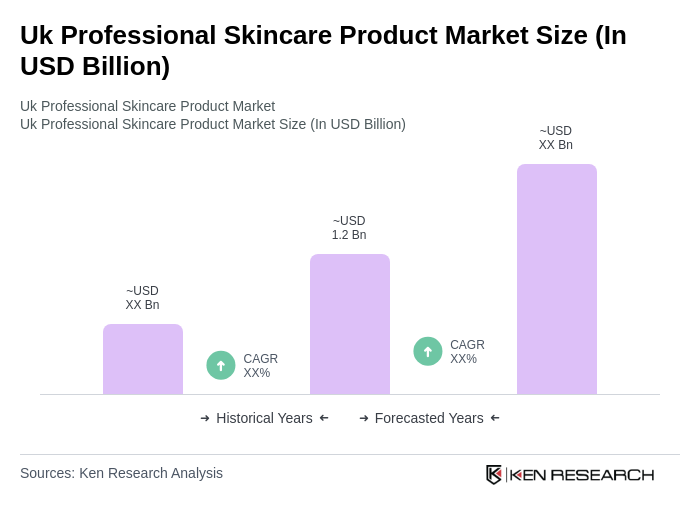

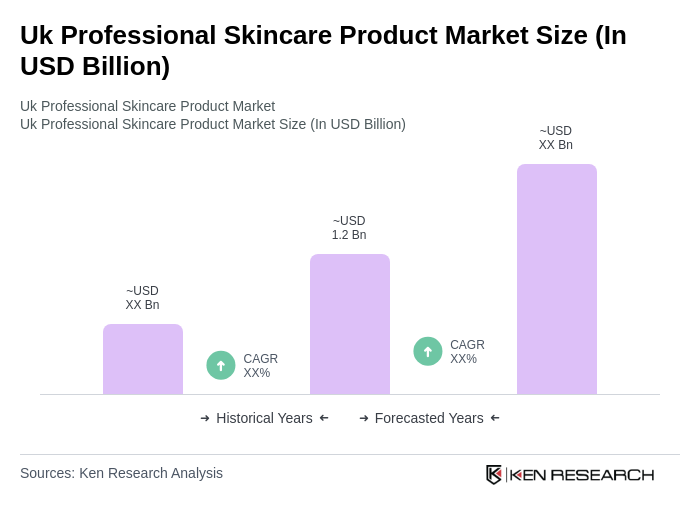

Uk Professional Skincare Product Market Overview

- The UK Professional Skincare Product Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding skincare, the influence of social media and beauty influencers, and a rising demand for high-quality, effective products. The market has seen a significant shift towards professional-grade products as consumers seek solutions for specific skin concerns. Growth is further supported by the expansion of e-commerce, the popularity of natural and organic formulations, and the emergence of personalized skincare solutions .

- Key cities dominating the market include London, Manchester, and Birmingham. London, as a global fashion and beauty hub, attracts numerous skincare brands and consumers seeking premium products. Manchester and Birmingham also contribute significantly due to their large populations and increasing interest in skincare and beauty treatments, making them vital markets for professional skincare products .

- The UK government enforces regulations requiring all skincare products to undergo safety assessments before market entry. These regulations ensure consumer safety and product efficacy, mandating that brands provide comprehensive ingredient lists and adhere to strict labeling guidelines. Such measures are designed to enhance consumer trust and promote transparency in the skincare industry .

