Region:Europe

Author(s):Shubham

Product Code:KRAA4961

Pages:97

Published On:September 2025

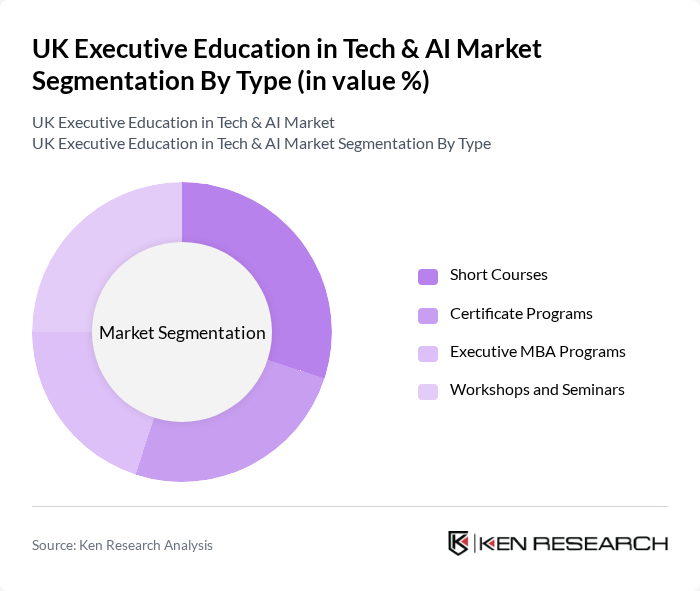

By Type:The market is segmented into various types of educational offerings, including Short Courses, Certificate Programs, Executive MBA Programs, and Workshops and Seminars. Each of these sub-segments caters to different learning needs and preferences, with a growing emphasis on practical skills and real-world applications.

The Short Courses segment is currently dominating the market, driven by the increasing preference for flexible and focused learning options among professionals. These courses allow individuals to quickly acquire specific skills in technology and AI, making them highly appealing in a fast-paced job market. The demand for short, intensive learning experiences is further fueled by the need for continuous professional development in the tech industry.

By End-User:The market is segmented by end-users, including Corporates, Government Agencies, Non-Profit Organizations, and Individuals. Each segment has distinct training needs, with corporates leading the demand for executive education to enhance employee skills in technology and AI.

Corporates are the leading end-user segment, as organizations increasingly recognize the importance of investing in employee education to stay competitive in the tech landscape. Companies are prioritizing training programs that focus on AI and technology to enhance productivity and innovation, driving significant demand for executive education tailored to their workforce needs.

The UK Executive Education in Tech & AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Oxford, University of Cambridge, Imperial College Business School, London Business School, Warwick Business School, University of Edinburgh Business School, Manchester Business School, University of Bristol, University of Glasgow, Ashridge Executive Education, Henley Business School, Cranfield School of Management, University of Leeds, University of Birmingham, University of Strathclyde contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK executive education market in tech and AI is poised for transformation, driven by the increasing emphasis on lifelong learning and the integration of AI into educational frameworks. As organizations prioritize employee development, the demand for customized and flexible learning solutions will rise. Additionally, the shift towards hybrid learning models will enhance accessibility, allowing a broader audience to engage with tech education. This evolving landscape presents significant opportunities for providers to innovate and meet the diverse needs of learners.

| Segment | Sub-Segments |

|---|---|

| By Type | Short Courses Certificate Programs Executive MBA Programs Workshops and Seminars |

| By End-User | Corporates Government Agencies Non-Profit Organizations Individuals |

| By Delivery Mode | Online Learning In-Person Training Hybrid Learning |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) |

| By Industry Focus | Technology Finance Healthcare Manufacturing |

| By Certification Type | Accredited Programs Non-Accredited Programs |

| By Price Range | Low (Under £1,000) Medium (£1,000 - £5,000) High (Above £5,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Executive Education Program Directors | 100 | Directors, Deans, Program Coordinators |

| Corporate Training Managers | 80 | HR Managers, Learning & Development Heads |

| Alumni of Tech & AI Programs | 150 | Graduates, Current Professionals in Tech Roles |

| Industry Experts in AI | 70 | Consultants, Researchers, Thought Leaders |

| Participants in Online Learning Platforms | 90 | Online Learners, Course Instructors |

The UK Executive Education in Tech & AI market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by the increasing demand for upskilling in technology and artificial intelligence across various sectors.