Region:Middle East

Author(s):Rebecca

Product Code:KRAD5062

Pages:100

Published On:December 2025

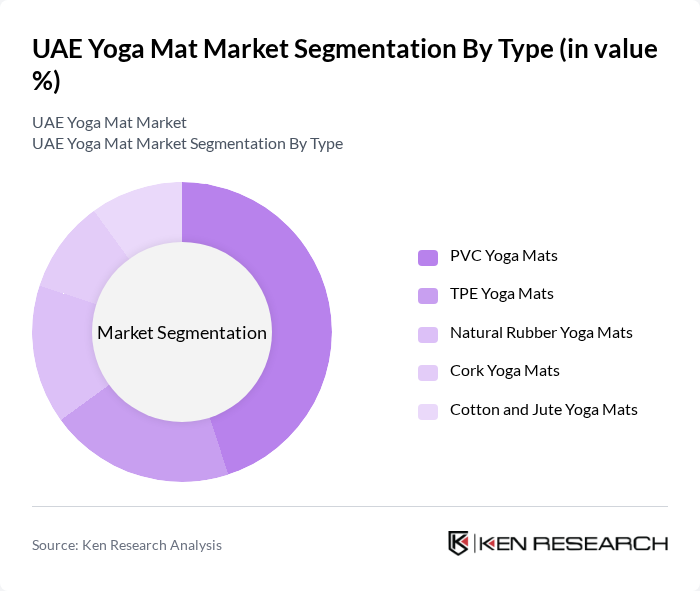

By Type:The market is segmented into various types of yoga mats, including PVC Yoga Mats, TPE Yoga Mats, Natural Rubber Yoga Mats, Cork Yoga Mats, and Cotton and Jute Yoga Mats, in line with typical material-based segmentation used in UAE yoga and exercise mat studies. Among these, PVC Yoga Mats continue to account for a significant share of volume sales due to their affordability, durability, and wide availability across hypermarkets, sports chains, and online platforms. However, there is a clear and accelerating trend towards eco-friendly options like TPE, Natural Rubber and Cork Yoga Mats, driven by increasing consumer awareness about sustainability, demand for non-toxic and non-slip surfaces, and positioning of premium international brands around natural and recyclable materials.

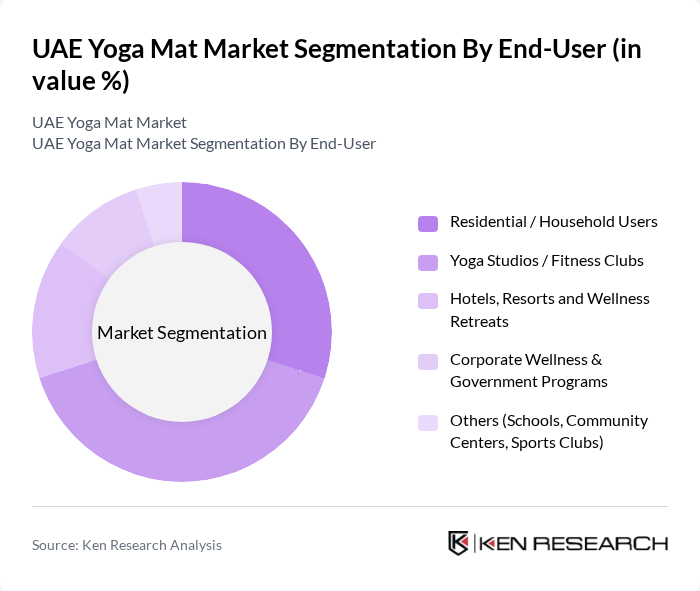

By End-User:The end-user segmentation includes Residential/Household Users, Yoga Studios/Fitness Clubs, Hotels, Resorts and Wellness Retreats, Corporate Wellness & Government Programs, and Others (Schools, Community Centers, Sports Clubs), which reflects how UAE yoga mat demand is commonly broken down between home, commercial fitness, hospitality, and institutional buyers. The Yoga Studios/Fitness Clubs segment leads the market, driven by the increasing number of fitness centers, boutique yoga studios, mixed-format gyms, and group training concepts, as well as packaged memberships that include yoga, Pilates, and functional training sessions. Residential users are also contributing significantly as more individuals practice yoga at home, supported by digital fitness platforms, online classes, and e-commerce availability of mats in a wide range of price points and materials.

The UAE Yoga Mat Market is characterized by a dynamic mix of regional and international players, consistent with global market coverage of yoga mat brands. Leading participants such as lululemon athletica inc., Manduka LLC, Gaiam, JadeYoga, Liforme Ltd., Yoga Design Lab, Alo Yoga, Nike Inc., Decathlon SA (Domyos, Nyamba), Adidas AG, Under Armour, Inc., Namshi General Trading LLC (Private Label Fitness/Yoga Mats), Sun & Sand Sports LLC, Sports One LLC, Sharaf DG LLC (Private Label Fitness Accessories) contribute to innovation, geographic expansion, and service delivery in this space through performance-focused designs, eco-friendly material innovations, and diversified distribution via specialty stores, mono-brand outlets, marketplaces, and direct-to-consumer channels.

The UAE yoga mat market is poised for continued growth, driven by increasing health awareness and the expansion of fitness facilities. As more consumers embrace yoga as a lifestyle choice, the demand for high-quality, innovative yoga mats will rise. Additionally, the integration of technology in fitness products and the growing trend of online yoga classes will further shape the market landscape, presenting opportunities for brands to innovate and cater to evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | PVC Yoga Mats TPE Yoga Mats Natural Rubber Yoga Mats Cork Yoga Mats Cotton and Jute Yoga Mats |

| By End-User | Residential / Household Users Yoga Studios / Fitness Clubs Hotels, Resorts and Wellness Retreats Corporate Wellness & Government Programs Others (Schools, Community Centers, Sports Clubs) |

| By Material | PVC (Polyvinyl Chloride) TPE (Thermoplastic Elastomers) Natural Rubber Cotton, Jute and Other Natural Fibers Hybrid / Composite Materials |

| By Thickness | Standard Thickness (3-5mm) Extra Thick (6-10mm) Travel Mats (Less than 3mm) Professional / Studio Grade (>10mm) |

| By Brand Positioning | Premium International Brands Mid-Range International Brands Local and Private Label Brands Eco-conscious / Sustainable Brands Others |

| By Distribution Channel | Online Marketplaces (Amazon.ae, Noon, Namshi, etc.) Brand E-commerce and Direct-to-Consumer Sports & Fitness Specialty Stores Hypermarkets & Supermarkets Department Stores and Lifestyle Retailers Others (Yoga Studios, Pharmacies, Boutique Stores) |

| By Price Range | Budget (Under AED 80) Mid-Range (AED 80 - AED 250) Premium (Above AED 250) Luxury / Designer Editions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Yoga Studio Owners | 40 | Studio Managers, Instructors |

| Fitness Enthusiasts | 60 | Regular Yoga Practitioners, Fitness Trainers |

| Retail Buyers | 50 | Purchasing Managers, Product Buyers |

| Health and Wellness Influencers | 40 | Social Media Influencers, Bloggers |

| Online Retail Platforms | 40 | E-commerce Managers, Marketing Directors |

The UAE Yoga Mat Market is valued at approximately USD 14 million, reflecting its growth driven by increasing health consciousness and the rising popularity of yoga and fitness activities among the population.