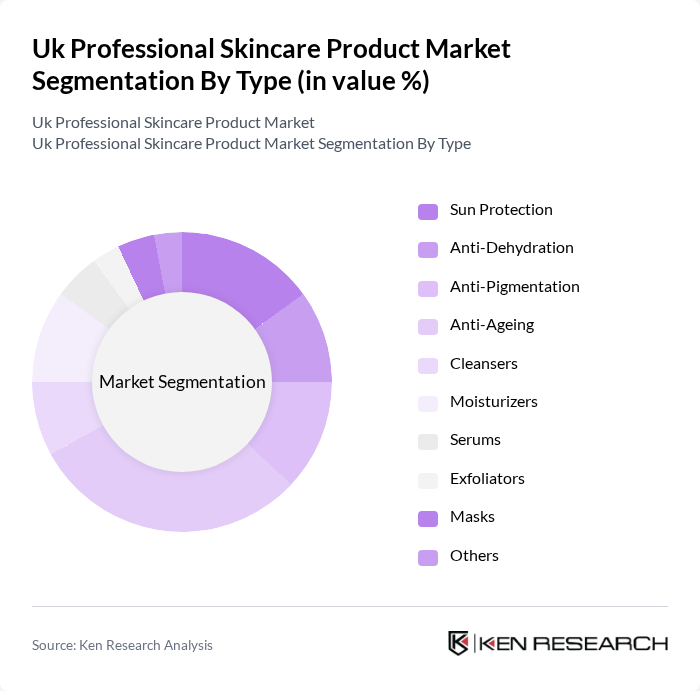

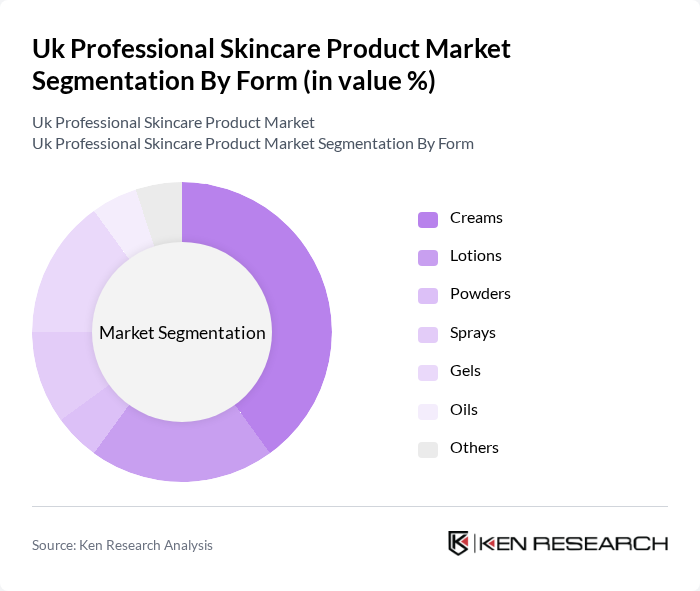

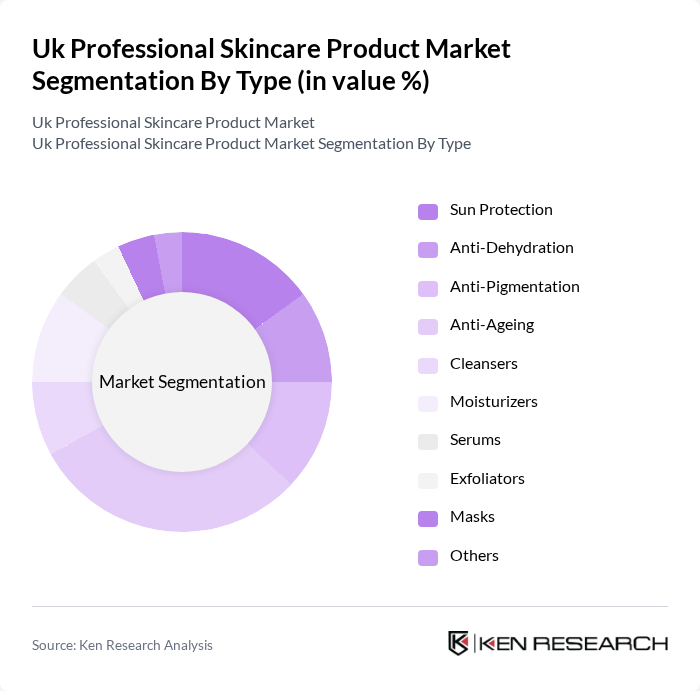

Uk Professional Skincare Product Market Segmentation

By Type:The market is segmented into Sun Protection, Anti-Dehydration, Anti-Pigmentation, Anti-Ageing, Cleansers, Moisturizers, Serums, Exfoliators, Masks, and Others. The Anti-Ageing segment leads the market, driven by the growing aging population and heightened consumer awareness of skin health. Demand for anti-ageing products is further fueled by a trend toward preventive skincare among younger consumers and the increasing focus on maintaining youthful skin .

