Region:Europe

Author(s):Geetanshi

Product Code:KRAD0014

Pages:86

Published On:August 2025

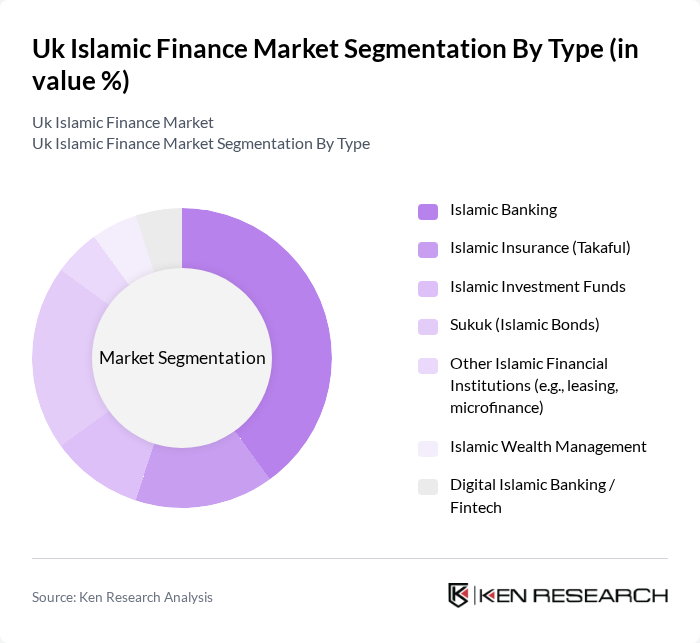

By Type:The Islamic finance market is segmented into various types, including Islamic Banking, Islamic Insurance (Takaful), Islamic Investment Funds, Sukuk (Islamic Bonds), Other Islamic Financial Institutions (e.g., leasing, microfinance), Islamic Wealth Management, and Digital Islamic Banking / Fintech. Among these, Islamic Banking is the most dominant segment, driven by the increasing number of Sharia-compliant banks, the expansion of retail banking offerings, and the growing demand for ethical and digital banking solutions .

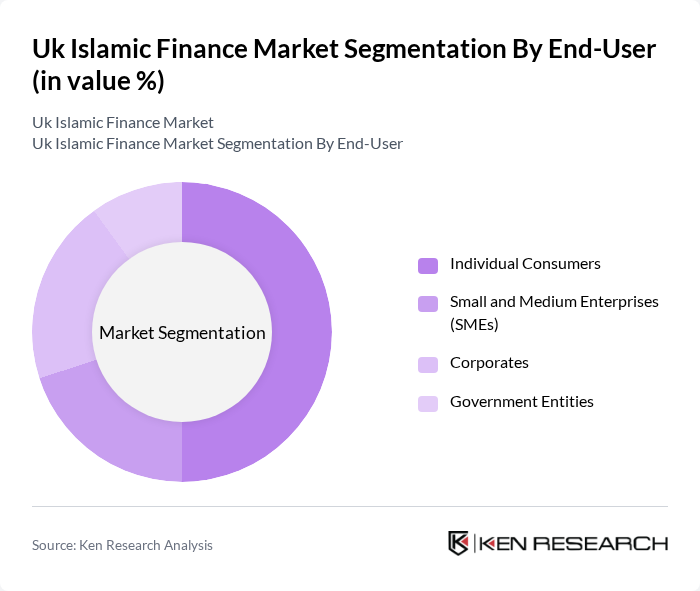

By End-User:The end-user segmentation of the Islamic finance market includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers represent the largest segment, driven by the increasing awareness of Islamic finance products, the growing Muslim population, and the rising demand for retail Sharia-compliant financial solutions .

The Uk Islamic Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rayan Bank, Bank of London and The Middle East (BLME), Gatehouse Bank, Qatar Islamic Bank (UK) plc, Abu Dhabi Islamic Bank (UK), Standard Chartered Saadiq (Islamic Banking Division), HSBC Amanah (UK), Al Baraka International Bank (UK), Dubai Islamic Bank (UK Representative Office), Maybank Islamic Berhad (UK Branch), Emirates Islamic Bank (UK Representative Office), Abu Dhabi Commercial Bank (UK Branch), Kuwait Finance House (UK), Lloyds Bank (Islamic Finance Services), Barclays (Islamic Finance Division) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK Islamic finance market appears promising, driven by increasing consumer demand for ethical financial products and the ongoing digital transformation within the sector. As the market adapts to technological advancements, the integration of fintech solutions is expected to enhance service delivery and customer engagement. Additionally, the growing focus on sustainable finance aligns with Islamic principles, presenting opportunities for innovative product development that meets both ethical and financial objectives in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Islamic Banking Islamic Insurance (Takaful) Islamic Investment Funds Sukuk (Islamic Bonds) Other Islamic Financial Institutions (e.g., leasing, microfinance) Islamic Wealth Management Digital Islamic Banking / Fintech |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Retail Banking Corporate Banking Investment Banking Asset Management |

| By Distribution Channel | Direct Sales Online Platforms Financial Advisors Branch Networks |

| By Regulatory Framework | UK Regulatory Standards International Sharia Standards Compliance with Financial Conduct Authority (FCA) |

| By Policy Support | Subsidies for Islamic Financial Institutions Tax Exemptions for Islamic Products Regulatory Support for Market Development Training and Capacity Building Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Islamic Retail Banking Customers | 100 | Retail Banking Clients, Account Holders |

| Islamic Investment Product Users | 60 | Investment Advisors, Wealth Management Clients |

| Islamic Insurance Policyholders | 50 | Insurance Brokers, Policyholders |

| Islamic Finance Regulatory Experts | 40 | Regulatory Officials, Compliance Officers |

| Islamic Finance Educators and Researchers | 40 | Academics, Industry Researchers |

The UK Islamic Finance Market is valued at approximately USD 9 billion, driven by increasing demand for Sharia-compliant financial products, a growing Muslim population, and heightened awareness of ethical finance.