socioeconomic Status (Low, Middle, High) Geographic Location (Urban, Rural) Nationality (Emirati, Expatriate) Others |

| By Health Condition | Reproductive & Maternal Health (menstrual, fertility, pregnancy, postpartum) Chronic Disease Management (diabetes, hypertension, obesity, etc.) Mental Health Support (stress, anxiety, depression, counseling) Preventive & Wellness (screenings, fitness, nutrition) Menopause Management Others |

| By Technology Used | Artificial Intelligence (AI) Blockchain Internet of Things (IoT) Cloud Computing Big Data Analytics Others |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2G (Business to Government) C2C (Consumer to Consumer) Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Health Tech Startups Regulatory Sandboxes & Accelerators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Women’s Health Digital Services | 60 | Healthcare Professionals, Digital Health Entrepreneurs |

| Telemedicine Usage Among Women | 50 | Female Patients, Telehealth Users |

| Health App Engagement | 40 | Women Aged 18-45, App Developers |

| Community Health Initiatives | 45 | Community Leaders, Health Advocates |

| Digital Health Awareness Programs | 50 | Women’s Health Educators, Policy Makers |

The UAE Women Digital Health Market is valued at approximately USD 765 million, reflecting significant growth driven by the increasing adoption of digital health solutions among women, particularly in areas such as reproductive health, mental wellness, and chronic disease management.