By Form:The market is also segmented by product form, including Creams, Lotions, Powders, Sprays, Gels, Oils, and Others. Creams are the leading sub-segment, favored for their rich texture and effectiveness in delivering moisture and active ingredients to the skin. The preference for creams is driven by their versatility and the perception of higher efficacy in addressing various skin concerns, making them a staple in many consumers' skincare routines. Gels and serums are also gaining traction due to their lightweight texture and suitability for targeted treatments .

Uk Professional Skincare Product Market Competitive Landscape

The Uk Professional Skincare Product Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Professional, Dermalogica, SkinCeuticals, Elemis, Murad, Guinot, Neutrogena Professional, Jan Marini Skin Research, PCA Skin, Image Skincare, Biologique Recherche, Aveda, CeraVe, The Ordinary, Kiehl's, Clarins, Unilever (Paula's Choice, REN Clean Skincare), Procter & Gamble (Olay Professional), Allergan (SkinMedica), The Estée Lauder Companies (Clinique, La Mer), Future Beauty Labs, Cellular Goods, Faace contribute to innovation, geographic expansion, and service delivery in this space.

Uk Professional Skincare Product Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Skincare:The UK skincare market is witnessing a surge in consumer awareness, with 70% of individuals aged 18-34 actively seeking information about skincare products. This demographic is increasingly influenced by social media, where skincare education is prevalent. According to the British Beauty Council, the skincare sector generated £2.6 billion in future, reflecting a growing trend towards informed purchasing decisions. This heightened awareness is driving demand for professional skincare products, as consumers prioritize quality and efficacy.

- Rise in Demand for Natural and Organic Products:The UK market is experiencing a significant shift towards natural and organic skincare products, with sales reaching £1.3 billion in future. This trend is driven by a growing consumer preference for clean beauty, as 60% of consumers express concerns about synthetic ingredients. The Soil Association reports a 30% increase in organic skincare sales over the past year, indicating a robust demand for products that align with health and environmental consciousness, further propelling market growth.

- Growth of E-commerce Platforms:E-commerce has become a vital channel for skincare sales, with online sales accounting for 35% of the total market in future. The UK’s online retail sector is projected to grow by 20% in future, driven by increased internet penetration and consumer preference for convenience. Major retailers like Boots and Superdrug have expanded their online offerings, enhancing accessibility to professional skincare products. This shift is expected to continue, further boosting market growth as consumers increasingly shop online.

Market Challenges

- Intense Competition Among Brands:The UK professional skincare market is characterized by fierce competition, with over 1,200 brands vying for consumer attention. This saturation leads to price wars and aggressive marketing strategies, making it challenging for new entrants to establish a foothold. According to Mintel, 50% of consumers report being overwhelmed by choices, which complicates brand differentiation. This competitive landscape necessitates innovative marketing and product development strategies to capture market share effectively.

- Regulatory Compliance and Standards:Navigating the regulatory landscape poses a significant challenge for skincare brands in the UK. Compliance with the Cosmetic Product Regulation (CPR) requires rigorous testing and documentation, which can be costly and time-consuming. The UK government reported that 35% of small beauty businesses struggle with understanding these regulations. Non-compliance can lead to product recalls and legal issues, making it essential for brands to invest in regulatory expertise to mitigate risks.

Uk Professional Skincare Product Market Future Outlook

The UK professional skincare market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized skincare solutions, brands that leverage data analytics and AI for product development will likely gain a competitive edge. Additionally, the integration of sustainability practices in product formulation and packaging will resonate with environmentally conscious consumers, further shaping market dynamics. The focus on holistic wellness will also drive innovation in product offerings, enhancing market resilience.

Market Opportunities

- Expansion into Emerging Markets:UK skincare brands have significant opportunities to expand into emerging markets, where demand for professional skincare is rising. Countries like India and Brazil are experiencing a growing middle class, with skincare spending projected to increase by 25% annually. This expansion can enhance brand visibility and revenue streams, allowing companies to tap into new consumer bases eager for quality skincare products.

- Development of Customized Skincare Solutions:The trend towards personalized skincare is gaining momentum, with 45% of consumers expressing interest in tailored products. Brands that invest in customization technologies, such as skin analysis tools and bespoke formulations, can meet this demand effectively. This approach not only enhances customer satisfaction but also fosters brand loyalty, positioning companies favorably in a competitive market landscape.