Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0020

Pages:86

Published On:August 2025

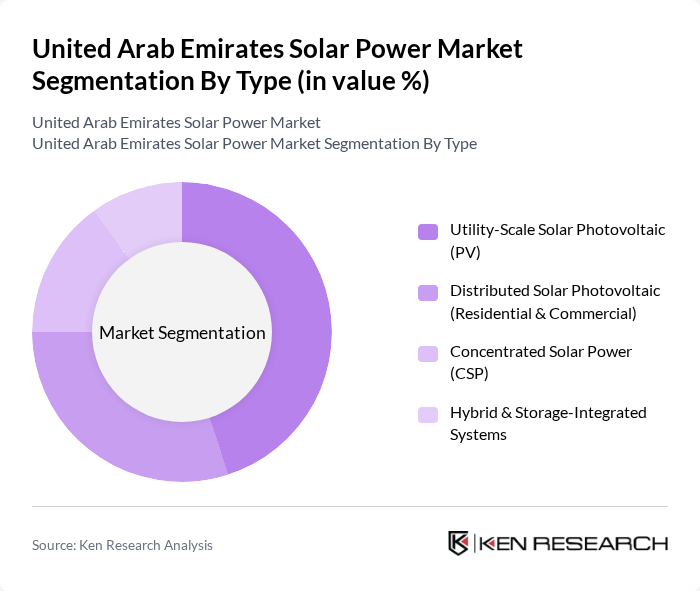

By Type:The market is segmented into Utility-Scale Solar Photovoltaic (PV), Distributed Solar Photovoltaic (Residential & Commercial), Concentrated Solar Power (CSP), and Hybrid & Storage-Integrated Systems. Utility-scale solar PV is the leading segment, driven by large-scale deployment in projects such as Noor Abu Dhabi and Mohammed bin Rashid Al Maktoum Solar Park, which offer high efficiency and cost-effectiveness for grid supply. Distributed solar PV is gaining traction among residential and commercial users, supported by decreasing installation costs, government-backed net metering programs, and increasing awareness of renewable energy benefits. CSP and hybrid systems are also being adopted, particularly for grid stability and energy storage applications .

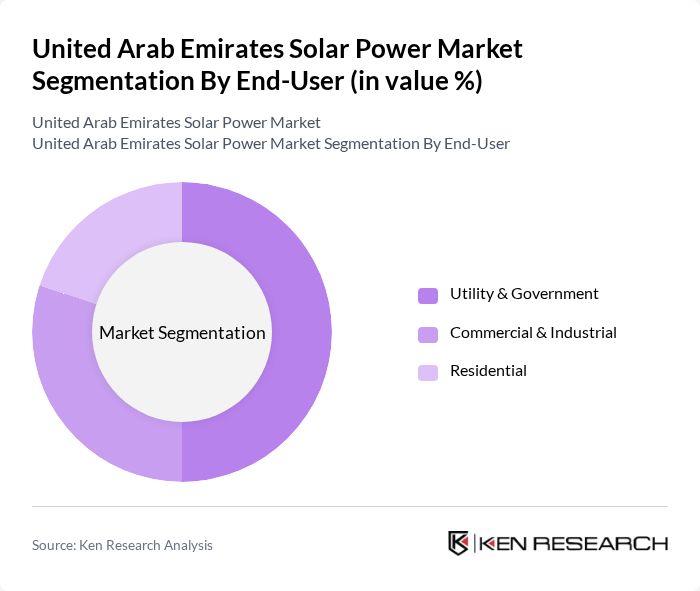

By End-User:The market is categorized into Utility & Government, Commercial & Industrial, and Residential. The Utility & Government segment leads the market, driven by large-scale solar projects, government procurement, and national renewable energy targets. The Commercial & Industrial segment is expanding as businesses seek to reduce operational costs, meet sustainability targets, and benefit from government incentives. The Residential segment is also growing, supported by rooftop solar programs and increased consumer awareness .

The United Arab Emirates Solar Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Masdar (Abu Dhabi Future Energy Company), ACWA Power, Dubai Electricity and Water Authority (DEWA), Sunergy Solar, MAYSUN SOLAR FZCO, CleanMax Mena FZCO, Yellow Door Energy, Enerwhere Sustainable Energy DMCC, Environmena Power Systems LLC, Engie SA, Canadian Solar Inc., Trina Solar Limited, Akuo Energy SAS, Shams Power Company, and Noor Energy 1 contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE solar power market appears promising, driven by increasing investments in renewable energy and a strong commitment to sustainability. In future, the integration of smart grid technologies is expected to enhance energy management and efficiency, while the expansion of solar parks will provide significant capacity additions. Additionally, the rise of corporate sustainability initiatives will further stimulate demand for solar energy, positioning the UAE as a leader in the renewable energy sector in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Utility-Scale Solar Photovoltaic (PV) Distributed Solar Photovoltaic (Residential & Commercial) Concentrated Solar Power (CSP) Hybrid & Storage-Integrated Systems |

| By End-User | Utility & Government Commercial & Industrial Residential |

| By Application | Grid-Connected Utility-Scale Projects Rooftop Installations Off-Grid & Remote Applications |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 60 | Homeowners, Solar System Installers |

| Commercial Solar Projects | 50 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 40 | Project Managers, Energy Analysts |

| Government Policy Impact | 40 | Regulatory Officials, Energy Policy Advisors |

| Investment Trends in Solar Energy | 45 | Investment Analysts, Venture Capitalists |

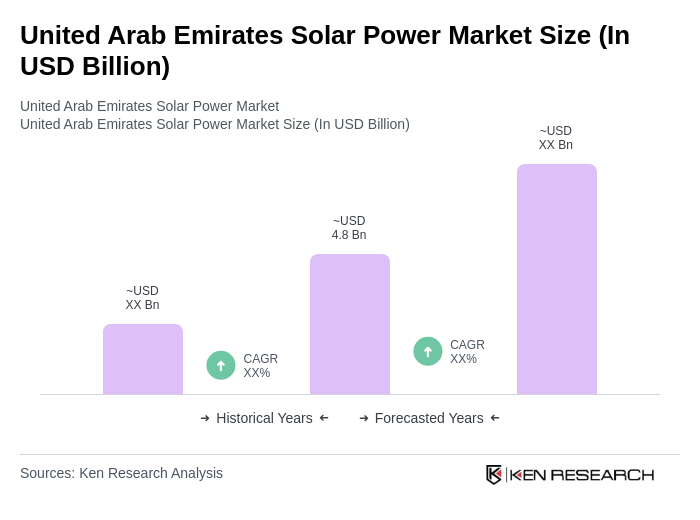

The United Arab Emirates Solar Power Market is valued at approximately USD 4.8 billion, reflecting significant growth driven by government initiatives, investments in solar infrastructure, and the increasing demand for sustainable energy solutions.