Region:Europe

Author(s):Geetanshi

Product Code:KRAA2311

Pages:94

Published On:August 2025

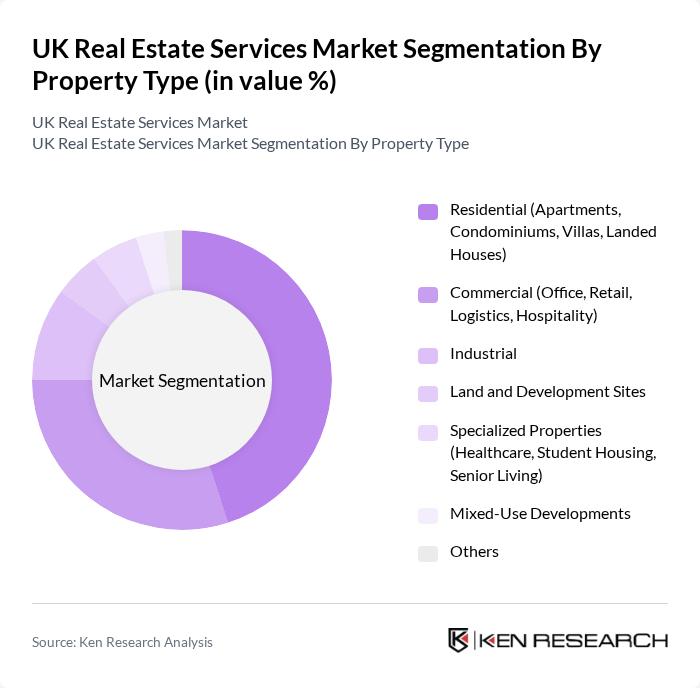

By Property Type:The property type segmentation includes various categories such as residential, commercial, industrial, land and development sites, specialized properties, mixed-use developments, and others. Among these, the residential segment, which encompasses apartments, condominiums, villas, and landed houses, is currently dominating the market. This is largely due to the increasing population and urban migration, leading to a heightened demand for housing solutions. The commercial segment, which includes office spaces, retail, logistics, and hospitality, also plays a significant role, driven by the growth of businesses and the need for commercial spaces.

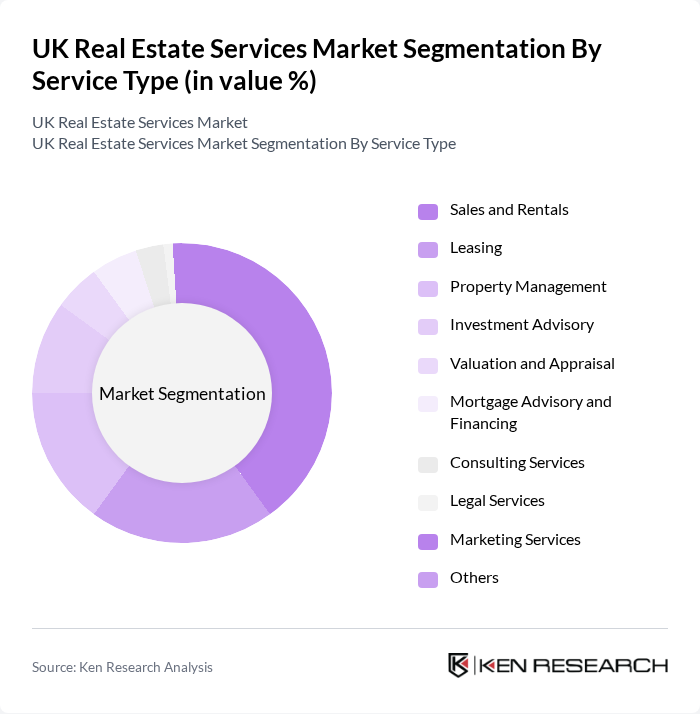

By Service Type:The service type segmentation includes sales and rentals, leasing, property management, investment advisory, valuation and appraisal, mortgage advisory and financing, consulting services, legal services, marketing services, and others. The sales and rentals segment is currently the leading service type, driven by the high demand for residential and commercial properties. Property management services are also gaining traction as property owners seek professional management to maximize their investments and ensure compliance with regulations.

The UK Real Estate Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Savills plc, Knight Frank LLP, CBRE Group, Inc., JLL (Jones Lang LaSalle), Cushman & Wakefield plc, Colliers International Group Inc., Strutt & Parker LLP, Foxtons Group plc, Hamptons International, Purplebricks Group plc, Countrywide plc, Savills Investment Management, Lendlease Group, Berkeley Group Holdings plc, Barratt Developments plc, Carter Jonas LLP, BNP Paribas Real Estate UK, Lambert Smith Hampton, Chestertons, and Dexters contribute to innovation, geographic expansion, and service delivery in this space.

The UK real estate services market is poised for transformation, driven by urbanization and technological advancements. As cities expand, the demand for innovative housing solutions will increase, particularly in underserved regions. Additionally, the integration of digital tools in property management will enhance operational efficiency. However, economic uncertainties and regulatory pressures will require stakeholders to adapt strategically. The focus on sustainability will also shape future developments, ensuring that the market remains resilient and responsive to changing consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Residential (Apartments, Condominiums, Villas, Landed Houses) Commercial (Office, Retail, Logistics, Hospitality) Industrial Land and Development Sites Specialized Properties (Healthcare, Student Housing, Senior Living) Mixed-Use Developments Others |

| By Service Type | Sales and Rentals Leasing Property Management Investment Advisory Valuation and Appraisal Mortgage Advisory and Financing Consulting Services Legal Services Marketing Services Others |

| By End-User | Individuals / Households Real Estate Investors Corporates & SMEs Government Entities Others |

| By Region | England (London, Rest of England) Scotland Wales Northern Ireland |

| By Investment Source | Domestic Investments Foreign Direct Investments Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Market | 100 | Real Estate Agents, Home Buyers, Property Investors |

| Commercial Real Estate Sector | 80 | Commercial Property Managers, Business Owners, Investors |

| Real Estate Development Trends | 60 | Property Developers, Urban Planners, Architects |

| Rental Market Insights | 90 | Landlords, Tenants, Property Management Firms |

| Investment Sentiment Analysis | 70 | Institutional Investors, Real Estate Analysts, Financial Advisors |

The UK Real Estate Services Market is valued at approximately USD 120 billion, driven by increasing demand for residential and commercial properties, urban expansion, and investments in smart building solutions.