Region:Europe

Author(s):Dev

Product Code:KRAA5412

Pages:91

Published On:September 2025

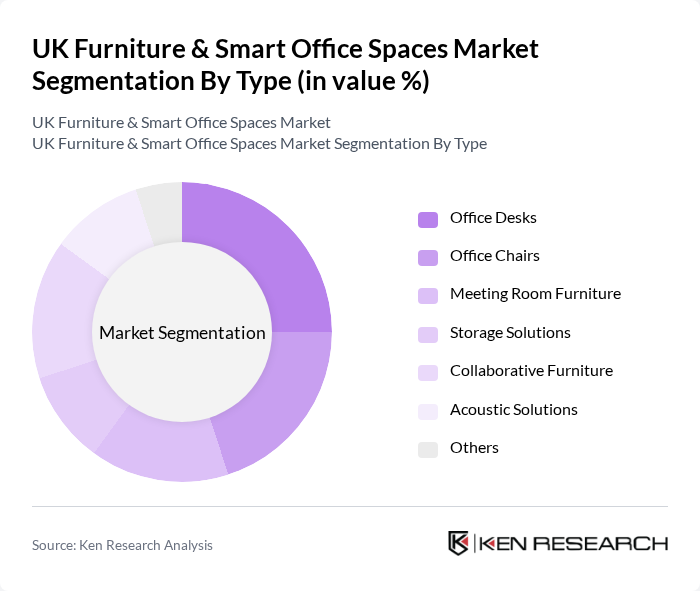

By Type:The market is segmented into various types of furniture, including office desks, office chairs, meeting room furniture, storage solutions, collaborative furniture, acoustic solutions, and others. Each of these subsegments caters to specific needs within office environments, with a focus on functionality, design, and user comfort.

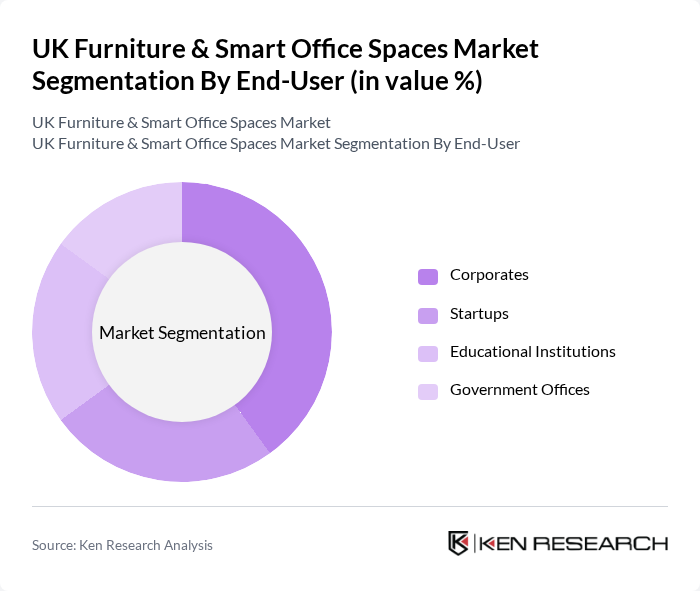

By End-User:The end-user segmentation includes corporates, startups, educational institutions, and government offices. Each segment has unique requirements and preferences, influencing the types of furniture and solutions they seek for their workspaces.

The UK Furniture & Smart Office Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Steelcase, Herman Miller, HNI Corporation, Knoll, Vitra, Teknion, Haworth, Allermuir, Boss Design, Orangebox, Humanscale, Kinnarps, Modus Furniture, Vitra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK furniture and smart office spaces market appears promising, driven by ongoing trends in remote work and technological integration. As businesses increasingly prioritize employee wellness and productivity, the demand for ergonomic and tech-enabled furniture is expected to rise. Additionally, sustainability will play a crucial role, with manufacturers focusing on eco-friendly materials and practices. The market is likely to see further innovations in smart office solutions, enhancing the overall workspace experience and aligning with evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Desks Office Chairs Meeting Room Furniture Storage Solutions Collaborative Furniture Acoustic Solutions Others |

| By End-User | Corporates Startups Educational Institutions Government Offices |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Direct Sales Distributors |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Industrial Minimalist |

| By Price Range | Budget Mid-Range Premium |

| By Functionality | Multi-functional Furniture Ergonomic Furniture Smart Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 150 | Procurement Managers, Office Administrators |

| Smart Office Technology Integration | 100 | IT Managers, Facility Managers |

| Employee Satisfaction with Office Layout | 80 | HR Managers, Employee Experience Officers |

| Trends in Remote Work Furniture | 70 | Home Office Users, Freelancers |

| Impact of Ergonomics on Productivity | 90 | Occupational Health Specialists, Ergonomists |

The UK Furniture & Smart Office Spaces Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by the demand for ergonomic and flexible office solutions, as well as the rise of remote working practices.