Region:Europe

Author(s):Dev

Product Code:KRAB3606

Pages:95

Published On:October 2025

By Type:The market is segmented into various types, including Full-Service Brokerage, Discount Brokerage, Robo-Advisors, Forex Brokerage, Cryptocurrency Brokerage, and Others. Among these, Discount Brokerage has emerged as a leading segment due to its cost-effectiveness and accessibility for retail investors. The rise of technology-driven platforms has made it easier for individuals to engage in trading without incurring high fees, thus driving the popularity of discount brokerage services.

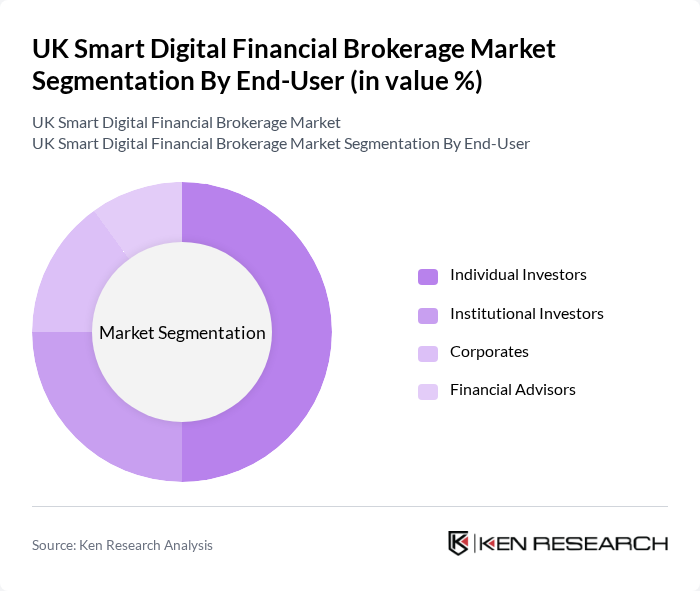

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, and Financial Advisors. Individual Investors dominate this segment, driven by the increasing number of retail investors entering the market, particularly during periods of market volatility. The accessibility of online trading platforms and the availability of educational resources have empowered individual investors to take control of their financial futures.

The UK Smart Digital Financial Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as IG Group Holdings plc, CMC Markets plc, Hargreaves Lansdown plc, Interactive Investor, eToro (UK) Ltd., Plus500 Ltd., Saxo Capital Markets UK Ltd., DEGIRO, Trading 212, Revolut Ltd., Freetrade, Robinhood Markets, Inc., XTB Online Trading, Charles Schwab UK, OANDA Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UK smart digital financial brokerage market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance trading strategies and customer service, while the rise of mobile trading applications will cater to the growing demand for on-the-go access. Additionally, the focus on sustainable investments will likely attract a new demographic of environmentally conscious investors, further diversifying the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Robo-Advisors Forex Brokerage Cryptocurrency Brokerage Others |

| By End-User | Individual Investors Institutional Investors Corporates Financial Advisors |

| By Service Model | Commission-Based Fee-Only Hybrid Model |

| By Customer Segment | Retail Investors High Net-Worth Individuals Millennial Investors |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Geographic Presence | Urban Areas Suburban Areas Rural Areas |

| By Investment Type | Equity Investments Fixed Income Investments Alternative Investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Experience | 150 | Individual Investors, Retail Traders |

| Institutional Brokerage Services | 100 | Institutional Investors, Fund Managers |

| Digital Platform Usability | 80 | UX Designers, Product Managers |

| Regulatory Compliance Insights | 70 | Compliance Officers, Legal Advisors |

| Fintech Adoption Trends | 90 | Financial Analysts, Market Researchers |

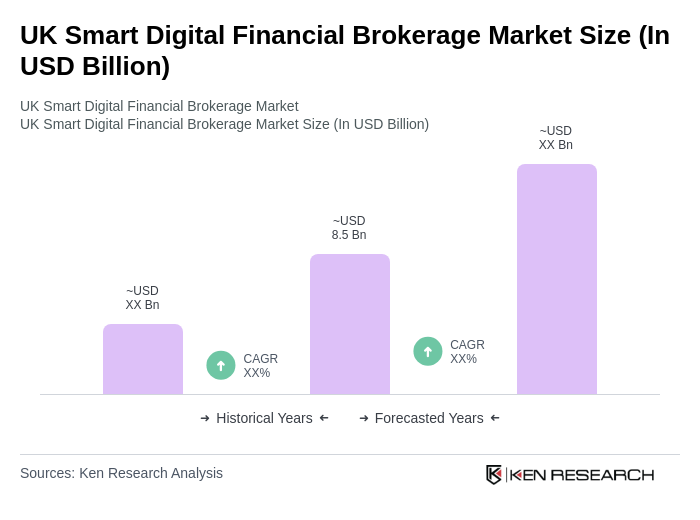

The UK Smart Digital Financial Brokerage Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by the increasing adoption of digital platforms and advancements in technology, particularly among retail investors seeking low-cost trading options.